Bitcoin follows the path lit by the CME

The spot market is taking a cue from institutions.

In the past two years, Bitcoin’s evolution in the institutional markets scene has been nothing short of exemplary. Derivatives have become all the rage in the cryptocurrency market with a lot of regulated exchanges launching Bitcoin Futures. Now, the very products that sparked Bitcoin’s 2017 bull run are lighting the way for the rest of the market.

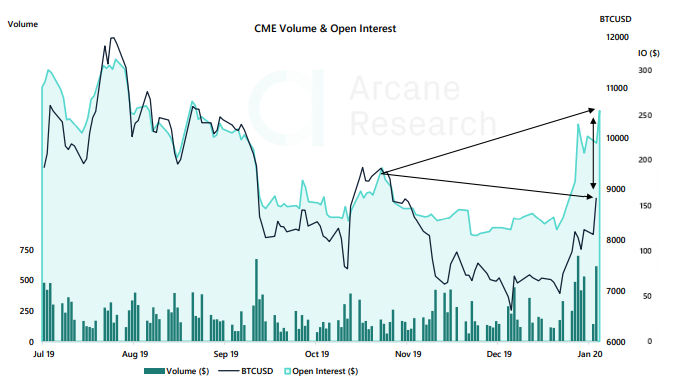

According to the latest report from Arcane Research, activity on the Chicago Mercantile Exchange has been “on the rise lately,” to the extent that it is “outgrowing BTC.” The CME is not the only U.S-regulated exchange that offers Bitcoin Futures, with the CBOE dropping out in March 2019.

Bakkt, the Intercontinental Exchange’s platform, is still vying for its spot, but its volume is too low to measure up to the CME just yet. CME regularly sees over 6,000 contracts traded, with each contract representing 5 Bitcoins while Bakkt’s ATH is just shy of $50 million.

Source: CME OI Volume vs Bitcoin price, Arcane Research

Open Interest, the metric looking at the number of contracts open at a time, is $240 million on the CME. What’s notable about this figure is that the last time Bitcoin was trading over $8,000, back in November, the OI was a $100 million less. This suggests that a higher number of positions [both long and short] have been created on the CME’s platform, showing increased trading activity.

The volume also is creating a gulf of difference between the derivatives and spot market. With the price moving from $7,500 to within touching distance of $9,000, volatility has been off the charts lately, inviting more trades. The report also said that volume has been within the $500 million – $700 million range “several times this year.”

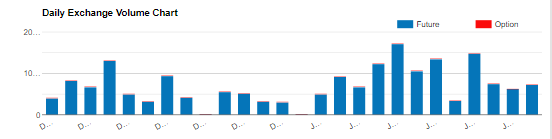

The volume upbeat began on 3 January, with Bitcoin surging by $700, following Iranian commander Qasem Soleimani’s death. As the United States and Iran locked horns, over 9,100 contracts were traded on the CME. The volume steadily increased till 8 January, when over 17,000 contracts were traded; with the BTC price around $8,100 at the time, the volume reached $692.5 million.

On 14 January, as Bitcoin gained by 8.74 percent in a single day, over 14,800 contracts were traded, with volume closing in on $650 million for the second time in two weeks.

Below is the Bitcoin Futures volume from 13 December to 17 January on the CME.

Source: Bitcoin Futures volume, CME Group

The reason why this OI and volume move is important is because of the corresponding Bitcoin price movement, or lack thereof. The report pointed out that the last time the price moved this high, volume and OI did not respond this way.

Several reasons can be attributed to for this change – CME’s Bitcoin Options launch, the December Bitcoin price slump, or the safe haven tendencies shown by the cryptocurrency. Market and investment change aside, Arcane, in closing, suggested that there is a “fundamental change in investor sentiment on the CME.”

This could be a telltale for Bitcoin’s 2020 price.