Why crypto regulations need not always be bad news for the markets

Crypto regulations – Are they good or bad for the industry? This question has been troubling the community for years now. A recent report released by the Federal Reserve Bank of Dallas opined that regulatory measures need not always be bad news for the crypto markets.

According to the report, bitcoin’s price is significantly affected by regulatory laws. The report thus opined that price responses signal a clear preference for a defined legal status, albeit a light regulatory regime.

All the crypto regulations in place at the moment curb the freedom of cryptocurrencies, especially FATF guidelines. FATF’s ‘travel rule‘ demands all cryptocurrency exchanges to reveal the users’ personal information along with their transaction details.

To tackle regulatory concerns, authorities will first need to clarify the regulatory classification of cryptocurrency-related activities. The report further read,

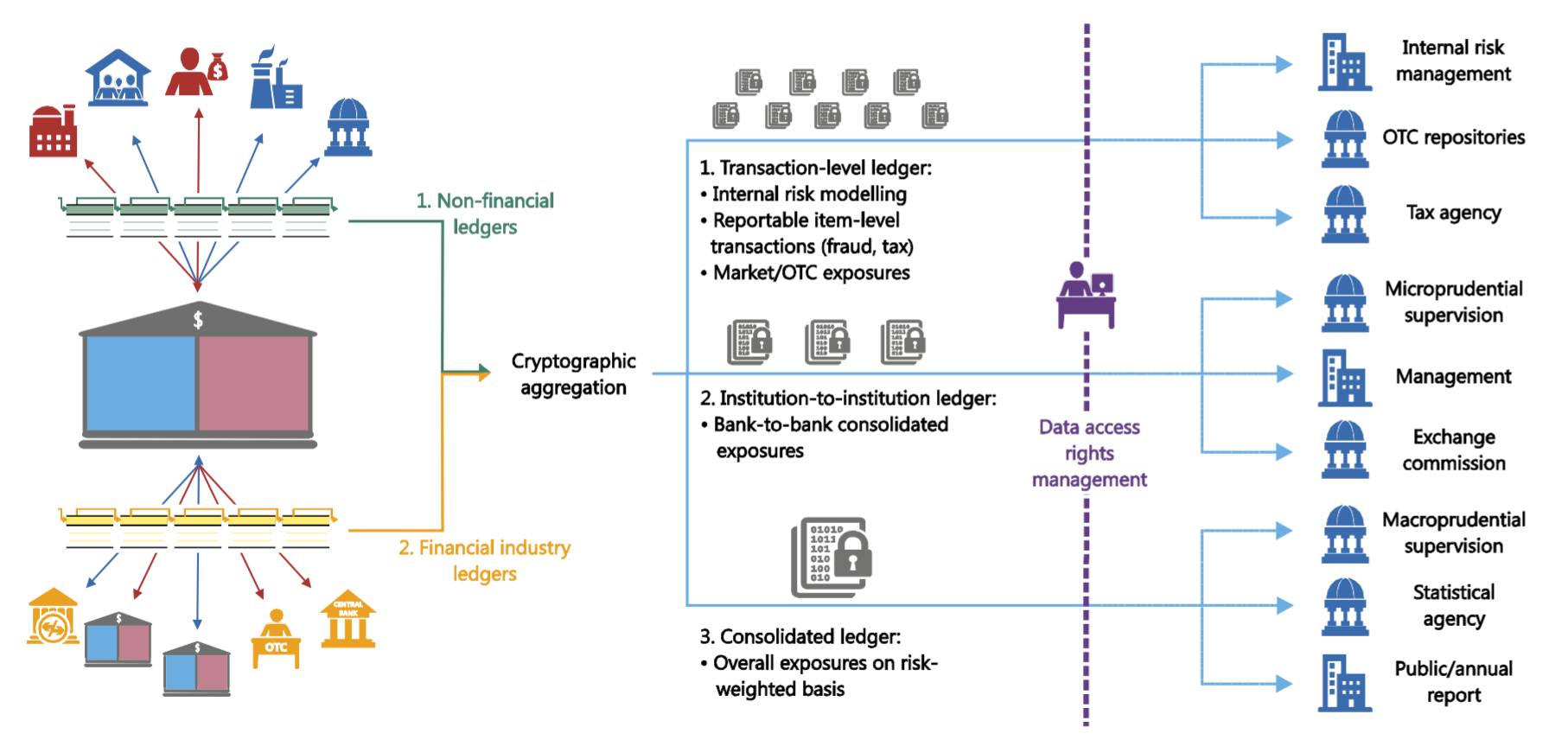

“For policies to remain effective, rules and enforcement will need to be coordinated and enforced across the globe. But the absence of such coordination need not impede effective intervention. One avenue authorities could pursue is “embedded supervision”, ie implement a supervisory framework for crypto assets that allows for compliance with regulatory goals to be automatically monitored by reading the market’s ledger.”

Source: Compliance process using embedded supervision, dallasfed

‘Embedded supervision’ can verify compliance with regulations by reading the distributed ledgers in both wholesale and retail banking markets. This suggests that at the current juncture, authorities around the globe have to make regulation effective.

However, regulators also face a lot of difficulties as they have to deal differently with cash, electronic money, and then crypto-assets. While regulating cash is not much of a challenge, there are certain regulatory issues involved when it comes to electronic and virtual currencies like the safety and soundness of cash schemes.

Flori Marquez, Co-founder of BlockFi recently commented that it is indeed going to take regulators a little bit time in understanding the fundamental difference between Bitcoin and cash. “We have to get them to understand how Bitcoin and other crypto-assets work,” she had stated.