XRP long-term Price Analysis: 9 September

Following Bitcoin’s lead, XRP has been consolidating. The value of the fourth-largest digital asset in terms of market cap was close to $0.2391, at press time. Given the recent pressure in the market, XRP has been shedding its value and was currently close to its immediate support of $0.2288.

Source: XRP/USD on TradingView

The above chart of XRP outlined the gradual descent of the coin from $0.3046 to $0.2389, at press time. This shrinking of price took place within a descending channel which was a sign of a bearish market, as the price generally breaks down from the pattern.

Currently, the XRP market had low volatility as the Bollinger Bands had converged. While the signal line takes the position under the candlesticks, indicating a potential change in price trend, the 50 moving average was bearish. As XRP’s price tried to break higher from the current price level, the asset has remained in a state of equilibrium, wherein the buying and selling pressures had evened out.

XRP’s immediate support has been close to $0.2288 and $0.2207, while its resistance remains much higher at $0.2789, as the price did not test resistances in between the two points.

Source: XRP/USD on TradingView

According to the Fib retracement tool, in the given period XRP’s price had been moving sideways between $0.2437 and $0.2208. Although the price was stuck between these two prices even at press time, there has been an effort in the market to push the price higher. However, at this point, $0.2437 was acting as a resistance. XRP may take some time to recover from a descending market as the immediate resistances have been market further at $0.2598, $0.2759, and $0.2959.

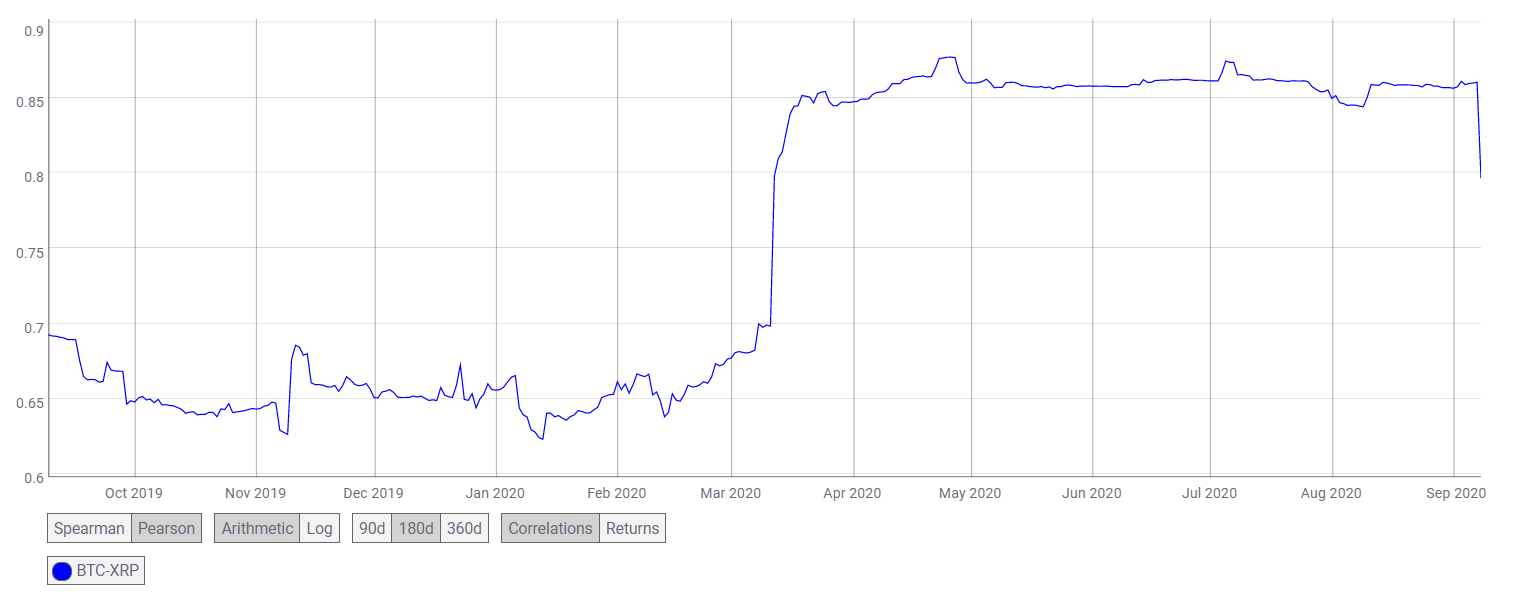

As XRP bounces between the current resistance and supports, its correlation with Bitcoin has sunk.

Source: CoinMetrics

According to the above chart, the BTC-XRP correlation coefficient fell from 0.8598 to 0.7967 within a couple of days. Even though the decrease in correlation, it was still strong to drive the price on the whims of the BTC market trend.