Bitcoin to fall, before recording 10% upsurge to $8,600

Bitcoin is dipping while moving sideways; however, this is close to an end. The price of Bitcoin, at press time, was recorded to be $8,300, with the world’s largest cryptocurrency registering a market cap of $151 billion after its failure to swing high after $9,200.

As mentioned in a previous article, there are two important ranges for Bitcoin, ranges where it needed to consolidate. The first range, $8,500 to $8,300, was achieved by Bitcoin after its collapse on 19 January. The second range, $8,100 to $7,800, seems unlikely at the moment, simply due to the lack of bearish momentum.

Source: BTC/USD on TradingView

As seen above, the price needs to break out of the pattern it is in at press time – a falling wedge. Breaching this, the momentum would side with a bullish breakout and reach the top of the zone at $8,600. There is, however, the possibility of the price going even higher, $8,900, where the ultimate exhaustion of bears will happen. The second level, in particular, is very important because it would allow the price to retest the 200 DMA [purple line].

Another important thing to look for is the dip before the pump; the price as seen above, clearly, needs to go another leg down. This will push BTC to the low $8,300s, while scratching the $8,200 levels. Further, there could be a fakeout, causing the price to breach in the opposite direction, where Bitcoin will touch the $8,100 level, followed by a surge to the targets mentioned previously [$8,600 and $8,900].

Open Interest

Source: Skew

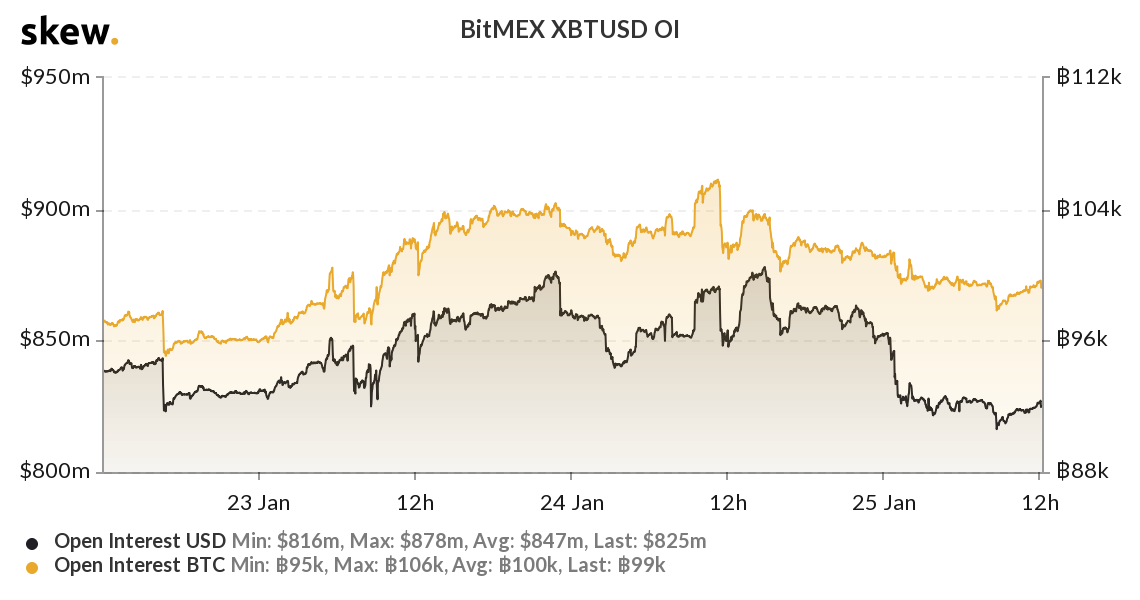

Adding more credence to the bullish breakout is the uptick in BitMEX’s OI over the last 15 – 20 hours, as seen above. OI aka Open Interest gives a measure of open contracts and hence, the leverage present on an exchange, something that helps determine the trend. Usually, the OI tends to decline near the $1 billion-mark, indicating trend exhaustion of longs/bulls. At press time, there is still leeway for OI to increase by $100+ million, a finding that indicates an upcoming upsurge in the market.

Conclusion

The price of Bitcoin has already begun its surge journey to $8,600 and possibly, $8,900. However, this journey will come only after a certain dip to $8,200 and in dire circumstances, $8,100. Optimistically, Bitcoin has a maximum upside of 10%.