Bitcoin’s price correction positive for consolidation above $8200

Bitcoin’s valuation has registered significant price movement over the past week. The king coin did experience a dip on 17 December, a day when the price slumped down to $6537. However, the following day, it was back above $7400. It consolidated between $7500 and $6900 till the end of the month, before the crypto-asset began to pick up pace recently.

Bitcoin 1-day chart

Source: BTC/USD on Trading View

Since 27 November, Bitcoin’s price has registered sideways movement between $7750 and $6900, besides the aforementioned depreciation to $6500 on 17 December. It can also be observed that BTC’s valuation pictured an inverted head and shoulder pattern which was positively breached on 4 January. The bullish breakout on 4 January witnessed Bitcoin’s rise above the $8000 mark.

On 7 January, the $8000 breach took place following which, Bitcoin immediately retracted back under the mark. A significant breakout took place after as the price scaled above $8000 again, leading to a spike of up to $8400 on 8 January.

According to the VPVR indicator, a major volume of trade had taken place around $7200 after which significant volume resided above the $7800 range. The price correction from $8400 to the current valuation of $7900 is a positive scenario and indicates that another bullish surge could surface in the next 48 hours.

The price also went above the 50-Moving Average for the first time since 14 November, highlighting a definite change in trend.

Fractal Observation

Source: BTC/USD on Trading View

Comparing Bitcoin’s 1-hour chart at press time with its 1-day chart back from 2019 pictured the formation of a fractal where it can be observed that the current price of BTC is following a similar trend. This suggests that another spike could take place soon. However, nothing can be said with utmost certainty as past performances aren’t an indication of future price actions.

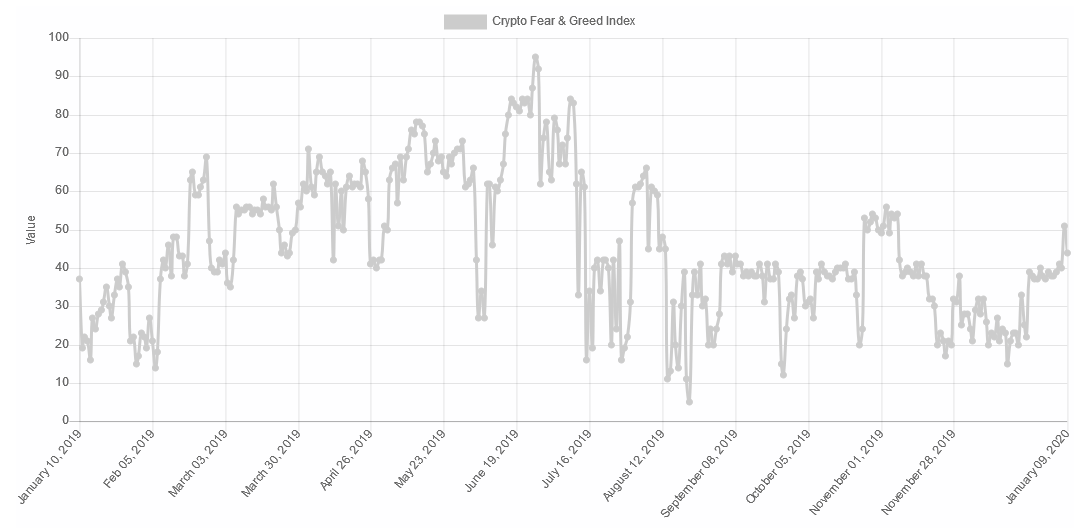

Source: alternative.me

Bitcoin’s ‘Fear and Greed’ index has improved as well over the past week after December indicated an average of ‘Extreme Fear.’ At press time, the index was registering a ‘fear’ scenario, but remained fairly close to the neutral standpoint.

With all of the above empirical observations, Bitcoin’s price might spike up to $8100-$8300 in the next 24 hours. However, there is a possibility of a further correction down to $7800-$7500.

Conclusion

Depending on the current correction period, Bitcoin should scale up back to $8200-$8500 in the next 48 hours and another breach below $7600 looks far less likely.