By 2024, EU will put in place a comprehensive framework on DLT, crypto-assets

Members of European Union have decided to make use of distributed ledger technology and adopt crypto-assets such as stablecoins, by 2024, in order to introduce new regulations to make cross-border payments cheaper and quicker according to two EU documents received by Reuters today.

According to the report, this move from the European Commission was a strategy to encourage greater use of digital finance especially as Covid-19 related lockdowns increased cashless payments.

The documents also stated that physical and online purchases were currently dominated by payment card schemes and that 78% of payments in the eurozone were in cash. Moreover, the EU planned to make instant payment systems the “new normal” by the end of 2021. The EU documents stated:

By 2024, the EU should put in place a comprehensive framework enabling the uptake of distributed ledger technology (DLT) and crypto-assets in the financial sector…It should also address the risks associated with these technologies. By 2024, the principle of passporting and a one-stop shop licensing should apply in all areas which hold strong potential for digital finance.

The documents explained that the EU will have anti-money laundering and identity checks in place after which the bloc would make rules to allow new customers to start using financial services.

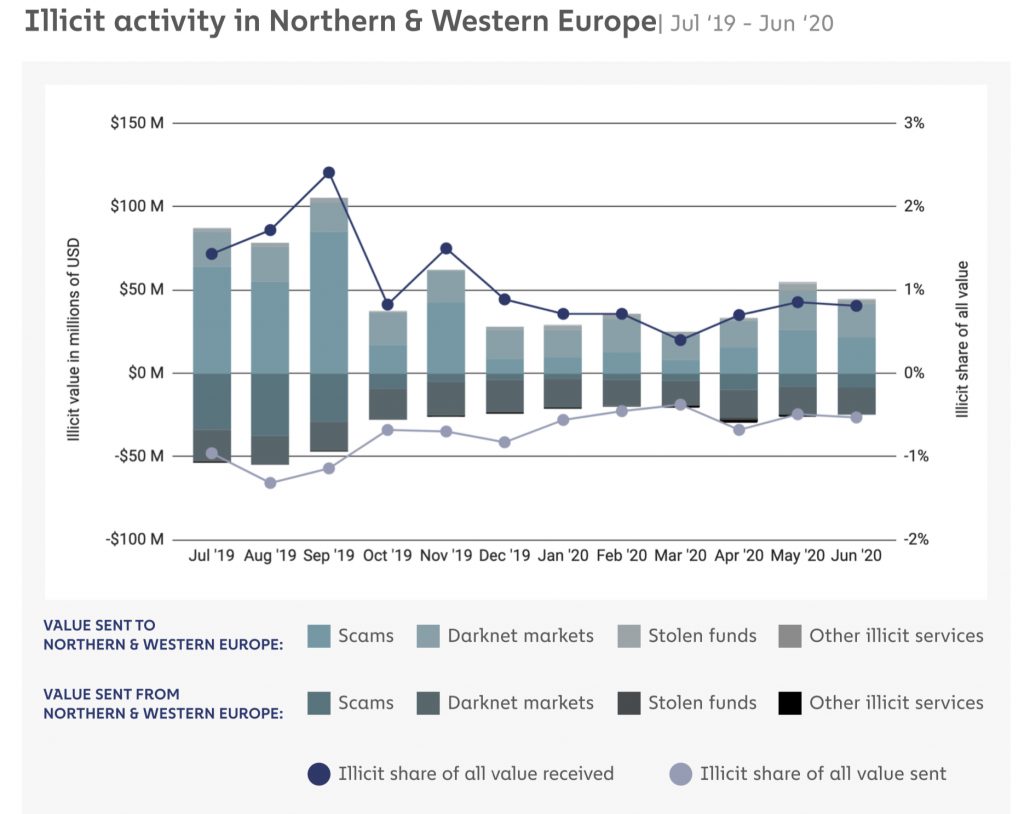

A recent study from Chainalysis stated that crypto-related crime was said to be higher in North-Western Europe as a share of all cryptocurrency activity, was said to be driven by “ransomware and darknet markets as seen below:

UK, Germany, and France showed high cryptocurrency activity in North-Western Europe with most of these nations having already passed their own unique cryptocurrency regulations.

In addition to this, the report stated that the current regulations in some of these EU member states were reportedly making it hard for crypto companies to treat the EU as “one, integrated market.” Whether the situation in the EU will improve, especially with EU’s new upcoming regulations on the horizon, will be something to watch for.