XRP short-term Price Analysis: 1 September

Disclaimer: The following price prediction should not be taken as investment advice as it is the sole opinion of the writer. The prediction should materialize in the next 24-hours.

Just like the rest of the industry, XRP was able to take advantage of the bullish comeback for the major altcoins. Dropping down below $0.26 on 26th August, the recovery since then has been significant for XRP with respect to its current valuation. Over the past 24-hours, XRP’s value has risen by 4 percent as its market cap surmounted $13 billion once again.

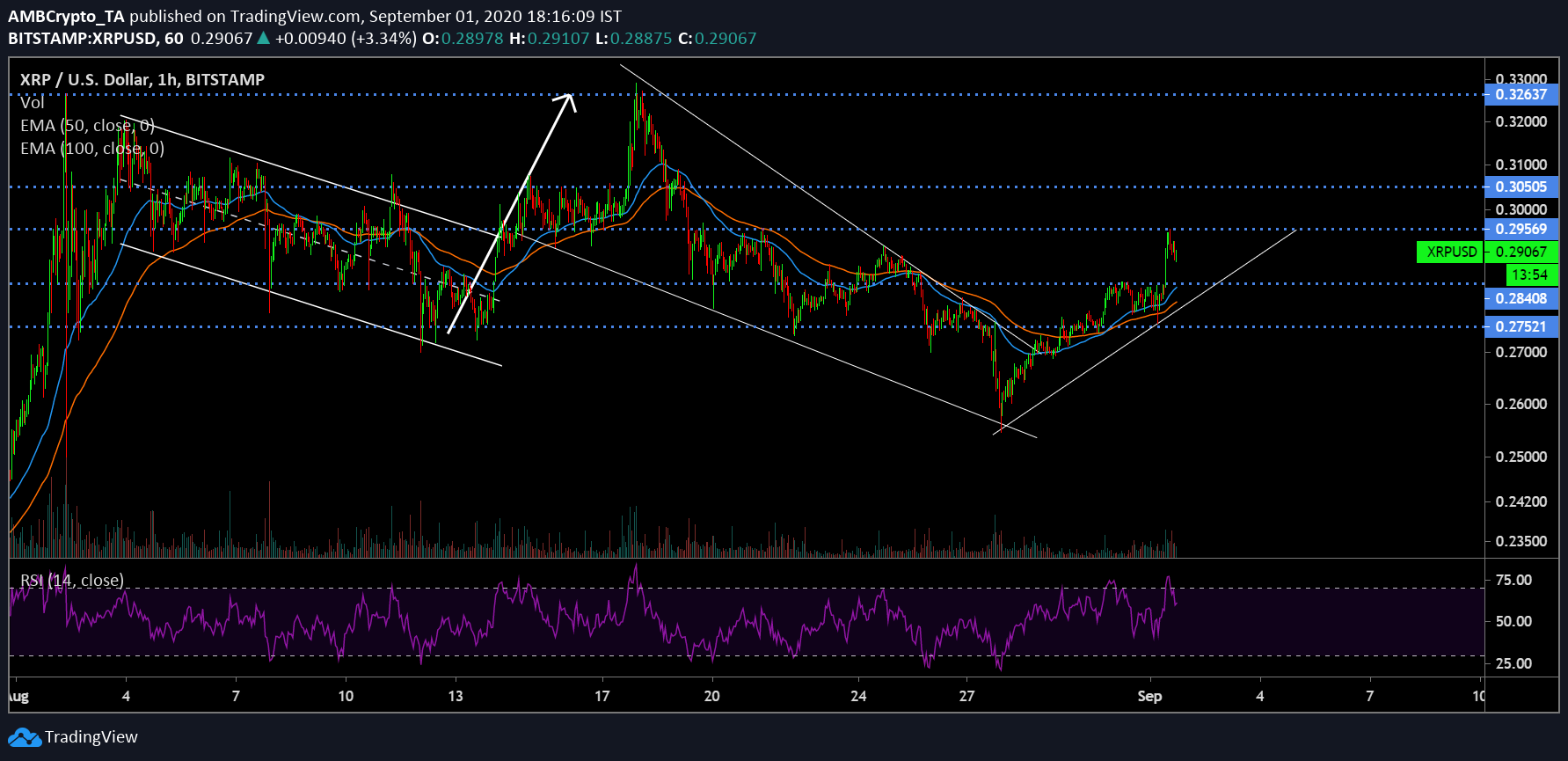

XRP 1-hour chart

Source: XRP/USD on Trading View

Although undergoing a bullish trend, the choppiness of XRP’s price movement was widely evident over the past couple of weeks. The hike mid-month came at the back fo a descending channel and after testing resistance at $0.32, the token underwent price oscillation between the trend lines of a falling wedge.

At press time, XRP had actively breached above the wedge pattern which carried bullish implications, and consequently toppled resistance at $0.275 and $0.284. At the moment, XRP is mediating right below the resistance $0.295 but considering XRP is currently nursing calculated corrections, a pullback upwards is definitely in the cards.

The current relationship between 50 and 100 Moving Average spoke volumes as well. At press time, 50-Moving Average had a clear advantage over the 100-Moving Average, suggesting a bullish period for the asset.

With the Relative Strength Index RSI firmly placed under buying pressure, the price should have it relatively easy to breach its immediate resistance at $0.295.

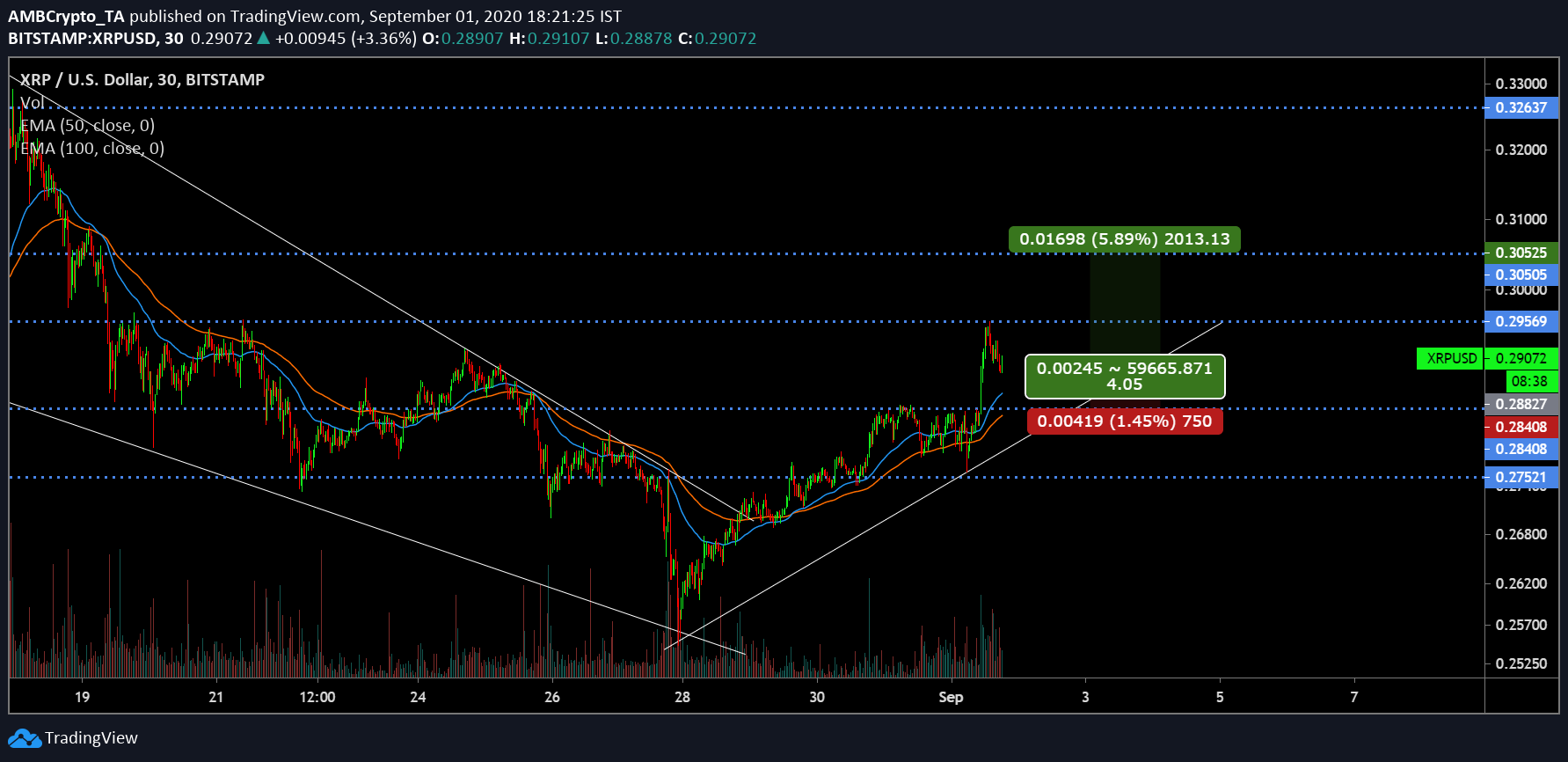

XRP 30-minute chart

Source: XRP/USD on Trading View

Now, considering the resistance at $0.295 will be breached, a retest of $0.305 can also be brought into the discussion. Such a scenario opens up a long opportunity for the traders at the moment. An entry point can be marked ar $0.288 but a close stop loss is important at $0.284. It co-exists with the current support, hence it allows the trade to have a foundational base. Profits can be taken at $0.305 as mentioned, concluding a Risk/Reward ratio of 4.05x.

The trade should play out in the next 24 hours considering market volatility and price movement is turbulent at the moment.