Bitcoin may shed at least $1,900 before the bull run

Bitcoin’s outlook since the Black Thursday looks quite bullish. This is despite the network suffering three massive negative difficulty adjustments in the last 3 months. However, as of today, the hashrate has quickly surged to [133 TH/s] just below the pre-halving levels [136 TH/s].

Taking a closer look at the price again would show that in the short to mid-term, the price is actually bearish and a drop of $1,900 is incoming.

The bigger picture

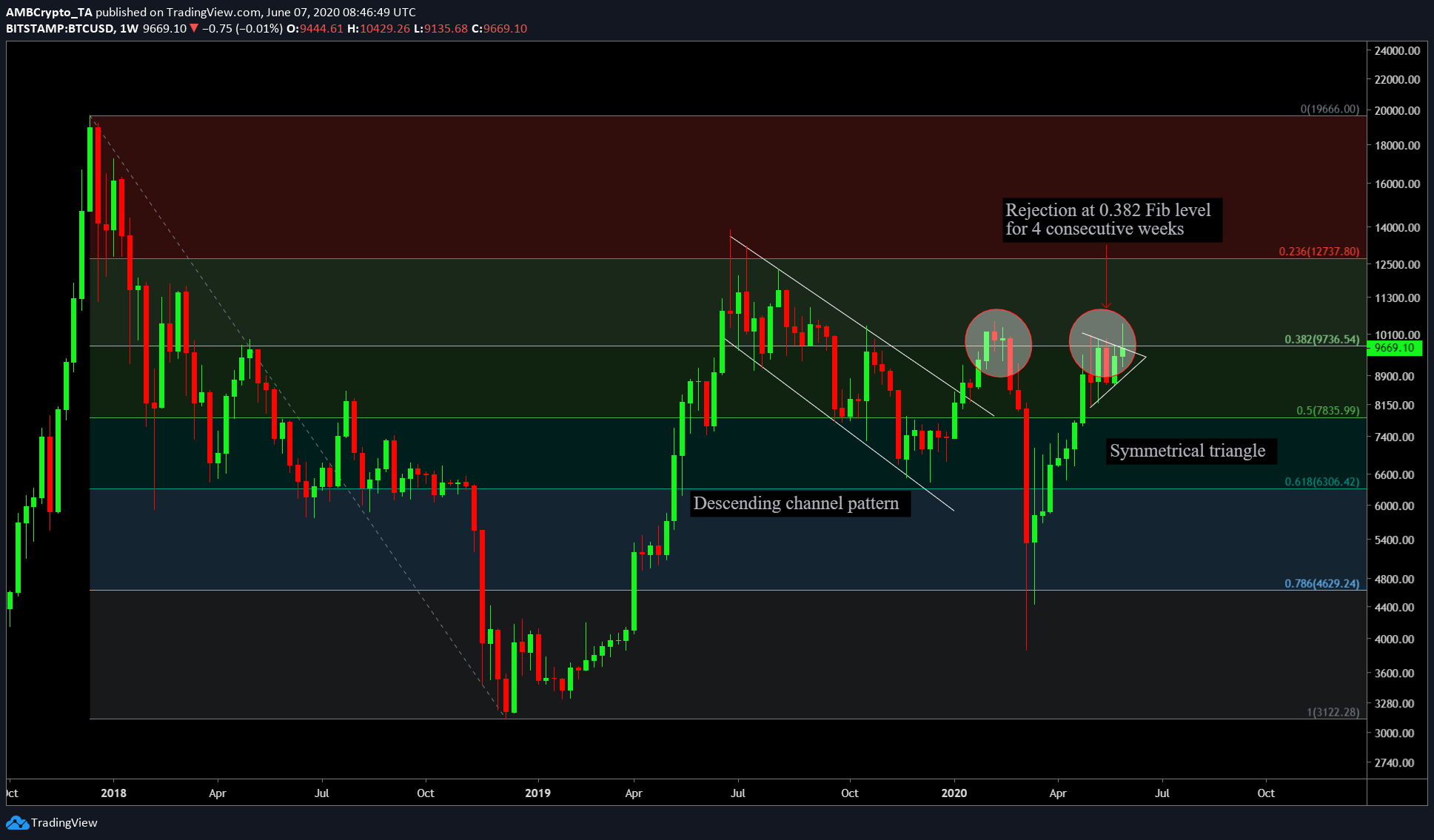

BTCUSD TradingView

In the weekly chart attached above, it can be seen that the price [at press time] was being rejected at the 0.382 Fibonacci level for the second time in 2020. With the price at $9,669, the next weekly candle will end tomorrow and will decide the next route for bitcoin. Furthermore, the formation of the symmetrical triangle shows that the price could break either way. However, considering the rejection of 4 consecutive weekly candles, the probability of the 5th candle closing above this level seems less likely.

So, where will the price go next?

The logical answer is for it to trend down to the next support level, which, according to the Fibonacci Retracement tool is at 0.5 Fib level aka $7,835.99. From the current level, the target of $7,835 is a 20% drop and although this seems extremely bearish, there is a supporting argument to it.

Bitcoin & $7,800

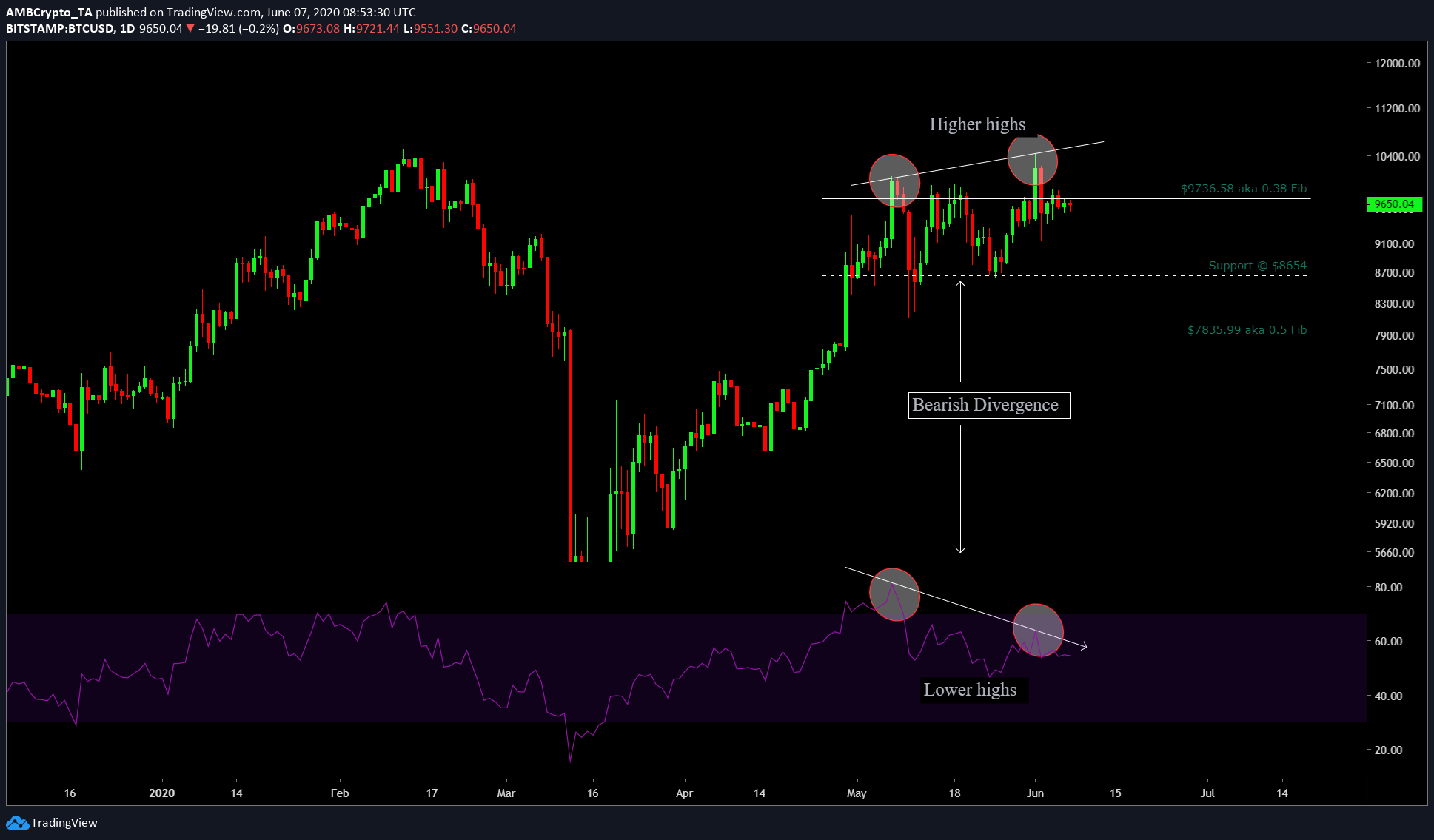

From the chart below, it is clear that there is a formation of a bearish divergence between the price and RSI. While the price has formed a higher high between May and June, RSI has formed a lower high. This shows that the buyers are exhausting the momentum and this will eventually come to an end with a downward retracement by sellers.

BTCUSD TradingView

Although the ultimate target is at $7,835.99, the price might not close there, it might wick to that level and close higher, similar to the price action in the first week of May. This will put the price at $8,654, which is an 11% drop from the current levels.

Conclusion

At present, expecting a drop to $7,800 might seem outlandish, given the increasing hashrate and the bullish nature of investors who are accumulating, but a drop here seems inevitable.