What does Bitcoin Futures’ OI surging to pre-crash levels mean?

The second week of March 2020 was the worst the year had to offer for Bitcoin and the stock markets. Over that time period, Bitcoin‘s price crashed from $9,200 to sub-$4,000 levels. A crash that was similar in severity to 3 others contributed to liquidation in 100s of millions. However, as of today, Bitcoin Futures’ OI has surged to pre-crash levels. Going forward, understanding what this means for Bitcoin and its market is important.

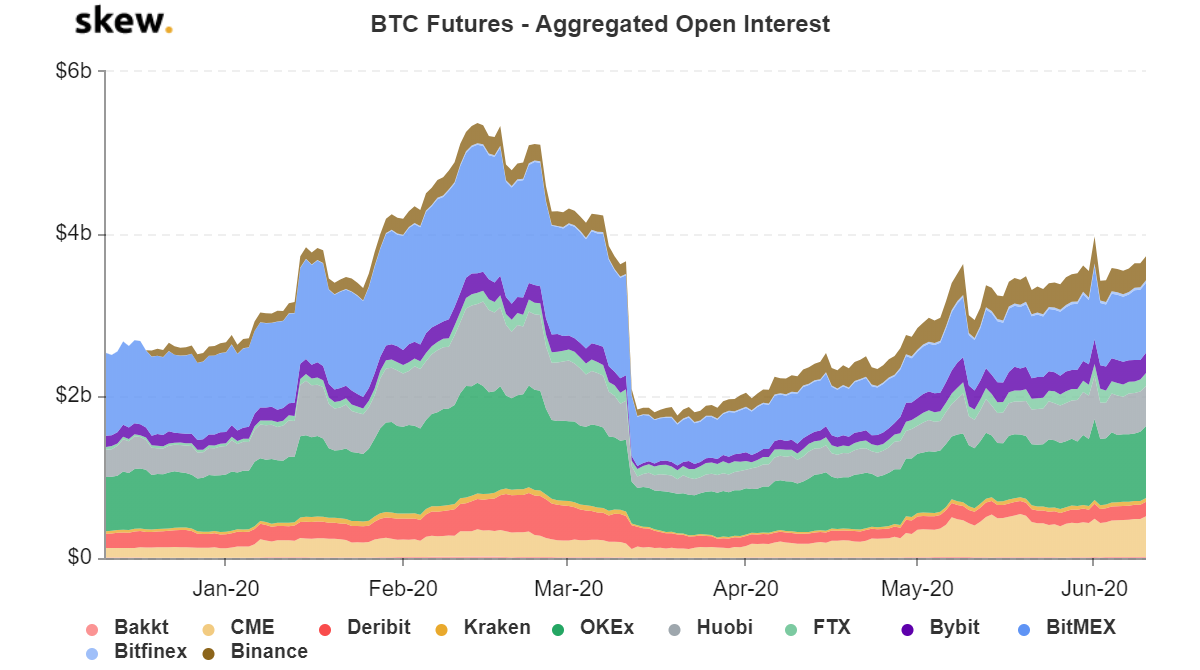

Source: Skew

Why did the crash happen?

In hindsight, looking at the OI on BTC Futures fall drastically shows that this drop was caused by an institutional sell-off, institutions who had to de-risk their portfolios. For CME, the OI went from $210 million to $113 million, for BitMEX, it plummeted from $831 million to $370 million. This sell-off by institutions came as the stock market noted an equally brutal fall. Bitcoin’s simultaneous crash contributed to the correlation between the two rising to new levels.

BTC recovered quite quickly, however, when compared to the stock markets. And while the price recuperated from $3,700 to $7,100 in less than a week, the OI rose just recently as the CME started gaining more traction.

The CME, in particular, saw an influx of traders who pushed the OI from $113 million to $379 million in just two months,. Similarly, Bakkt also saw a drastic increase. The same happened with Grayscale as it accumulated more than 33% of all the Bitcoin mined in the last 3 months. All of this adds up to the increase in Bitcoin’s price and OI across all platforms. From the above chart, it is clear that OKEx, Binance, CME, and BitMEX have contributed the most to the OI rising to pre-crash levels.

What does this mean?

The increase in OI, no doubt, provides liquidity to the market, but it doesn’t necessarily mean it’s bullish. By definition, OI is the number of positions that are open [regardless of where the positions are aligned, ie., long or short]. In a previously written article, the alignment of traders on CME had shown that shorts had the upper hand. Considering the fact that the price was forming an ascending parallel channel, which also happens to be a bearish pattern, the price is due for a short-term drop.