Bitcoin’s tug-of-war with the CME seems to be ending

Another month comes to a close and another set of CME Bitcoin Futures are set to expire; how has the derivatives market changed over that time? Well, quite a lot.

With the Chicago Board of Options Exchange [CBOE] pulling out of the market, the only viable competing force for the CME Group is the Intercontinental Exchange’s [ICE] digital asset brainchild, Bakkt. Over the past month, Bakkt has not only doubled its ATH volume, but it has also recorded consistent performance, doing away with the initial notion that Wall Street prefers their Bitcoin Futures in cash.

Another point of contention for CME is Bakkt, who while plying their physically delivered Bitcoin Futures contracts, will also be rolling out cash-settled derivatives. On 21 November, ICE had stated that Bakkt Bitcoin cash-settled monthly Futures will be listed by ICE Futures Singapore and will be cleared by ICE Clear Singapore. These contractual Bitcoins will be settled against their physically-delivered alternative issued across the Pacific, in the United States.

On the price front, Bitcoin is having a roller-coaster time, a boon for the volatility-hungry Futures markets. Since closing October at $9,100, Bitcoin has been consistently dropping, reaching a six-month low after China was rumored to have resumed its cryptocurrency crackdown last week. Following this news, the markets put Bitcoin at $6,800, and after breaking above $7,000 a few days later, the news of the Ethereum theft on Upbit sank Bitcoin once again.

With the increasing price volatility, both the Futures markets were having a better November.

Bakkt in the game

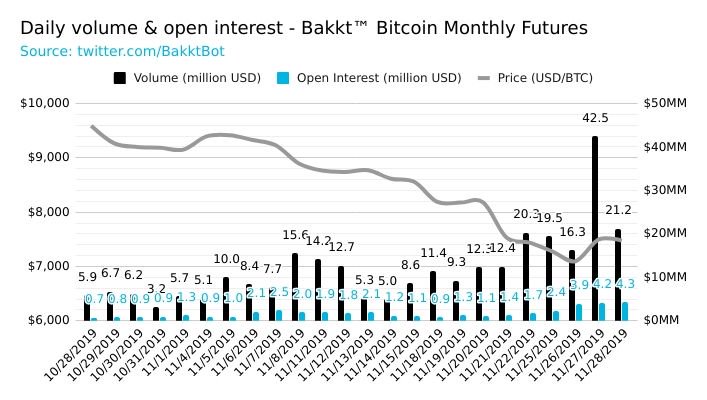

Bakkt saw consistently surging volumes, with the lowest being $5 million and the highest being over $42 million. On average, the daily volume per day was over $13 million. To put that figure in perspective, the highest volume for the entire month of October was $10.3 million on 25 October when Bitcoin shot up by over 40 percent in a day, following Xi Jinping’s blockchain blessing.

Source: Bakkt Volume Bot, via Twitter

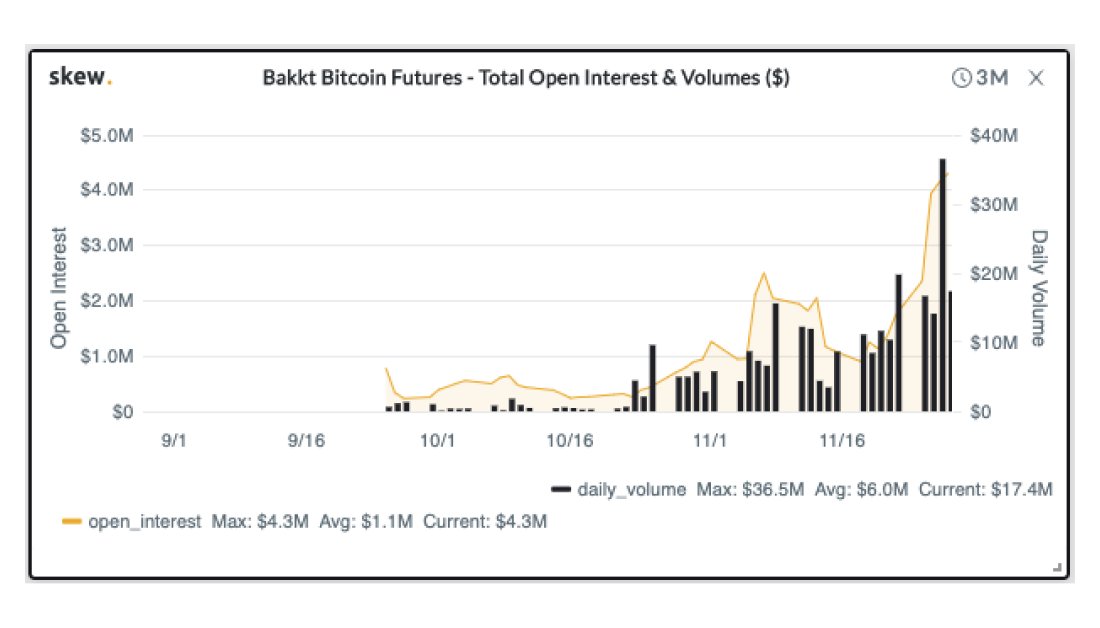

Volatility in price and speculation saw the volume shoot to double its previous highest point seen less than a week ago, as Bitcoin is responding quite sensitively to news coming out of China. Open Interest, a metric that records the total number of outstanding contracts of both Futures and Options on a particular exchange, has also risen to its highest point, according to data from Skew Markets. Following the pre-Thanksgiving pump, Bakkt’s OI shot up to over $35 million.

Source: Skew Markets, via Twitter

CME not far behind

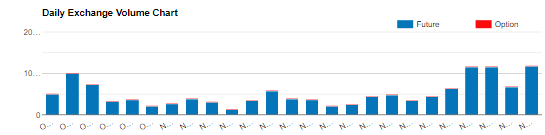

While the performance prior to 21 November 21 had been dismal, since then, CME Bitcoin Futures volume has been looking good. Keep in mind that in August, Tim Court, the CME’s Managing Director, had stated that YTD, the exchange saw an average of 7,237 contracts traded per day.

Source: Bitcoin Futures Volume, CME Group

Between 22-27 November, the average contracts traded per day on the CME were 10,371, an increase of over 30 percent from the YTD figure. Three days saw over 11,400 contracts traded per day, and with an average of $7,200 per Bitcoin and five BTCs per contract, the volume [in pure dollar terms] was over $400 million. An ocean compared to the drop that is Bakkt, but still cash-settled compared to Bakkt’s custody-complete physically delivered contracts.

Expiry to Manipulation

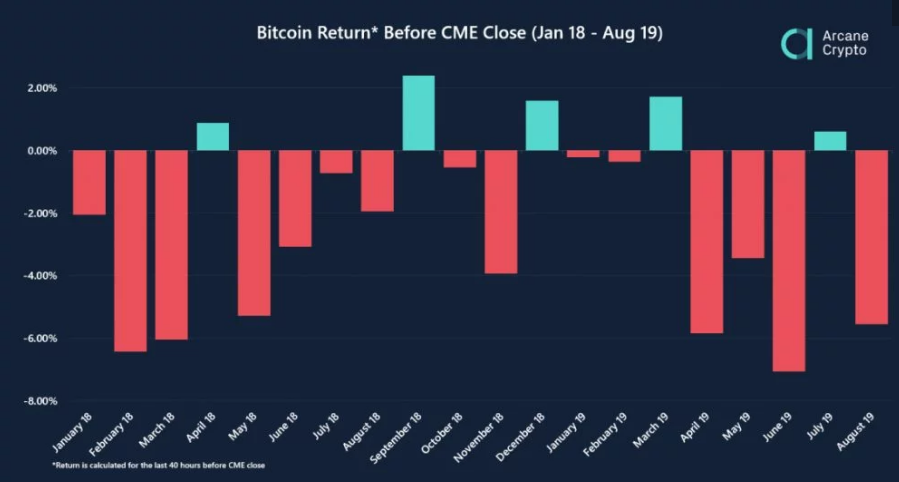

The CME Bitcoin Futures expiry does bear importance to the larger market owing to the strings between Wall Street and Bitcoin’s spot price. According to a study by Arcane Crypto, Bitcoin’s spot price drops by 2.27 percent towards each settlement, while on any other day it drops on average by 0.06 percent. Bendik Norheim Schei, the author of the study, wrote,

“Statistically, it is highly unlikely that the price falls in advance of CME settlement should be caused by mere coincidence. With approximately the same number of positive and negative days over the period, there is less than 2% probability of observing 15 (or more) days of price drops out of 20 possible.”

An important caveat to notice here is that according to Schei himself, it is uncertain that this is down to “deliberate manipulation,” or as a simple hedging strategy. Moreover, important factors affecting both spot price and the Bitcoin Futures market have not been included. All in all, there is a drop of 2 percent in Bitcoin’s price during the close of CME’s Futures, stated the study, looking at data from August 2018 to August 2019, and the same occurs on the last Friday of the month.

Source: Bitcoin Return via Arcane Crypto

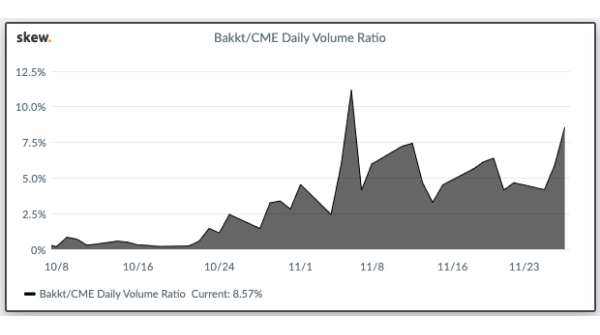

The absence of Bakkt data in the study cannot be overstated. ICE’s digital assets platform has changed the way Bitcoin Futures are traded, and their increasing volumes is evidence of the industry’s slow, but gradual confidence in its products. Its volume has been increasing against the Chicago exchange, reaching its second-highest point in the past few days, according to data released by Skew Markets.

Source: Skew Markets via Twitter

Mati Greenspan, the Founder of Quantum Economics, told AMBCrypto that Bakkt is pivotal to the industry and hence, the CME-Bitcoin spot effect should be seen after Bakkt has time to settle in the market. He said,

“That study was done just before Bakkt launched, so I guess we’ll have to wait for further data to understand the affects.”

Bitcoin Holding Strong

The tug-of-war with the CME markets and allegations of Wall Street manipulating the price during every expiry have eased off, looking at the current state of Bitcoin’s price. Given there are a lot of factors at play with the current trend in Bitcoin’s price, CME is not the least of it by any means.

Source: BTC/USD via TradingView

It could be argued that the regulated Futures market’s hold on the spot price has decreased as Bakkt has gained a strong foothold in the derivatives market. Furthermore, it can also be said that Bitcoin is increasingly becoming more sensitive to more retail movements, rather than institutional. The China induced price rally on 25 October and the 2 percent hourly drop following the Upbit hack are testaments to the same.

Since dropping to $6,800 for the second time in two weeks on 27 November, the price of the king coin has been ascending. Whether this can be tied down to CME’s lack of relevance, intrinsic factors or something else, one thing is for certain; Bitcoin will be enjoying the holiday weekend.