CryptoCompare report claims transaction fee mining exchanges are on a decline

Transaction fee mining has long been a controversial subject, with it being criticized by many in the crypto-community for a while now. According to a recent report, TFM is slowly on the decline. CryptoCompare’s latest report titled “Exchange Review October 2019” revealed that cryptocurrency exchanges implementing trans-fee mining [TFM] had declined by 3.8% between September and October.

The London-based data and price aggregator service’s report said,

“Exchanges that charge typical taker fees represented 66% of total exchange volume in October, while those that implement trans-fee mining (TFM) represented 32%”

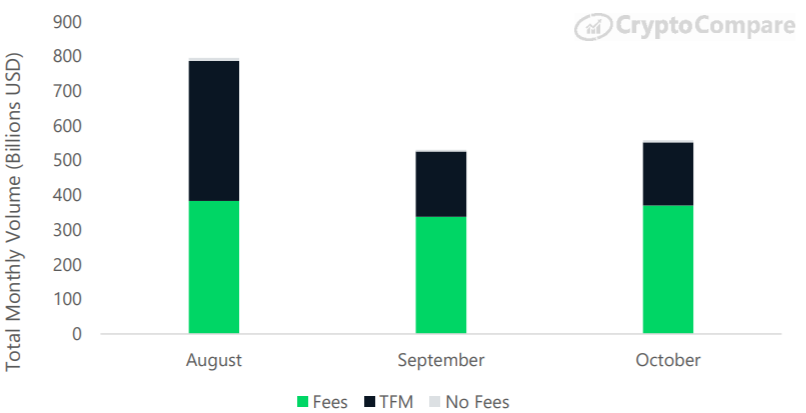

Source: CryptoCompare | Total Monthly Trading Volume by Predominant Fee Type

Crypto-platforms that charged fees traded a total of $370.3 billion in October and recorded an increase of 9.8% since September. On the other hand, those that implemented TFM traded $181.42 billion and recorded a decline of 3.8% since September. According to the report, the remaining volume represented trading by exchanges that charge predominantly no trading fees. The figure for the same stood at $6.39 billion.

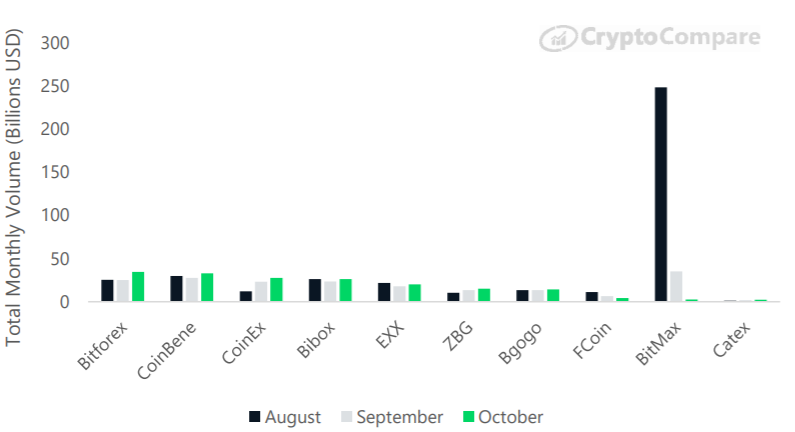

Source: CryptoCompare | Historical Monthly Volume – Top Transaction-Fee Mining Exchanges

To top the list of TFM exchanges was BitForex with $34.48 billion in total volume in October; up by 37.33% since September. This was followed by CoinBene at $32.96 billion; an increase of 19.65% in a month.

CryptoCompare had previously stated,

“Zero-fee exchanges as well as transaction-fee mining exchanges present a problem when it comes to assessing whether trading volume as well as pricing are legitimate due to the well-known criticisms of exchanges engaged in these practices”

The blog further stated that transaction fee mining exchanges rebate 100% of transaction fees in the form of their own exchange tokens. This might subsequently give traders an incentive to trade more so that they receive more tokens. This often has valuable features or dividends, both of which can effectively lead to wash trading, the blog added.