Ethereum’s Hodling game strong as more ETH 2.0 users plan running validator nodes

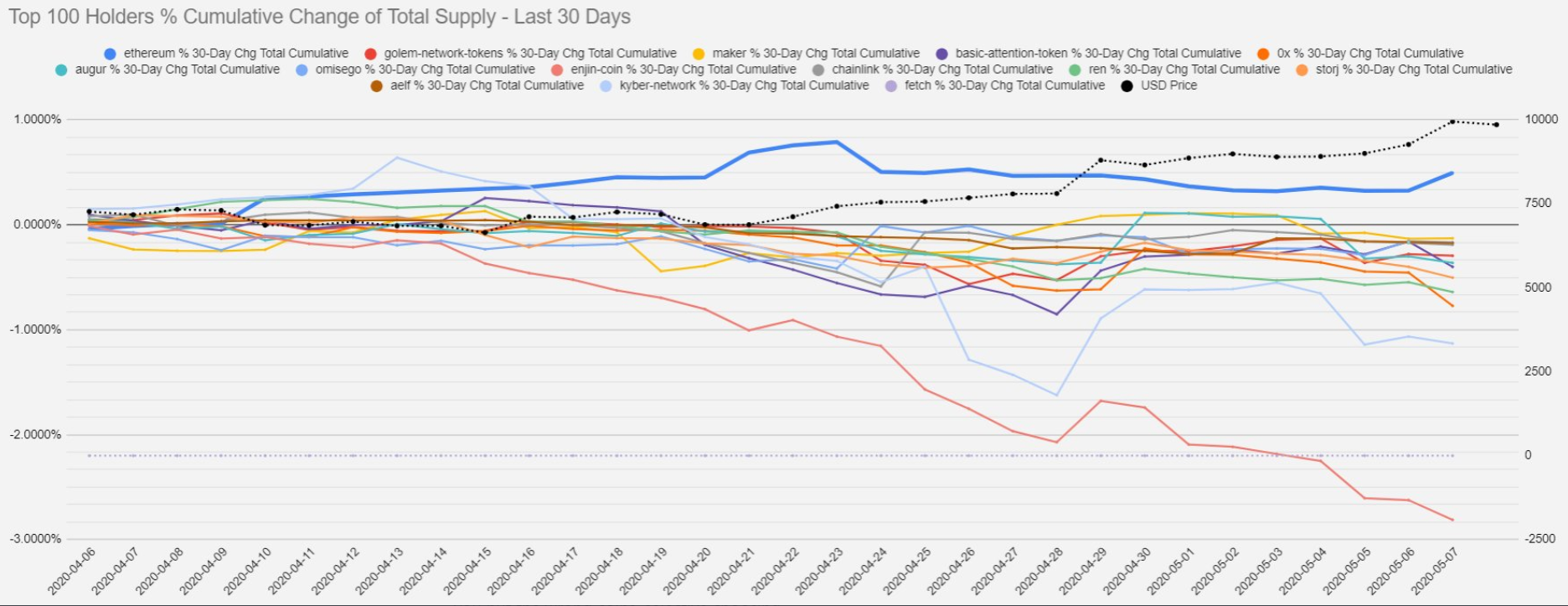

Ethereum hodlers seem to be stashing more coins than ever as the world’s largest altcoin regained its strength over $200. At a time when the majority of the market’s alts appeared to be selling, ETH hodlers were seen accumulating, as observed by the crypto-analytic firm, Santiment.

Ethereum’s YTD gains stood at more than 63%, at the time of writing, with ETH’s holders now anticipating profits from more gains, something evidenced by the rising accumulation pattern in the market.

Source: Santiment

Additionally, Ethereum witnessed a dramatic spike with respect to its Hodl waves. As of 3 May, it was found that more than 16% of ETH‘s supply hadn’t been moved in 3-5 years. This periodic value rose substantially over the next 48-hours and on the 5 May, it was observed to have surged all the way to 271.1%.

Over the same period, the amount of Ethereum held by crypto-exchanges such as Binance, Bitfinex, BitMEX, Bitstamp, Bittrex, Gemini, Huobi, Kraken, and Poloniex, also surged significantly.

The Options market for Ethereum seemed to be a bit disputed, however. One of the market’s leading exchanges, Deribit, on the other hand, noted rising volume and OI on its platform. This was indicative of the fact that highly knowledgable Options market participants were pointing towards a bullish outlook in the next few days.

What has reinstated this positive sentiment among the token’s accumulators? The answer to that question might be Ethereum 2.0 which finally achieved clarity recently, despite the fact that there is still a long road ahead. This is touted as something that would essentially bring about a massive network upgrade.

In fact, according to a recent report by ConsenSys that looked at the landscape of existing Ether holders – their intentions and preferences, a majority of respondents, roughly 66% of the survey respondents, planned to run up to five validator nodes or fewer.

In fact, 34% of the respondents plan to run just 1 node and 27% plan to run more than 5 nodes. The participants planning to operate their own nodes were found to hold the relatively largest amount of ETH under their hoods. Additionally, half of the people who were planning to run their own node[s], are hoping for 5-10% returns [average 5.8%] in order for it to be worthwhile.