CBDC creation may come in for sharper focus following COVID-19 pandemic

The COVID-19 pandemic gave the entire world a wake-up call in terms of health and hygiene; from washing hands every twenty minutes to the extensive use of hand sanitizers. Another thing that has gained traction lately is the fact that the virus could be transmitted via cash. In fact, even the World Health Organization [WHO] has encouraged people to use as many digital payment options as possible in the wake of the Coronavirus crisis.

Source: Google Trends search

The attached chart is a Google Trends data sheet gathered for five searches- “Cash Covid,” “Coin Covid,” “Cash virus,” “Coin virus,” and “Cash corona,” over the last 30 days. This is a reflection of the panic the pandemic has given birth to across the world.

Soon, many in the crypto-community took this opportunity to promote the use of Bitcoin. However, soon, many started questioning the need for crypto when there are digital govt-backed currency payment systems already in place.

As a response to this argument, a recent BIS report has asserted that not all digital payments are immune to this deadly virus. It opined that the pandemic may call for a sharper focus on CBDC creation. The report read,

“Debit and credit card transactions generally require a signature or a PIN entry at a merchant owned device for larger transactions. Contactless card payments, which are popular in several countries do not require a PIN for small transactions but have set higher transaction limits for contactless payments.”

Another important point to consider is that this sudden switch from a cash system to the digital payment system will have a severe impact on unbanked and older people. This could be an important debate going forward, potentially asking for the strengthening of cash’s role in the economy.

In light of these loopholes in the traditional system of payments, the report suggested that the introduction of a CBDC could be a possible solution. It also noted that CBDCs should be designed in such a way that it can withstand a huge range of shocks, including pandemics and cyber-attacks, along with allowing access options for the unbanked and (contact-free) technical interfaces suitable for the whole population.

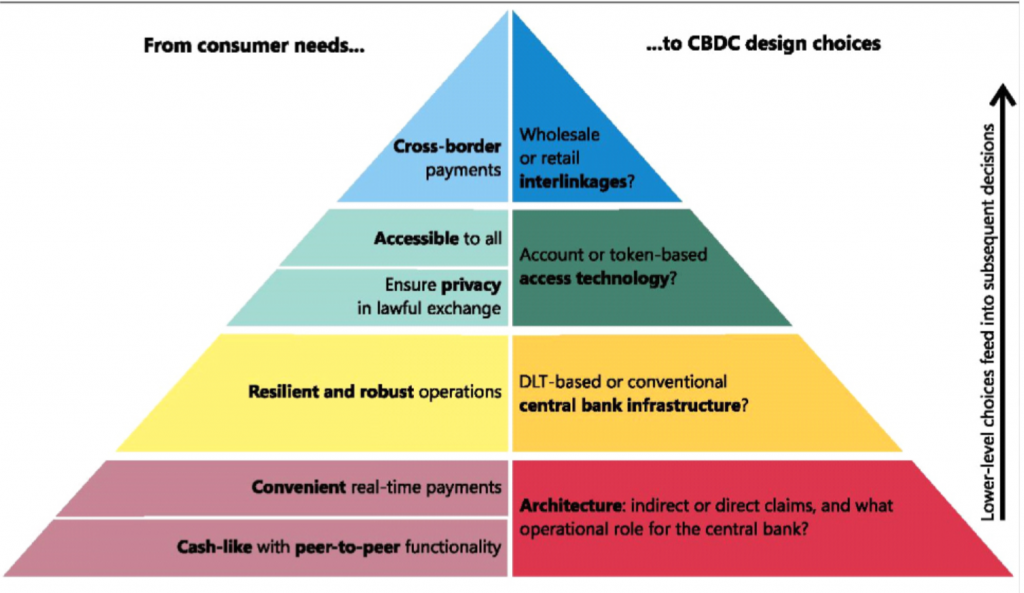

The attached CBDC pyramid maps consumer needs and the associated design choices for central banks. While ‘cash-like with peer-to-peer functionality’ and ‘convenient real-time payments’ are the basic needs of a CBDC, the operational role of central banks comes into question. Similarly, if all the above-mentioned user needs are met by the banks while designing the CBDC, the project might turn out to be a success. The bottom stays simple. A CBDC, to be successful, must be secure and accessible, offer cash-like convenience, and safeguard privacy.