Bitcoin’s rising implied volatility a sign of continuing price fluctuation

While few attribute the king coin’s intense volatility to Bitcoin’s fixed supply, many have highlighted the speculative demand from investors as a reason. However, since the start of 2020, Bitcoin’s price has recorded too many fluctuations. From breaching the $10,000 mark, twice, to falling below $9,000, Bitcoin has had a wild run in the last two months. Inevitably, the coin’s volatility is also on the rise and will continue to be, owing to its never-predictable price movement.

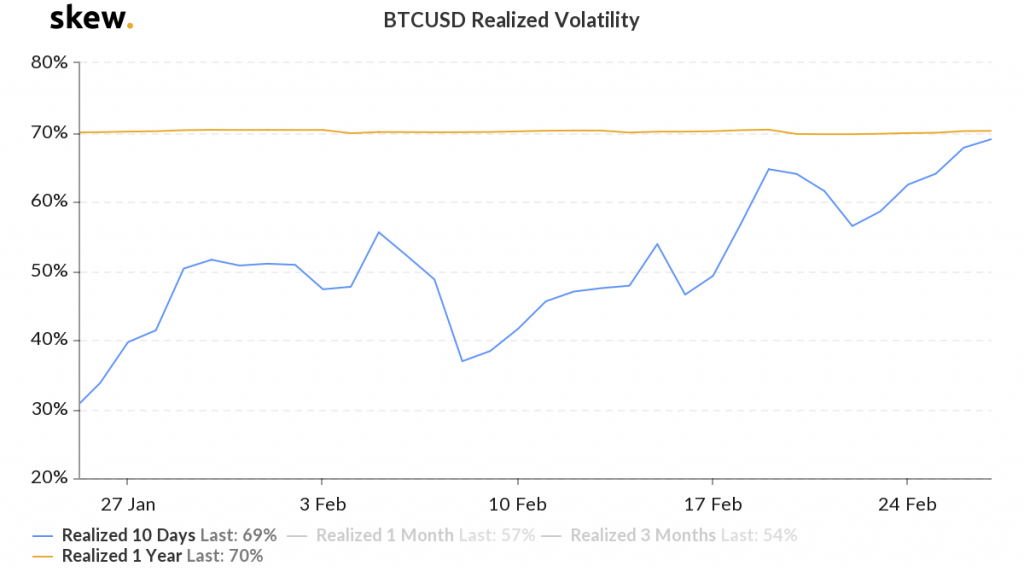

Source: BTCUSD Realized Volatility, skew

It can be seen from the above chart [realized volatility for one month] that the price’s realized volatility followed a rising pattern starting 27 January at 55%, and continued to rise until the volatility dropped on 8 February, reaching 52%. The three percent drop was followed by another steep drop on 15 February, with the volatility dropping almost by 10%. But starting 15 February, the coin saw a continuous rise in the realized volatility, surging from 42% on 15 February to 57% on 27 February – a whopping 15% rise.

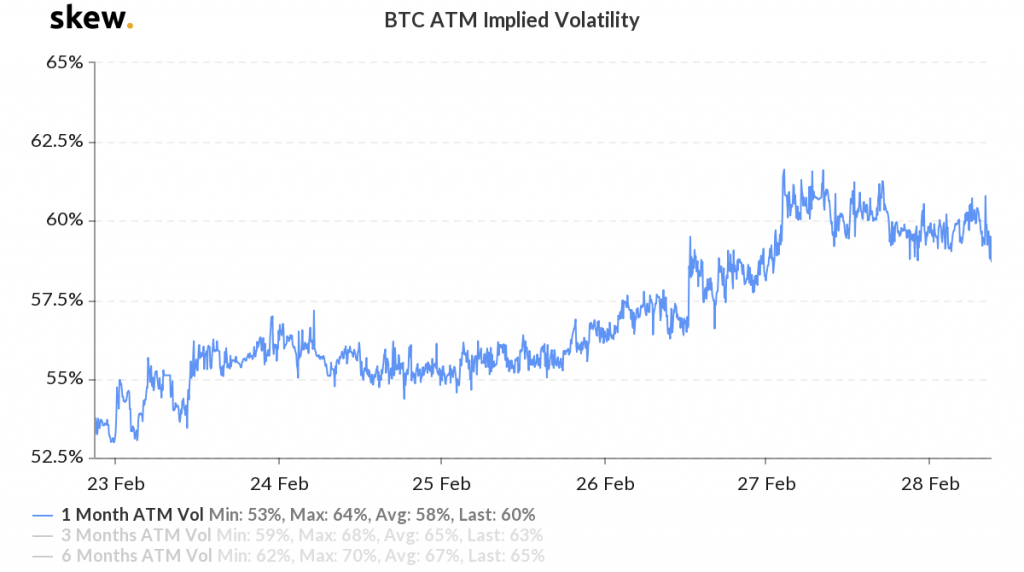

Source: BTC ATM Implied Volatility, skew

On the other hand, data from Skew markets also revealed that the implied volatility [IV] of Bitcoin is rising. This comes after just a few weeks ago, the IV for 3 months had dropped from a high of 3.5 percent, during the $10,000 pullback, to 3.2 percent.

From the above pattern, it can be seen that the implied volatility for a period of one month rose by 7% from 23 February to 27 February. There has not been significant movement in implied volatility seen post-February 27, and the coin’s price has been quite stable. However, starting 28 February, the implied volatility has slowly started to rise.

The implied volatility [IV] takes into consideration the supply and demand representing the expected fluctuations of an underlying stock or index over a specific time frame. Simply put, the IV is a forward-looking metric that captures the possible changes in the coin’s price. Investors often employ it to price Options contracts.

Source: BTCUSD/ BITSTAMP, Tradingview

Comparing the above two charts [time frame: February 18- 28], the price drop on February 18 to 19 wasn’t very significant and hence, it can be seen on the Implied Volatility chart that there’s not much variation in the volatility.

However, the steep price fall from February 24 to 26 indicates there is a clear rise in the volatility that is shown in the second chart. As Bitcoin’s price, at the moment, is playing around the $9,000 level, there is not much volatility seen in between, but the slow rise in the volatility pattern can not be missed.

Analyzing the above data, it can be predicted that the king coin’s price will continue to fluctuate in the near future and as Bitcoin’s third halving is right around the corner, owing to the market’s performance, the coin might experience even more volatility moving ahead.