BitMEX saw $120 million liquidated during Bitcoin’s drop from $10,000

After entering the coveted golden cross earlier in the week, Bitcoin dropped yet again. The cryptocurrency’s platonic relationship with the $10,000 price mark seems to have ignited a rush of liquidations.

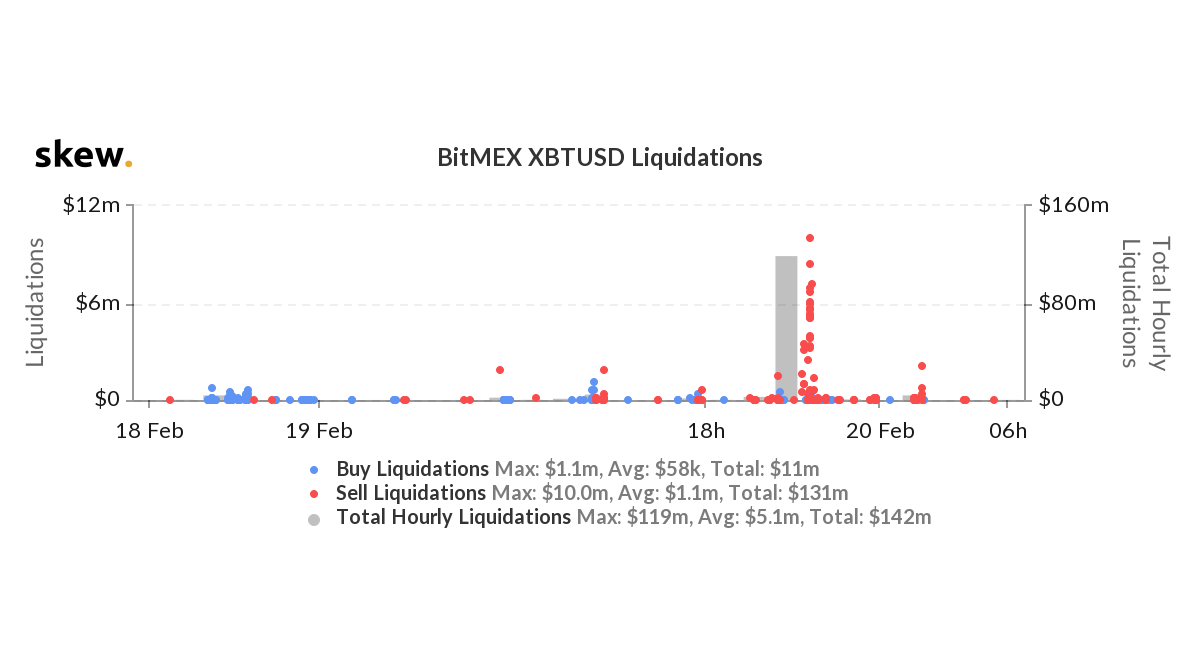

The rapid price drop of over 5.5 percent saw $119 million in liquidations on BitMEX’s XBTUSD contracts. Data from skew markets posit the longs to have been “rekt”, at around 1600 UTC on 19 February.

Source: BitMEX XBTUSD Liquidations, skew

Among the long-positions to get liquidated, the most notable ones were valued at $10 million, $8.4 million and $7.7 million respectively.

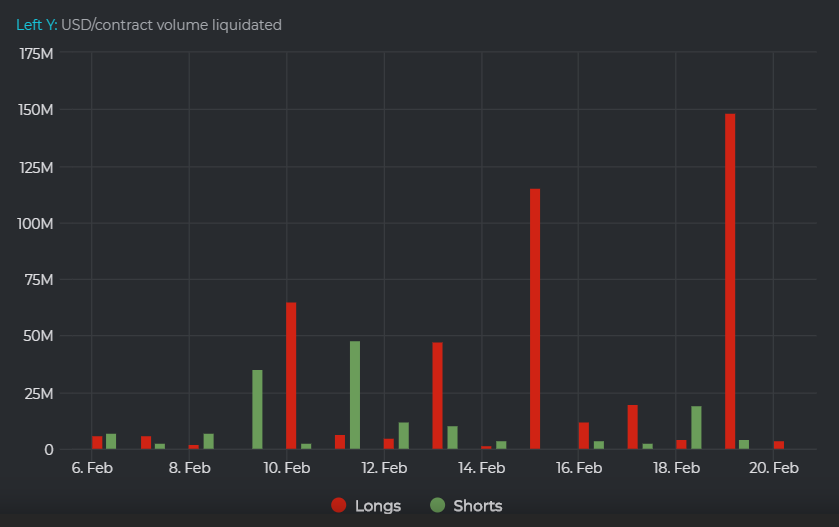

In total 63 long positions were taken out comprising of 88.4 BTCs, based on data from datamish. Interestingly, three days before the drop, longs of 34.9 BTC, 70.7 BTC and 117.6 BTC in volume were liquidated.

While the current trend suggested an increase in liquidations, looking at the bigger picture it’s simply a return to the old. In the past few months, liquidations have been relatively subdued.

Source: BitMEX Longs vs Shorts liquidation, datamish

The recent $120 million liquidation was the highest since January 19, when over $140 millions, of both longs and shorts were liquidated when Bitcoin dropped by over 4 percent in the hour, from $9,000 to $8,600. This drop was preceded by a rise of $200 in under 2 hours, resulting in both buy-side and sell-side rekt cases.

In fact, the liquidates over the past two months were so minuscule compared to the second half of 2019, that skew themselves suggested that 2020 could be the year of “less liquidation.”

Is less liquidation a new 2020 trend? pic.twitter.com/cvv5VngSnz

— skew (@skewdotcom) February 18, 2020

However, with 2019 seeing over $500 million in liquidations on two separate occasions on April 2, as the price rose by 17 percent in a day, and on September 24, as the price dropped by over 15 percent, 2020 liquidations are still a long way off.

With the halving scheduled for May 2020, derivatives volume increasing by the day, and the price moving the way it is, keep an eye on the liquidations.