Could Bakkt become the Monarch Butterfly of the Bitcoin market?

Update: Bakkt Bitcoin trading volume for October 23, 2019

Bakkt: The promised Neverland

The dream was sold and the promise unkept.

What the market needed was something to believe in. Something that could propel the stagnancy that Bitcoin was facing. And, in came Bakkt! Media bought in to the hype, investors touted it as the next BIG thing, and the ecosystem welcomed it as a sign that the world was finally legitimizing Bitcoin.

When Intercontinental Exchange announced its crypto-venture by unveiling Bakkt in 2018, it fueled the “institutions are coming” mantra. Several investors clung on to hopes that they could reverse market movement and set aflame the dim price movements. The effect from the beginning was poised to be huge.

Ever heard about the Butterfly effect? In Chaos theory, the effect is the sensitive dependence on initial conditions in which a small change in one state of a deterministic nonlinear system can result in a large difference in a later state. In short, even a small change can make much bigger changes happen.

If the entry of one of the key players in the traditional marketplace was not enough, the platform revealed its plan of being the first regulated marketplace that would settle its Futures market in Bitcoins. A step no other player in the market had taken so far, creating a hype that was never seen before.

After facing their first regulatory bump, Bakkt finally announced that the platform had met the prerequisites to keep its word of being the “first regulated platform that would settle in Bitcoins”. The launch date was finally made public in August 2019; September 23 was going to be the grand inauguration of the much-anticipated institutional crypto-establishment and it meant a great deal for not only its price, but also for Bitcoin’s market.

The prospectives were wide, from offering price formation for a marketplace that has for long been subject to manipulation, to being the gateway for security and regulation. It was a complete package that was sought after by institutional investors.

Kelly Loeffler, CEO of Bakkt, had stated in a blogpost,

“Seamless coordination between ICE Futures U.S., ICE Clear US and the Bakkt warehouse is an important feature of Bakkt’s Bitcoin futures. Much like cotton and coffee futures contracts that can go to physical delivery, many of the same processes apply to the Bakkt Bitcoin futures.”

Even Adam White spoke a great deal about the launch of Bakkt in an interview with CNN. He said,

“This is a big day we think, not just for Bakkt and Intercontinental exchange but for the whole space because for the first time ever, you have an end-to-end regulated marketplace for price discovery of Bitcoin. So, this new emerging asset class, you can now store a federally regulated custodian, trade on an exchange and clear in our clearing house.”

Bakkt had it all, but still, it wasn’t enough.

On the day of the launch of Bitcoin’s daily and monthly Futures contract, the eyes of the world were on Bakkt. It was going to be the beginning of a new crypto-era, with Bakkt leading the way. The platform was going to show everyone how to handle not only the market that was often labeled as the wild west, but also serve as an example when it came to regulation. The promise was clear, but the result was unexpected.

The first 24 hours of Bitcoin Futures contract launch recorded a trade volume of only 71 BTC, turning out to be a great disappointment for the much-anticipated player. The lackluster turnover even resulted in many crypto-players ridiculing the ‘institutions are coming’ hype. Adding fuel to the fire was the dump of the market, as Bitcoin lost $1000 the following day, resulting in several people blaming Bakkt’s poor performance.

Nevertheless, there are some people in the market who believe that the promise will be fulfilled in the long-run, rather than in the short-run. On the day of the launch, Su Zhu had tweeted,

“Bakkt will likely first trickle and then a flood. The reality is that most regulated futures contract get low adoption on day1 simple b/c not all futures brokers are ready to clear it, many ppl want to wait and see, the trickers are not populated on risk systems, etc.”

To aggravate Bakkt’s encumbrance, CME Bitcoin Futures recorded a high daily volume on September 24, reporting a Futures volume of 14,340 BTCs. This in turn, resulted in several investors speculating that the market was not ready for physically delivered Bitcoin Futures and that institutions preferred cash-settled market more as it meant quick money. Commenting on this, Mati Greenspan had told AMBCrypto that “Wall Street still doesn’t get Bitcoin,” and that the hike in CME was merely speculation surrounding Bakkt.

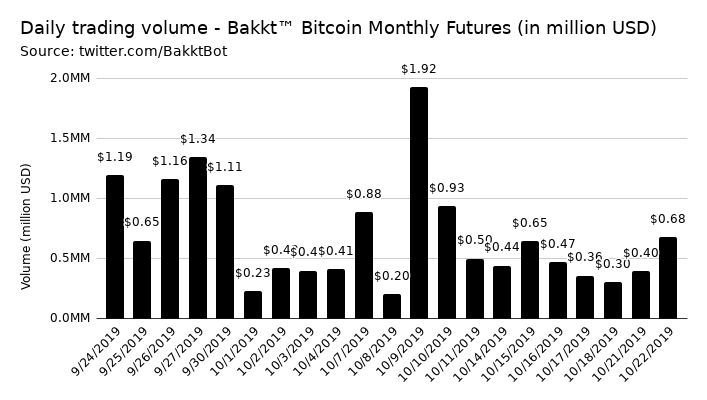

A month down the road, Bakkt’s Futures market showed improvement, if not a major impact. The platform recorded its first highest daily trading volume on October 9, with $1.92 million in volume.

Bakkt daily trading volume | Monthly Futures Contract | Source: BakktBot Twitter

On Bakkt participation, Damon Leavell from ICE told AMBCrypto,

“On the first day of trading on ICE Futures U.S., there was strong industry participation in Bakkt Bitcoin Futures and the Oct’19 monthly contract had the tightest bid-offer spreads in the market, which was an exciting achievement. As the only end-to-end regulated market for digital assets, Bakkt Bitcoin Futures will play a key role in bringing greater price discovery and risk management to the Bitcoin market.”

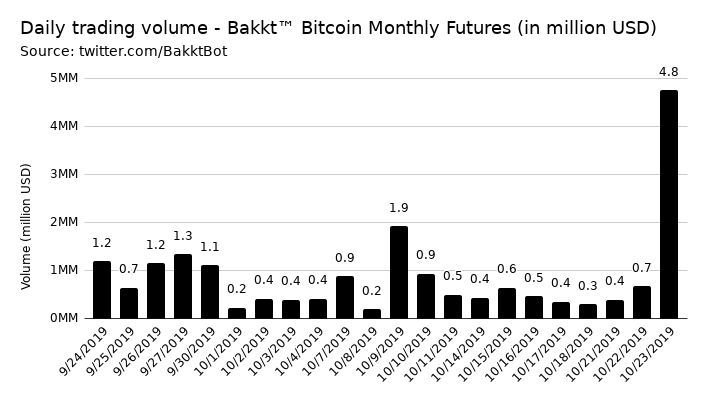

Notably, Bakkt marked another milestone on October 23, 2019, by recording its second highest Bitcoin trading volume, according to Bakkt Volume Bot, with the trading volume standing at $4.8 million.

Bakkt daily trading volume | Monthly Futures Contract | Source: BakktBot Twitter

Just hype or is this the calm before the storm? Only time will unveil the Bakkt effect on the market. A month is too short a period to term anything a success or a failure. What Bakkt had always represented remains true – institutions are coming, (they are taking their own time), it did legitimize Bitcoin to mainstream investors.

It may not have met our expectations of boosting Bitcoin’s price to $20,000 overnight, but its price discovery would have an effect on the regulation space. Bakkt’s method of price discovery can be compared to other exchanges’ price of Bitcoin to act as a comparison poll to gauge market manipulation and fraud.

Bakkt’s butterfly effect is yet to occur. All the markets can do is patiently wait and watch the caterpillar become the butterfly. For all we know, Bakkt could be the Monarch Butterfly!