Bitcoin v. Equity assets: Is falling correlation hinting at crypto’s positive future?

Can tokens outperform ventures? Dan Morehead, CEO and Co-Chief Investment Officer at Pantera Capital, thinks it is a possibility. In fact, he even pointed out that tokens would outperform ventures over a several-month period in the firm’s Blockchain Letter for the month of March. It read,

“Tokens reprice instantaneously, and so they have much more volatility, on both the upside and the downside. Venture pricing is typically lagged. The number of deals dries up quickly.”

Interestingly, Morehead also appeared on a recent podcast and analyzed how things have played out so far and if the tokens have done a good job in the ongoing financial crisis. He said,

“We wrote our investor letter in mid-March and made short term forecast that tokens would outperform venture and that has actually happened. We think it will probably continue for the next few months. And the reason being tokens have the unique characteristic amongst all software protocols in having a real-time price feed. Whereas venture is kind of asynchronous.”

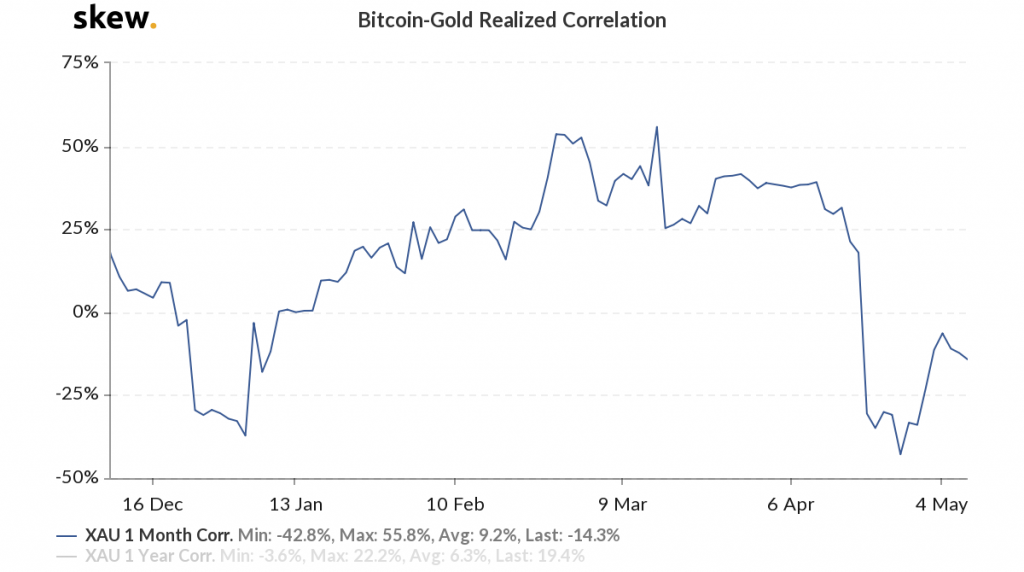

If looked at it, Bitcoin failed to act like an uncorrelated asset during the recent March market crash. The historical correlation between BTC and equities, gold, and other asset classes went beyond 0.8; however, considering the present scenario, the correlation fell and this might hint at a positive future for Bitcoin.

Source: Bitcoin-Gold Realized Correlation, skew

Bitcoin-Gold’s realized correlation has been on a decrease lately; it was at -14.3% as of 7 May, as seen in the attached chart. Noting that the community could see a regime going forward where Bitcoin and other cryptocurrencies might not be correlated with traditional assets, Morehead added,

“Bitcoin is up 23% year to date and the equity markets are still way down and all the other asset classes like oil are getting crushed. We think over the next couple of years the community could see an environment where Bitcoin and other cryptocurrencies go up at a time and equities go down.”