Bitcoin’s ‘inverted Bart pattern’ could push price by 26%

Bitcoin has been exhibiting a consolidation pattern ever since it dropped to $3,850. The consolidation was almost over when the price broke out of the pattern earlier today. This has pushed the price from $5,870 to $5,900. As it stands, Bitcoin might be undergoing an inverted Bart pattern if it pushes past $6,015.

After this price level, there is a chance for the price to soar higher without a great deal of resistance from the bears.

It must be noted, however, that the fall in price caught every one watching Bitcoin’s price by surprise. While some decided to leave, others hodled through it. But one thing is for sure, billions were liquidated due to the recent tumble. Further, even more surprising was the timing of the collapse which took place right during the stock market crash.

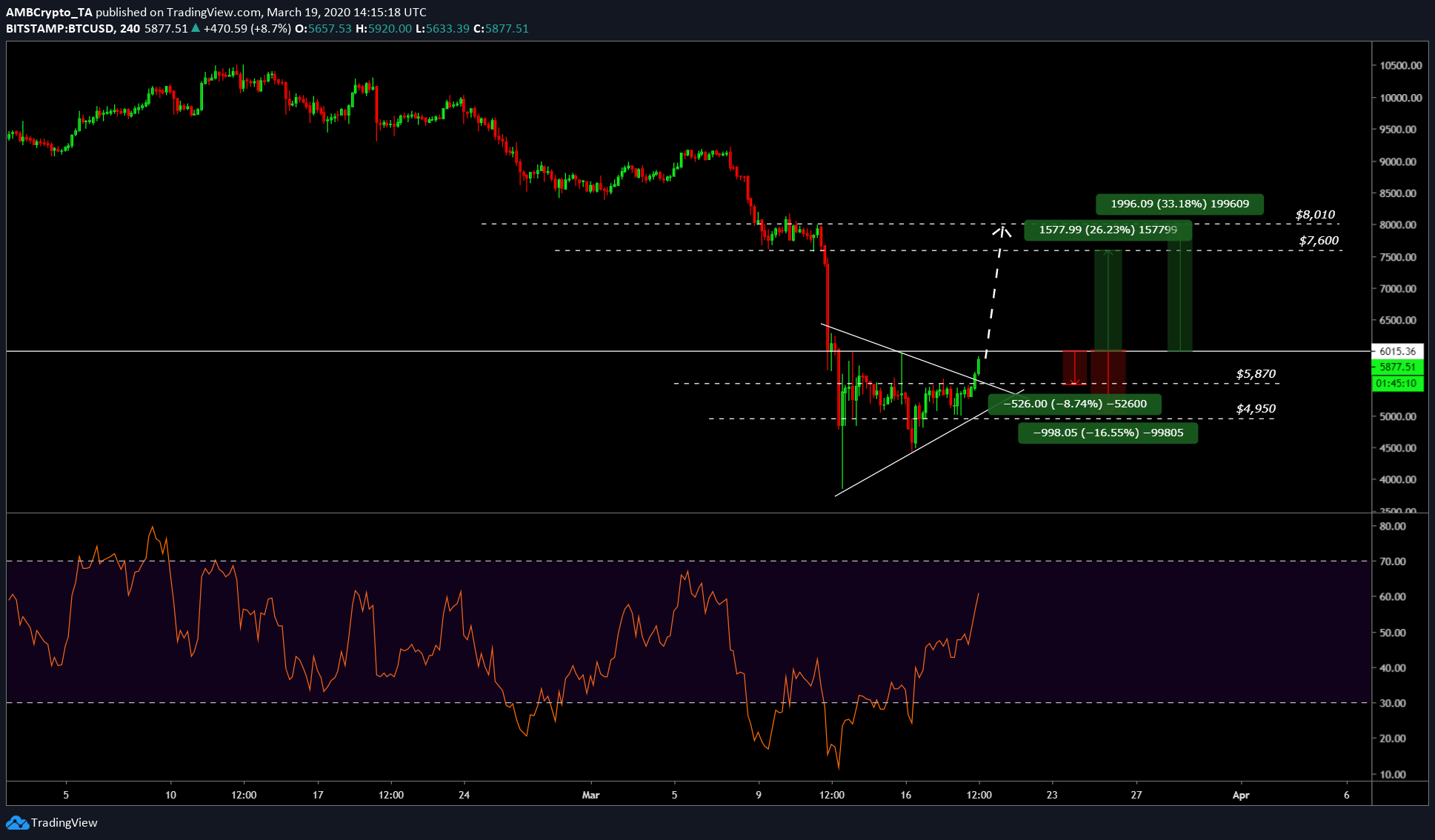

Bitcoin’s Four Hourly Chart

Source: BTC/USD on TradingView

The 4-hour chart for Bitcoin indicated the breach of the symmetrical pattern, a breach that followed sudden buying activity. The price of Bitcoin, in fact, has surged by 11.74% in the last 12 hours.

$6,015 is the only resistance stopping Bitcoin from forming an inverted Bart pattern. The price would easily climb from its current level to $7,600. However, there are two ways in which this could play out.

Scenario 1

The price breaches $6,015.

This would be followed by an instant buying pressure causing BTC to surge from $6,015 to $7,600, a $1,600 pump or a 26% surge. As the price reaches $7,600, there is a resistance zone ranging from $7,600 to $8,010. Hence, the price has a chance to surge from $6,015 to $7,600 and $8,010 after it breaches an important level of resistance.

In fact, most of the community is expecting a similar move from Bitcoin in the next couple of hours.

Pls sir… pic.twitter.com/z1sFxSVPXh

— Alistair Milne (@alistairmilne) March 18, 2020

Scenario 2

The price and buyers fail to push it above $6,015 and there is a pullback from here. This would leave Bitcoin with two options aka supports. One at $5,870, an 8% dip from $6,015, and a 16% drop from the same level.

This scenario perfectly plays with the RSI indicator. With the RSI close to the overbought zone, the retracement of price from $6,015 would give the RSI enough time to hit the overbought zone where it would face resistance. Further, exhaustion of buyers and their momentum will help the bears take over.

Conclusion

Depending on how the price reacts to $6,015, the next levels to watch include – $7,600, $8,010 in the North. Levels if the price fails to capture $6,015 include $5,870 and $4,950.