Investing in Bitcoin: When is it too risky?

The probability of losing funds through investing or trading to the point where it is no longer possible to recover the losses is termed as the risk of ruin. The “probability of ruin” is as high or higher than the probability of booking a profitable trade. However, it gets interesting when you think of recovering from losses. Since the risk of ruin is not exactly linear, to recover from a 10% loss you need 11.11% profits. In crypto trading, it is an even bigger challenge, as you add the volatility of cryptocurrency prices to the inherent risk of ruin.

Though FUD has subsided, and the market is what smart money wanted it to be. Crypto traders risk going from a 10% loss to complete ruin, and that is a slippery slope. In the past 3 years, since the historic bull run, if you have made losses because of bad timing or unfortunate trading decisions, you may have an opportunity to make up for your losses in 2020.

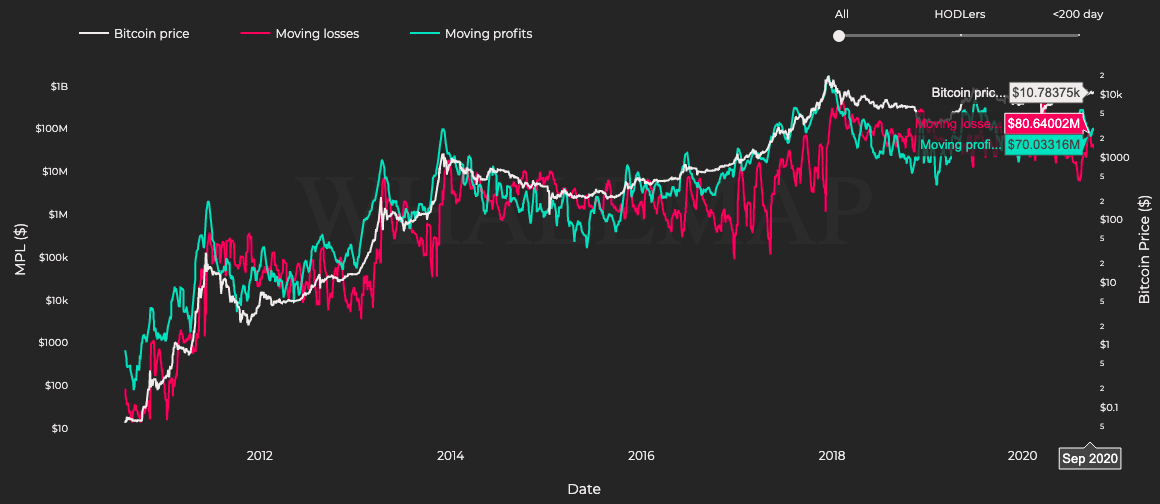

With the improving regulatory stance, there are hopes for a Bitcoin ETF. With bullish sentiments, traders are buying above $11.3k and over 88% HODLers are sitting on unrealized profits. Based on moving PNL charts by Whalemaps, profits are 3 times that of losses in the current phase of the market cycle.

Moving PNL || Source: Whalemaps

The moving PNL has remained largely positive. Profitable trades are three times that of losses and HODLers are booking unrealized profits, after hodling since 2018 based on the map of spent HODLer Bitcoins.

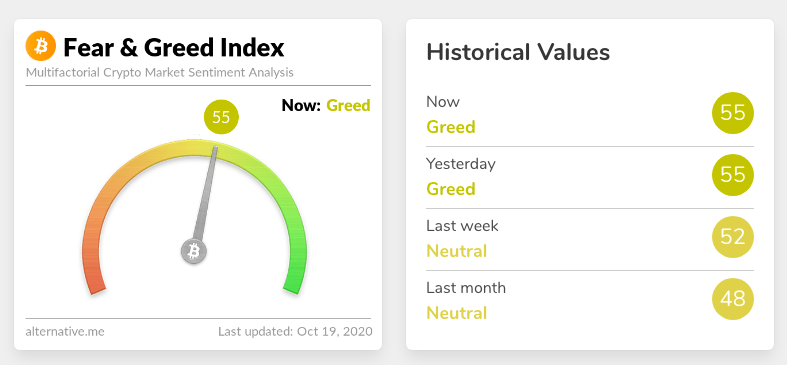

Post the third halving, the price had dropped to the $8.5k level. This is considered as the fair price of Bitcoin. After hitting the fair price, sentiment slowly turned neutral, and based on the Crypto Fear and Greed Index in the past week, from neutral we are inching towards Greed. Higher demand may be generated from retail buyers, following the increasing demand from institutions.

Fear and Greed Index || Source: Alternative

Smart money is pouring in despite the risk of ruin and the low volatility in Bitcoin prices may be key to this institutional investment. Bitcoin reserves on exchanges are at their lowest in the past 180 days and this poses as an excellent opportunity to book profits at reduced risk. The risk of ruin cannot be entirely eliminated and losses cannot be recovered in a few trades, however, the current market with its low volatility minimize risk exposure and offer a come back to retail traders.