For Bitcoin, how thin is the line between flexibility and security?

While Bitcoin provides the empowering sense of autonomy and self-sovereignty, it comes with the added responsibility of securely storing one’s Bitcoin. In the past, there have been countless instances in which Bitcoin has been lost by their owners, as a result of losing their access to private keys or through larger hacks on exchanges were their crypto was stored. Unlike traditional finance, the decentralized nature of Bitcoin and the absence of an overlooking institution means that once Bitcoin is lost, it is lost forever.

Speaking to Charlie Shrem on the Untold Stories podcast, Jameson Lopp, Casa Co-founder & CTO pointed out the significant need for greater privacy and security measures within Bitcoin. He highlighted how companies like Chainalysis with their ability to monitor and track stolen coins provide a more enhanced ecosystem. He said,

“We are already seeing the beginning phases of a world like that as a result of companies like Chainalysis and others that are tracking known stolen coins. Basically any, UTXOs that are considered tainted because they were directly tied to some sort of criminal activity.”

However, Lopp added that at the moment there aren’t many people actively using privacy tools, which makes the ones who do use them, look rather suspicious. He said,

“The mere fact that you are using privacy tools now is suspicious and can get your account blocked. We’ve seen a little bit of that happening as well from various exchanges…But if everybody is doing it, they can’t block everybody.”

Source: The 2020 State of Crypto Crime, Chainalysis

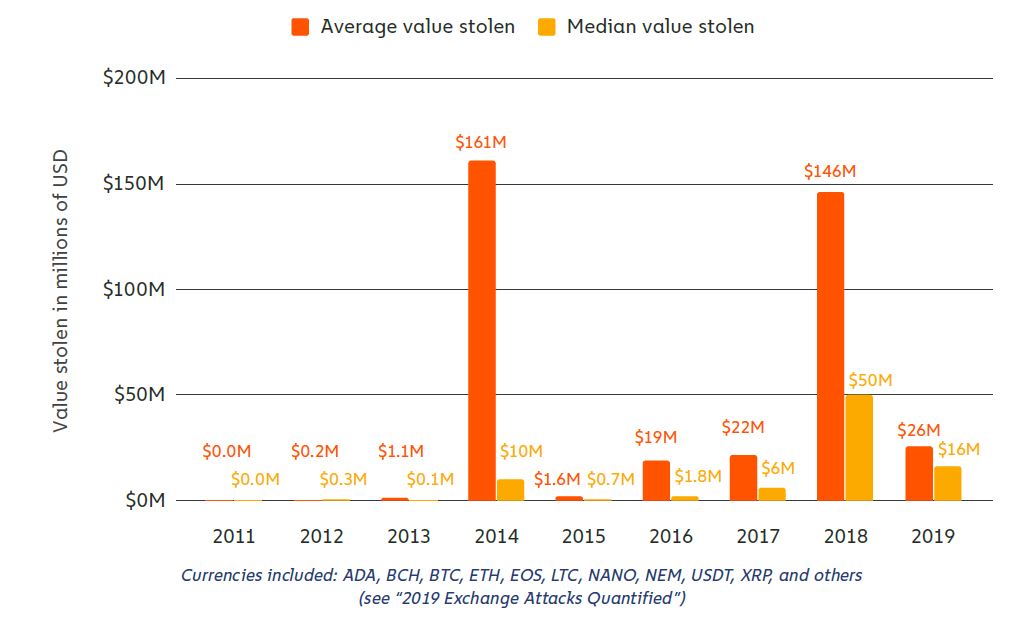

Interestingly the previous year, 2019, saw a reduction in cryptocurrencies being stolen as a result of exchange hacks. According to data from Chainalysis, both the average and median amount-stolen per hack fell substantially in 2019.

However, Lopp added that

“While a lot of people are probably worried about, you know, getting their private keys hacked because that’s what you hear about a lot, to be quite honest, the more pressing danger in this space is that the user shoots themselves in the foot and just loses access to their coins and they end up being gone forever.”

According to data from Blockchain.com, there is over 18 million Bitcoin in circulation. However, this does not take into account all the Bitcoin that has been lost due to various reasons and remains irretrievable. As per a report by Blockgeeks, as of 2020, there are just over 18 Million Bitcoins in existence. However, not all of them are actually usable. Among those 18 million, approximately 4 million bitcoins are lost whereas, around 1 million were stolen in various hacks and heists such as that of through Mt. Gox. That leaves us with 13 million bitcoins.

Highlighting the amount of Bitcoin that remains unusable owing to errors made by its users Lopp highlighted,

“I think everyone who has been in this space long enough has a story of something that they screwed up that ended up costing them a decent amount of money. And so, since we want to prevent people from hitting any catastrophic failure scenario, that means we need to understand that Humans make mistakes and we need to build some flexibility into these systems so that you can make a mistake and not have a catastrophic loss.”