Bitcoin realized market-cap hits ATH as fundamentals strengthen

On the charts and in the network, Bitcoin is on the up-and-up.

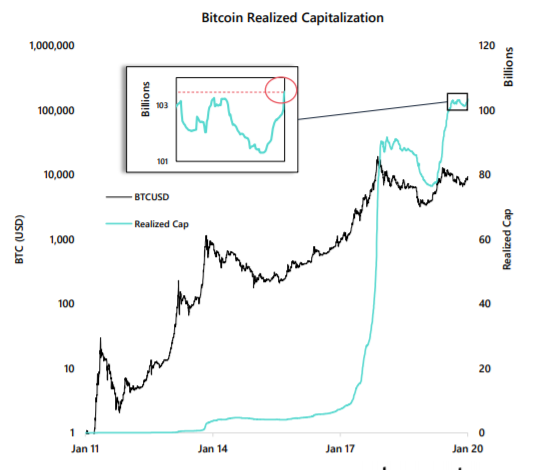

With Bitcoin breaking the $10,000 mark, a look at an alternate view of its market capitalization further points to a bullish outlook for the cryptocurrency. At press time, Bitcoin’s market capitalization is down by 44 percent against its ATH, but “realized market capitalization,” has reached an ATH.

According to a recent report by Arcane Research, the realized market cap reached its highest point ever of $103.5 billion, while the actual market cap stands at $183 billion, according to CoinGecko.

Source: Bitcoin Realized Capitalisation, Arcane Research

The report stated that the realized cap is based on the value of the coins based on the “last time they were moved.” This metric does not take into consideration the coins that are considered “lost,” or “inactive.”

Further, the report stated that the current real market capitalisation is 15 percent higher than when Bitcoin hit its price ATH of close to $20,000 back in December 2017.

While this is considered a bullish signal, the caveat of exchange-hodling does come into play. With Bitcoin being seen as a traded asset, over a hodled or transacted asset, cryptocurrency exchanges have increased their dominance.

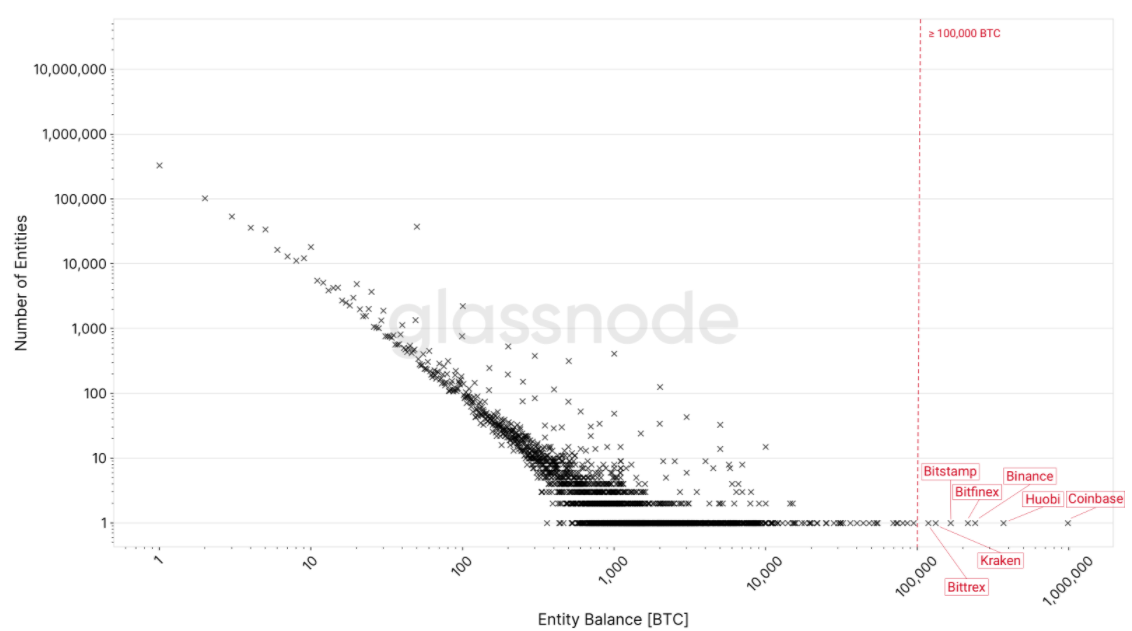

A recent study by Glassnode stated that only 75 entities hold 10,000 or more Bitcoin in active addresses, while only 7 entities hold 100,000 or more. Of these seven all are exchanges.

The biggest-hodling exchanges were, in order of the amount of BTC held – Coinbase, Huobi, Binance, Bitfinex, Bitstamp, Kraken and Bittrex.

These 7 “richest entities,” control over 2.35 million BTC, worth over $23.5 billion, with Bitcoin trading at $10,000 a pop. This constitutes 13 percent of the total Bitcoin in supply.

In light of the exchange-hodling dominance, the Arcane Research report noted,

“A large amount of the current bitcoin supply is held by exchanges and leaves no trace on-chain when traded within the same exchange.”

The on-chain activity, however, has been improving recently. Transaction value adjusted in USD, has increased by over 85 percent in the past month alone. Transaction count, which stood at over 320,000 [on 6 February] is experiencing a 10 percent uptick, in the same period. Miner fees in US dollars has increased by over 50 percent in January.

Source: Bitcoin Distribution Statistics, Glassnode

Active addresses, which has seen an increase by 20 percent in the past month, was one of the key contributing factors to Bloomberg’s assertion of Bitcoin, the “collectible” outpacing the minions i.e. the altcoins.

In a recent report titled “A Collectible vs. Minions,” Bloomberg stated that the growth of active addresses was building a ‘firm foundation.” This ‘robust indicator’ alone is enough to sustain Bitcoin’s price over $9,000, and its at its highest point since July 2019. The report read,

” Indicating increasing adoption, this is an important gauge for the benchmark crypto, with about 90% of total available supply that will ever be mined already in the market.”