How is Bitcoin performing after the crash? Altcoins show promise

Bitcoin gets rejected from the $7,000 level for the 5th time in 15 days showing that the bears are in effect. This struggle to climb above the $7,000 mark comes after the price plunged from $9,200 to $3,850 from March 07 to March 13. Although, at the time of the drop, the whole ecosystem suffered equally, however, some altcoins have been more resilient than others. Bitcoin, for one, is trying but failing while altcoins leave it in the rear-view mirror.

The drop had implications ranging beyond the most obvious factor, price. Bitcoin network’s difficulty, hash rate, block production times, mining industry, and companies within the space have all felt the ripple effect and are still reeling from it. As for companies, many received margin calls due to the drop. Take, for example, Hut8, who dipped deep into their BTC reserves during this crash.

Bitcoin’s crash and its performance

Source: BTCUSD TradingView

With the price at $6,6770, Bitcoin has recovered 41% since the drop and has 59% more to recover. Since the magnitude of this drop was huge, this has caused some Bitcoin values to go askew. The Sortino ratio for Bitcoin has reached levels unseen since 2016 and this is bad for Bitcoin as an asset, especially, at a time of uncertainty.

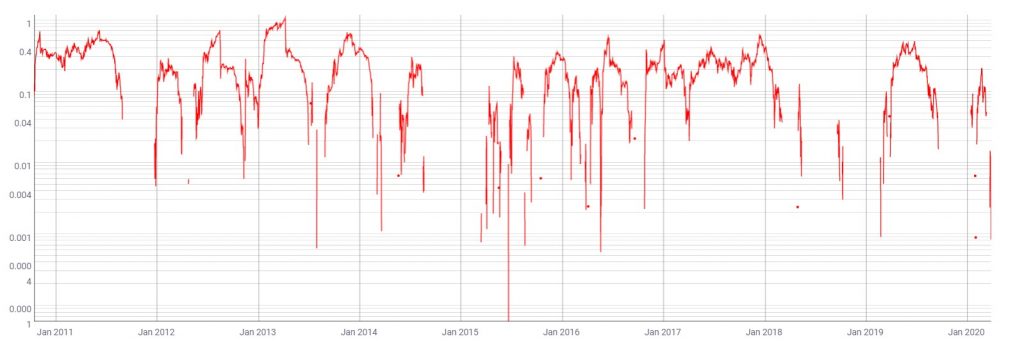

Sortino ratio is a variation of the Sharpe ratio and is used to measure a portfolio or an asset’s risk-adjusted return. The Sortino ratio is the ratio of the difference between the expected return of an asset and risk-free return, and downside volatility or negative standard deviation.

Source: Coinmetrics

At press time, the Sortino ratio, LIBOR 90d, value is at 0.00084. The last time Bitcoin’s value was this low was in 2016.

Source: TradingView

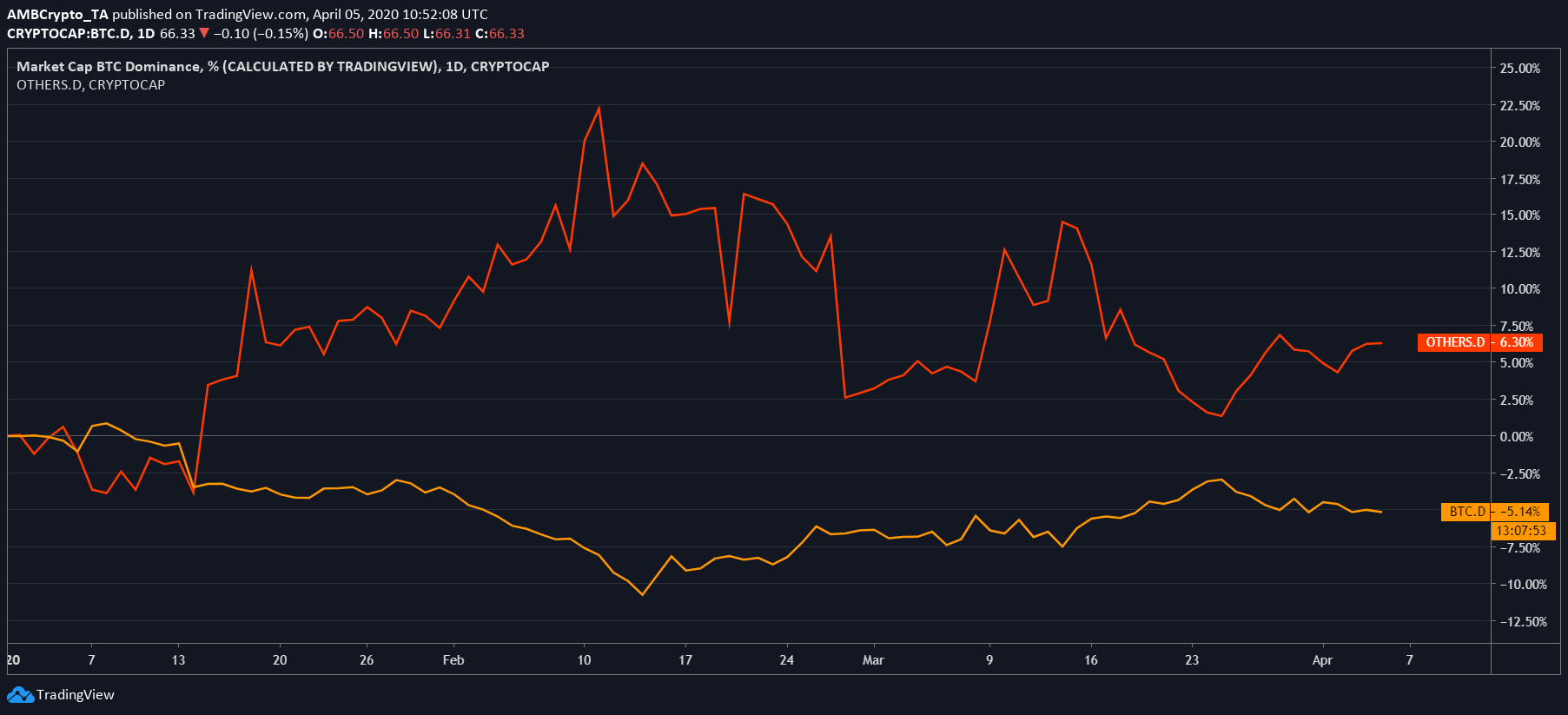

Additionally, among FTX’s altcoins, mid-cap, and shitcoin index, Bitcoin has been the worst-performing asset since 2020. BTC showed a total relative performance of -6.68%, the worst performance among the mentioned indices. Altcoin perpetual index was, surprisingly, the best performing index class with 11.69% surge YTD while, shitcoin perpetual index was at -4.81% and mid-cap had a relative performance of -2.81%.

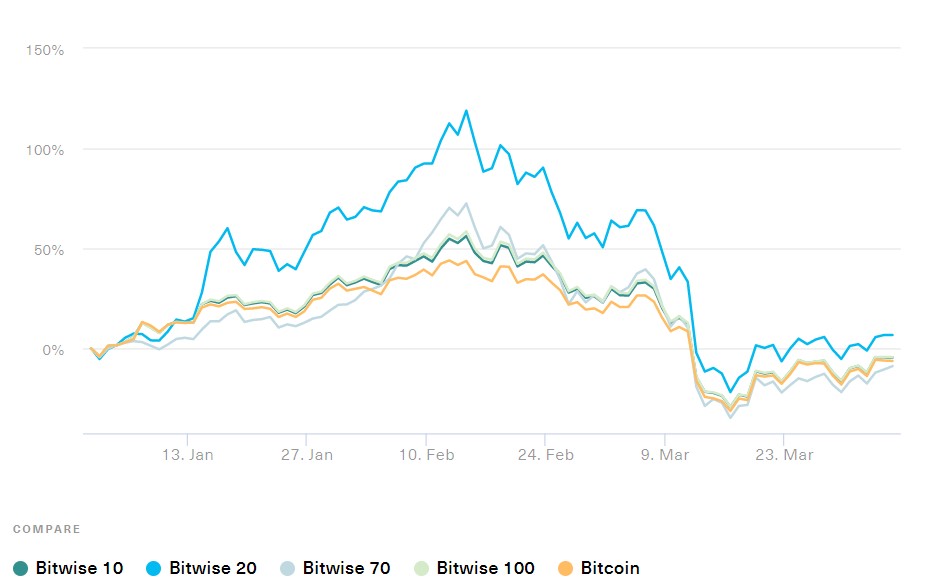

Source: Bitwise

A similar performance track record was noticed with Bitwise’s indices. Year-to-date, the best performing Bitwise index was Bitwise 20 with a 6.7% return. Following this was Bitwise 100 [-4.4%], Bitwise 10 [-4.6%], this was followed by Bitcoin with a -6.3% return since 2020. Bitwise 70 had the worst performance with a return of -8.9%.

What does the future hold?

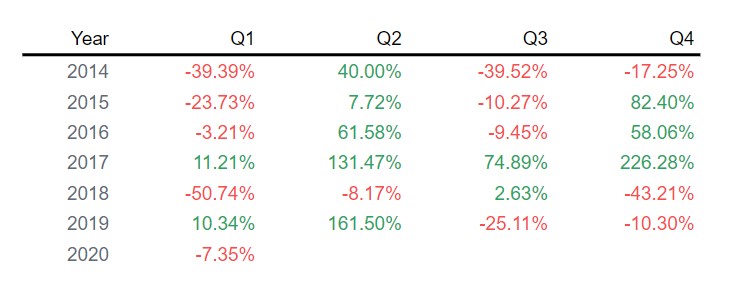

Although this looks bleak for Bitcoin, it is only in the shorter timeframe, the bigger looks much better. On average, historically, the first quarter of every year that Bitcoin has been alive has had negative returns.

Hence, the future or at least the second quarter looks bright for Bitcoin as seen in the above table.

Source: TradingView

Furthermore, the approaching halving might push the price higher, as many people expect it to.