Ethereum’s switch to PoS won’t cover for declining staking rewards

Ethereum’s imminent switch to a Proof-of-Stake consensus algorithm has been picking up significant traction over the past year. The divide between Proof-of-Work and Proof-of-Stake assets has also been increasing lately with Proof-of-Stake assets continuing to promote mainnet launches. However, PoW assets had an upper hand in 2019.

According to a recent report, Bitcoin remains the most secure network in the PoW space as it would cost hackers over $10 million dollars to attack the system for 24 hours.

In comparison, it was recently reported that a shift can be identified in the community over the past year. Many projects are moving to the PoS and DPoS systems and according to data, PoS and DPoS supported-coins dominated PoW coins in the top 50 digital assets.

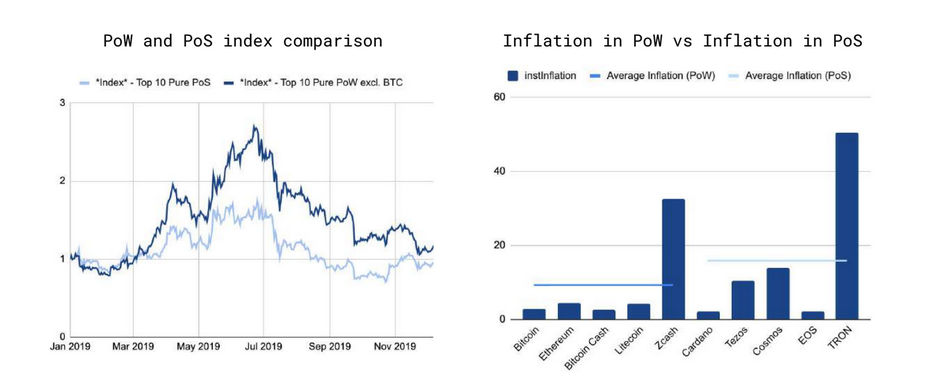

In spite of the aforementioned statistics, PoS assets did not witness a good year when collated with PoW assets.

Source: 2019/2020 State of Adoption

The attached chart suggests that the top 10 pure PoW assets excluding Bitcoin managed to outperform the top 10 PoS assets for the majority of the year. In terms of inflation as well, PoS assets registered higher Average inflation, whereas PoW assets dealt with a lower inflation rate.

One of the key attractions of the PoW system is the staking yield awarded to users. However, major crypto-assets that enable staking such as Tezos, NEO, TRON, and Stellar recorded negative real staking yield in 2019. Smart contracts deployed on Tezos also failed to record a substantial incline as smart contracts with code and capital simmered down.

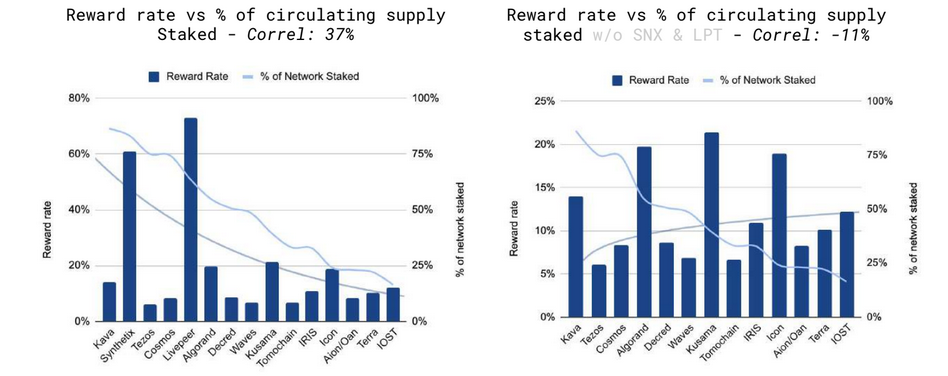

Source: 2019/2020 State of Adoption

Additionally, it can be observed that staking rewards did not make up for a strong incentive to attract users with the declining reward rate fairly evident in the charts.

In hindsight, certain PoS assets did undergo multiple mainnet launches and their work tokens were introduced in the markets. 2020 may witness more innovation on the PoS front but at press time, PoW assets continued to dominate the market cap data with a whopping 88 percent accumulation.