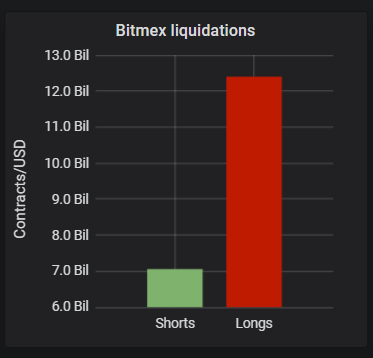

$12.3 billion longs got ‘rekt’ in 2019 on BitMEX; Shorting was a safer bet

Key Takeaways

- Longs were extremely liquidated in comparison to shorts

- A total of $12.3 billion longs were liquidated while only $7 billion shorts were liquidated

- Shorts dominated the start of 2019 while longs are starting to come into play

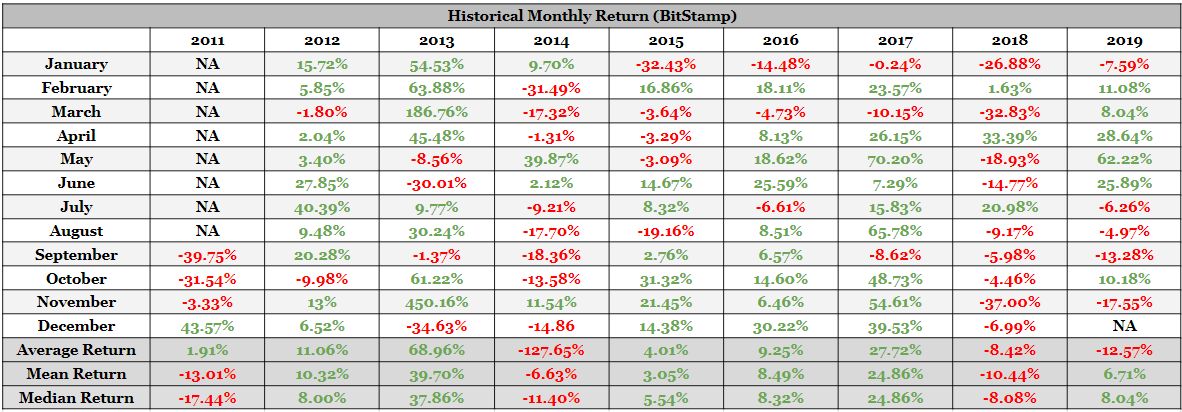

- Bitcoin’s median return has consistently increased since 2015; However, the 2019 average return has performed worse than in 2018

As Bitcoin moves sideways, stuck in the $7,000 region, the year comes close to an end. 2019 has certainly been a tumultuous year, with Bitcoin dragging itself through the low $3,000s and pumping to $13,800 out of the blue.

With the launch of Bakkt’s physically-settled Bitcoin Futures and other major updates, Bitcoin has grown and perhaps, matured, as a decentralized currency in the last 350 days or so. However, with Bitcoin and cryptocurrencies come inherent risks due to their volatile nature and many traders have faced volatility’s music and suffered the consequences.

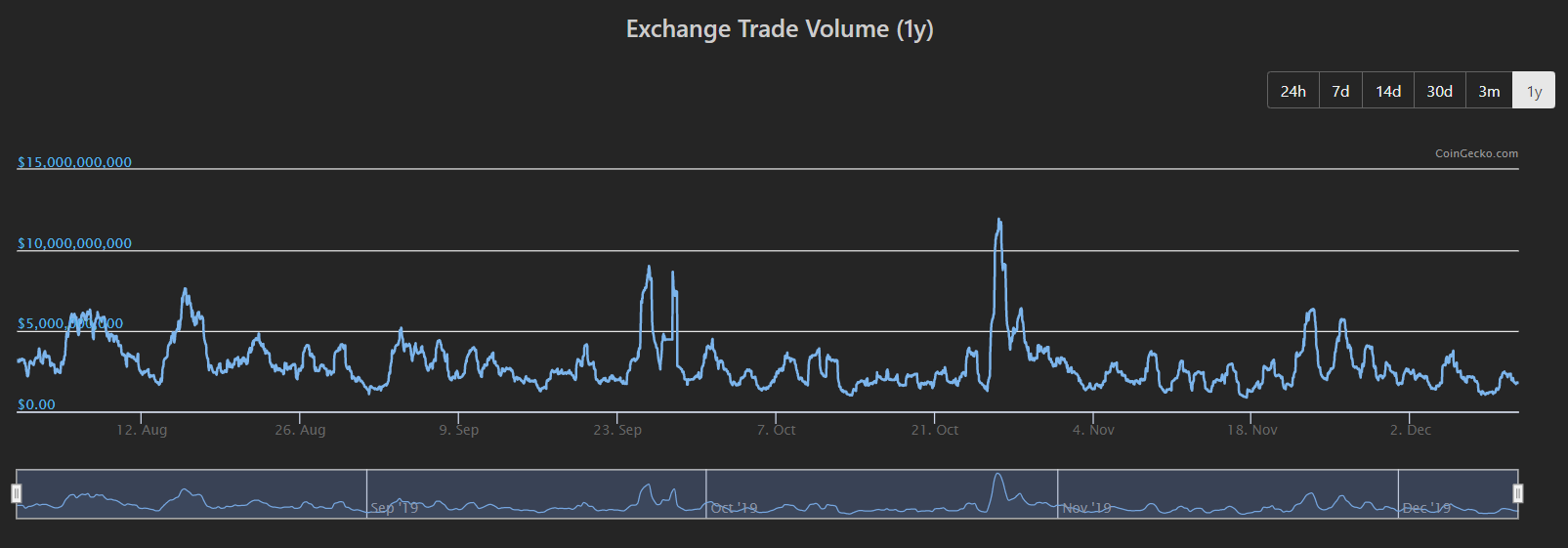

BitMEX – The King of Perpetual Contracts

BitMEX is the most popular derivatives exchange with a 24-hour trading volume almost always hovering over $1 billion with a few exceptional days. At press time, the trading volume was above $2 billion. Following BitMEX were either ByBit or OKEx , with trading volumes of over $1 billion of their own.

Source: CoinGecko

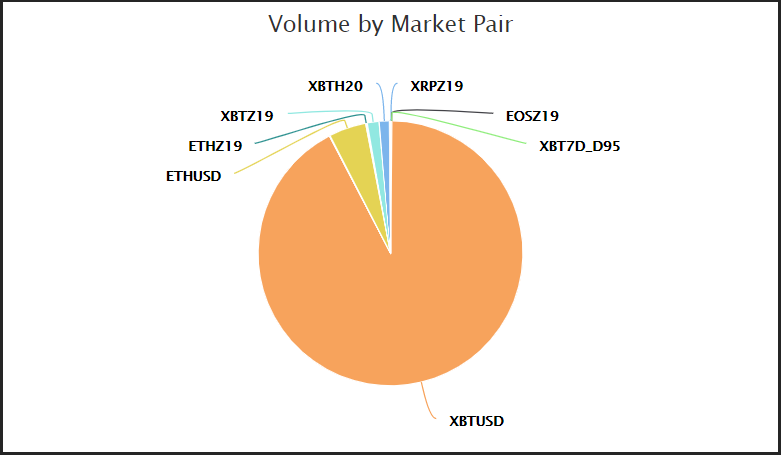

Bitcoin is the dominating cryptocurrency in the world and even on BitMEX. With Bitcoin capturing over 92.2% volume on BitMEX, other cryptocurrencies shy away from it, especially in terms of volume.

Source: CoinGecko

Ethereum, the smart contracts platform, is a natural successor, contributing more than 4% of the total trading volume. This is followed by Bitcoin’s XBTZ19 Futures contract, contributing about 1.9% to the total trading volume.

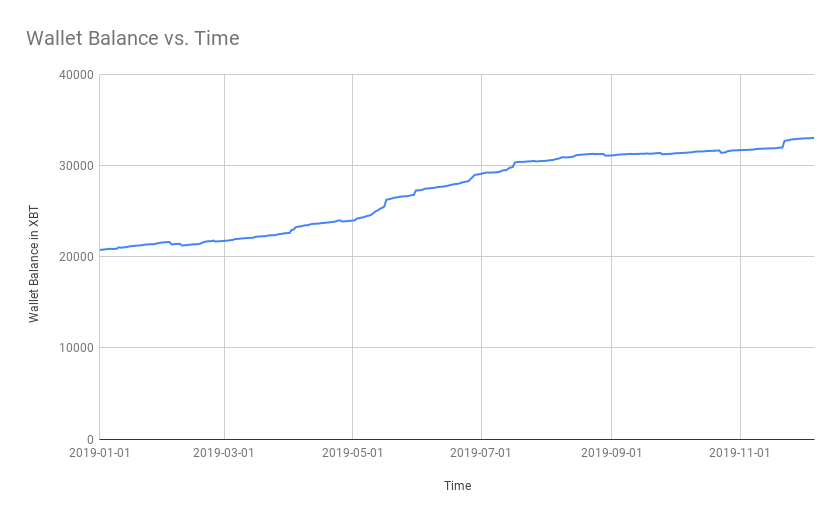

Considering the rocky journey of Bitcoin and the traders caught in its crossfire, liquidation numbers over the year have risen to an astounding $19.46 billion on BitMEX. Growing slowly but surely on the sidelines is the BitMEX insurance fund, which has grown up to ~33,000 BTC as of 7 December 2019.

Source: Datamish

A total of $12.4 billion in longs were liquidated, while the shorts didn’t come out unscathed either as $7.05 billion shorts were liquidated over the course of 2019. These liquidations are also probably one of the reasons why the BitMEX insurance fund has increased in balance by 59% since the start of 2019.

“Most people are leveraged long,” said Bobby Ong, Co-founder and CEO of CoinGecko to AMBCrypto. He continued,

“They probably also use higher leverage for long and has less capital in place to prevent liquidations during sharp drops. Another reason is that price decreases happen at a faster rate than price increases, giving traders less time to put sufficient capital into their accounts.”

The insurance fund has almost doubled since the start of 2019. Starting at 20,776 BTC, the wallet grew to 33,064 BTC and is now worth more than a quarter of a billion-dollars [$248,520,265].

Even though the price of Bitcoin faced a lot of tremors this year, Bobby Ong claimed that Bitcoin would see adoption in the upcoming year. He stated,

“For Bitcoin specifically, I will predict that we will see stronger Lightning Network growth and more exchanges following Bitfinex to launch Lightning Network support.”

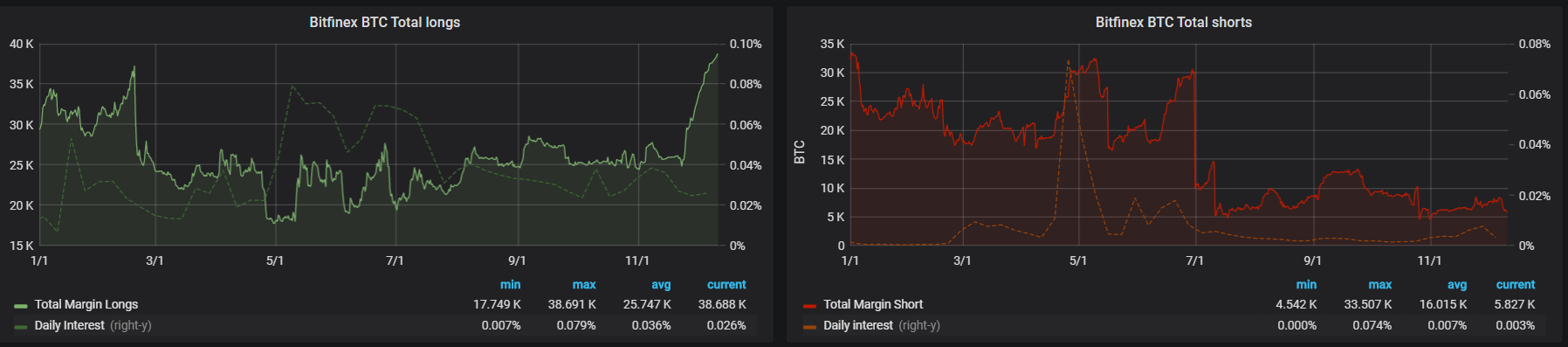

The Story So Far: Shorts v. Longs & Bitcoin’s RoI

Source: Datamish

As seen in the above image, shorts and longs have both had equal opportunities to take the center stage. As can be observed, longs reached a peak on 11 December 2019, and were worth about $38,690 in total. Shorts hit a peak of $33,500 during the start of 2019.

Looking at the current scenario, the longs are looking to make a move, while shorts have subsided after the move down to $7,100. Usually, the price of Bitcoin tends to side with the bulls at the end of the year. It also marks the start of a bull run in some cases.

Although 2019 is not over yet, Bitcoin’s RoI is far worse than its RoI in 2018. With 15 days left in 2019, BTC’s average RoI is at -12% while that of 2018’s was -8%. However, the 2019 median return is higher than that of 2018. With the exception of 2017 [bull run], Bitcoin’s median return has consistently performed better since 2015.

Another interesting observation is that Bitcoin tends to perform better in December and the month is not done yet. So, will the next 15 days surprise everybody with a rally? Or will it progress with bulls finishing the year strong?