Tezos, IOTA, Crypto.com Coin Price Analysis: 16 October

Corrections seemed to be the norm across the board, at the time of writing, after most of the market’s altcoins depreciated on the charts as Bitcoin consolidated its own position. While the likes of Tezos, IOTA, and Crypto.com Coin did climb on the back of Bitcoin’s movement, these alts were soon on their way down as the correction wave took over. That being said, it was too soon to suggest that any of these cryptocurrencies were on a downtrend, at the time of writing.

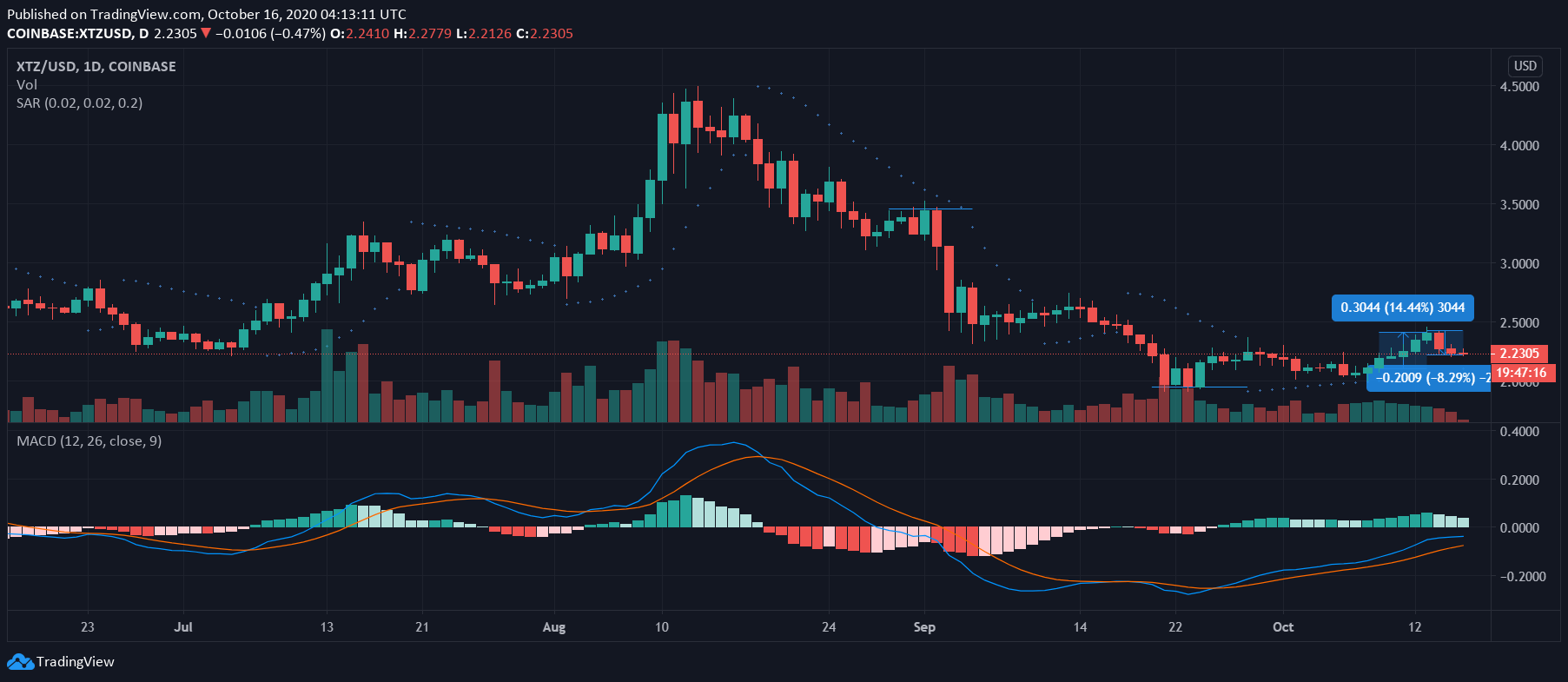

Tezos [XTZ]

Source: XTZ/USD on TradingView

Tezos, the crypto ranked 17th on CoinMarketCap’s charts at the time of writing, has noted significant losses on its price charts over the past two months. In fact, since XTZ surged to an all-time high in mid-August, the cryptocurrency has lost over 50% of its value. XTZ’s aforementioned losses were punctuated by the sharp downtrend the cryptocurrency has been on since it hit its ATH on 13 August.

Over the past week, while Tezos did climb by a significant 14% on the charts, corrections soon pulled down the value of the cryptocurrency by over 8%. Despite such corrections, however, Tezos was still noting YTD returns of 61%, at the time of writing.

XTZ’s technical indicators highlighted a certain degree of bullishness in the market, despite the recent depreciation in value. While the Parabolic SAR’s dotted markers were well under the price candles, the MACD line was over the Signal line on the charts. It should be noted, however, that the latter was closing in on a bearish crossover, and a trend reversal might be in the works soon.

Tezos made headlines recently after the $25M Tezos ICO Litigation Settlement was finally approved.

IOTA

Source: IOTA/USD on TradingView

IOTA’s price movements were very similar to XTZ’s, with the former climbing on the back of Bitcoin’s movement on the charts, before registering corrections of its own. In fact, at the time of writing, IOTA was back to trading at its July 2020 levels, with the cryptocurrency well below its mid-August 2020 highs.

While the prevailing market trends remained largely bearish, a look at the charts revealed that the downtrend IOTA had been on had stalled somewhat, with the cryptocurrency trading sideways for a while now.

The same was evidenced by the uniformity of the Bollinger Bands’ mouth, an interesting finding since IOTA was fairly volatile over the past week. Further, while the Chaikin Money Flow climbed sharply past 0.20 when IOTA climbed, it dipped as soon as corrections swept in.

IOTA was in the news a few days back after Co-founder Serguei Popov revealed that IOTA 3.0 will be ‘fully sharded.’

Crypto.com Coin [CRO]

Source: CRO/USD on TradingView

The native token of the Crypto.com Chain, CRO, until a few months ago, was one of the market’s best-performing crypto-assets, with CRO noting a sharp uptrend for weeks while the rest of the market struggled to strengthen and consolidate its gains after Black Thursday. Over the last two months, however, the aforementioned uptrend has been interrupted by sideways movement and brief, but sharp falls on the price charts.

Crypto.com Coin’s technical indicators highlighted the same as while the Relative Strength Index was treading close to the oversold zone on the charts, the Awesome Oscillator pictured seeling pressure in CRO’s market.