Bitcoin derivatives’ product volumes are still dominated by CME

Bitcoin has been historically volatile. The king coin sustained massive volatility in the latter part of 2019. From the crucial $10k-mark, Bitcoin dropped to a low of $7.48k in September.

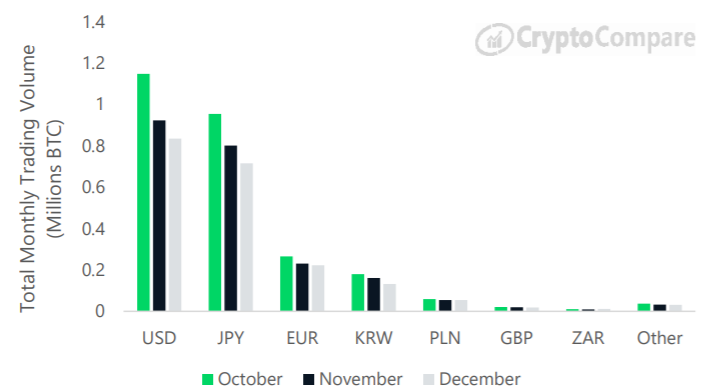

While the coin did manage to breach $9k, the upward trend did not last long. In December, the price of the coin further declined to $6.6k. During the same time, Bitcoin to US Dollar volume also plummeted when compared to the November figures.

While 70% of the total Bitcoin trading into fiat was made up of the US Dollar, the latest report from CryptoCompare noted,

“BTC to USD volumes decreased, from 922,000 BTC in November to 835,000 BTC in December [down 9.0%].”

Source: CryptoCompare | Historical Monthly Bitcoin Trading Volume into Fiat

Besides, BTC trading into Japanese Yen [JPY] represented 715,000 BTC in December. When compared to November figures, the BTC into JPY in the last month witnessed a decline of 1.0%. Additionally, BTC trading into EUR represented 222,000 BTC a decline of 3.0% since November.

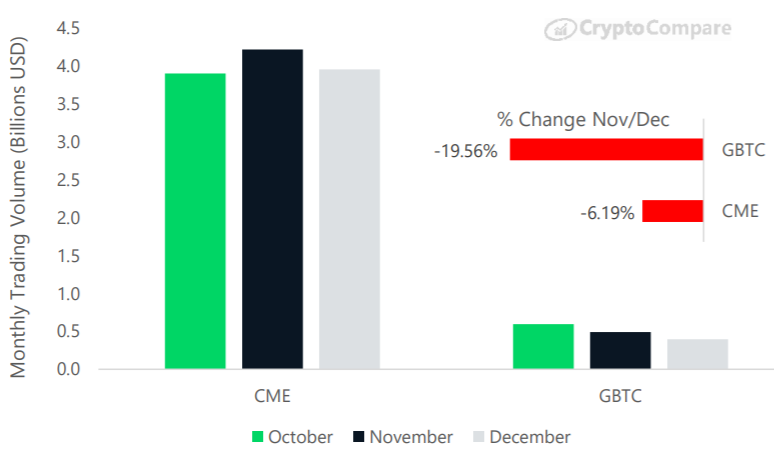

The Bitcoin derivatives market, however, continued to remain positive. While the figures declined in December, regulated Bitcoin derivatives product volumes are still dominated by CME. The total trading volumes in the last month of 2019 declined by 6.2% since November at $3.96 billion.

Source: CryptoCompare | Total Monthly Bitcoin Institutional Product Volumes

CryptoCompare’s Exchange Review stated,

“CME’s bitcoin futures product volumes decreased from a total of 4.22 billion USD traded in November to a total of 3.96 billion USD traded in December. Meanwhile, Grayscale’s bitcoin trust product [GBTC], decreased in terms of total trading volume with 394.72 million USD traded in December [down 19.6% since November]. “

AMBCrypto had earlier reported that Bitcoin Futures has reflected bullish figures on Chicago Mercantile Exchange [CME].