Ethereum hodlers project sense of ‘commitment’ despite price troubles

Market volatility in the digital asset industry is something all investors regularly have to deal with. Therefore, it becomes imperative that an investor enters the market at the right price point, in order to accrue the maximum profit.

Keeping that piece of advice in mind, recent data has suggested that a significant number of addresses may have entered the market of the world’s largest altcoin at the wrong time.

Source: intotheblock

The attached chart categorizes and classifies addresses in two divisions – All-Time Highers and All-Time Lowers. All-time-Highers are the addresses that practically bought into Ethereum in a range within 20 percent from its all-time-high valuation of $1420. In the same manner, All-time Lowers are the addresses that entered that market within 20 percent from the all-time low market value.

Jotting down the range in numbers, it was suggested that at press time, around 395K addresses present in the market had bought into the Ethereum market when it was priced between $1420 and $1130. The loss incurred by those addresses, at the moment, is close to 90 percent. In comparison, only 1.4k addresses came under the bracket of ATL, addresses that incurred a profit of close to 45 percent, at press time.

Ethereum hodlers’ sentiment

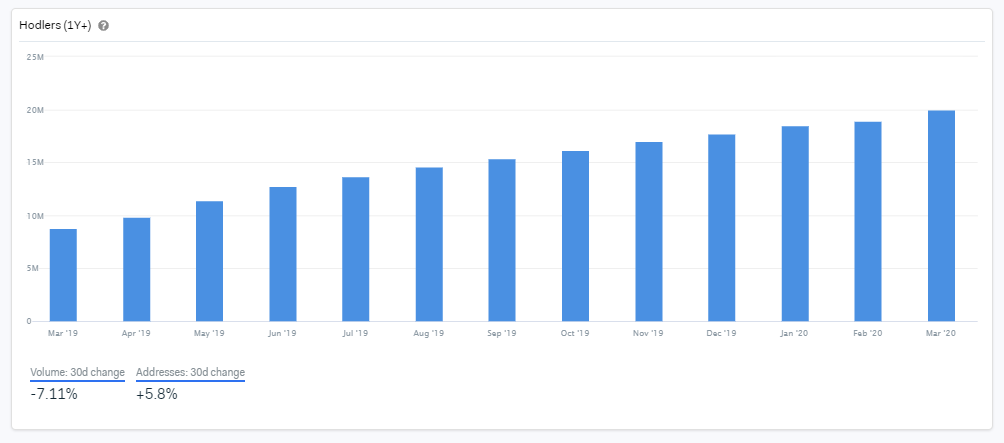

Source: intotheblock

In the short term, Ethereum’s credentials as an investment may have been affected, but over the past year, the number of users hodling the 2nd largest crypto-asset has grown in numbers.

In March 2019, around 8.79 million addresses held approx 48 million ETH collectively and the weighted average time period was around 2.1 years at that time. Since then, the weighted average has risen to 2.4 years and the total amount of ETH held has improved as well. At press time, March 2020 data revealed that over 57 million ETH tokens were being hodled together by 19.97 million addresses.

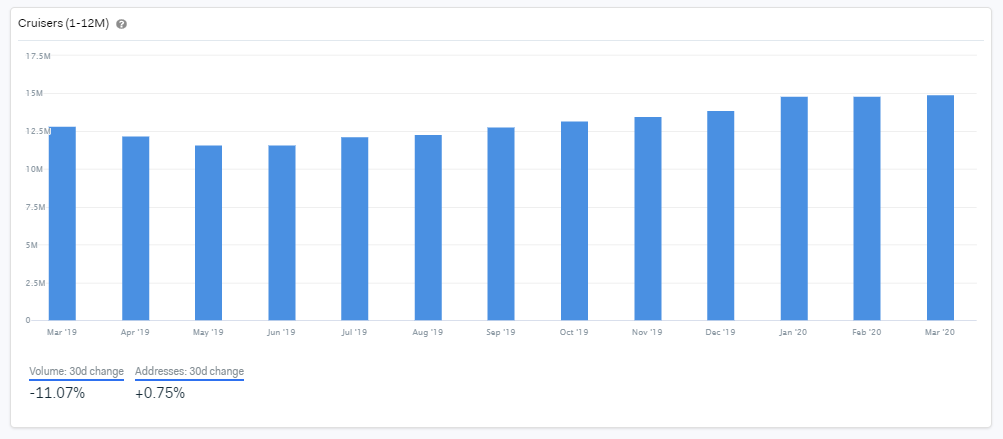

Source: intotheblock

In terms of cruisers’ addresses, entities holding Ethereum for a duration of fewer than 12 months remained consistent throughout the past year, with only a relative increase over the past 3 months.

In fact, the average time held in the short-term improved from 5.7 months during the end of December 2019 to 6.3 months on 17 March. The rise in short-term hodlers could be due to the early bullish rally in January and February this year.