Bitcoin’s price is anyone’s guess; the next US President not so much

Can you accurately predict Bitcoin’s price? Most people would disagree. In a market so fickle and sensitive, Bitcoin’s price can never be accurately estimated.

A testament to this unpredictability is the case of the golden cross. Earlier this week, market participants were celebrating the $10,000 ascent because it came with the crypto’s 50-day MA moving over its 200-day MA, a sign of bullish things to come. It wasn’t.

In the next few days, the coin dropped below $10,000 yet again, a 5.5 percent hourly drop that took the coin back down to $9,500. Whomp whomp!

If you think this was a golden cross anomaly, you’re wrong. Back in October, as Bitcoin entered the bearish equivalent of the golden cross, titled the ‘death cross‘ the price increased by 27 percent in the next three days.

Source: BTC/USD via TradingView

The Bitcoin market is quite shaky, but what could be worth predicting, in the larger scheme of things is who will become the most powerful person in the world, come November 2020. FTX, a crypto-derivatives exchange, rolled out PRESIDENT 2020 contracts for both the incumbent Donald Trump and the 5 top Democratic nominees.

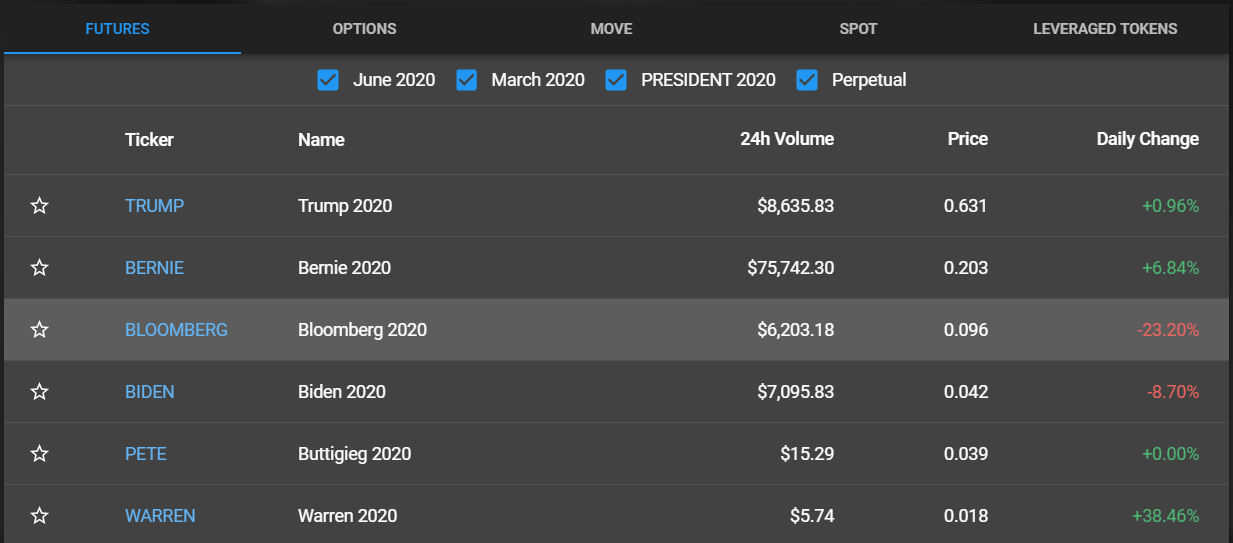

After last night’s Democratic primary debate, there has been a reshuffle, providing a glimpse of who the crypto-community is bullish on come the nominee pick.

At press time, while Bitcoin is down by over 5 percent in the daily charts, the biggest gainer on the Presidential derivatives is, surprisingly, Elizabeth Warren. The senator from Massachusetts’ Warren 2020 contracts are up by a whopping 38.46 percent after a strong showing in the debate. Despite the recent price rise, Warren 2020 contracts are still priced at $0.018, lowest of them all.

Source: PRESIDENT 2020, FTX

It seems that while the market has turned bullish on Warren, it turned bearish on perhaps the biggest capitalist of the filed, Michael Bloomberg. The former mayor of New York city saw his contracts drop by 23.2 percent. The Bloomberg 2020 contracts which before the debate was priced at $0.14 fell to $0.096, but is still second only to Bernie Sanders’ derivative.

The Bernie 2020 contracts were up by 6.84 percent, taking the lead at $0.203, with over $75,000 trading volume, more than the rest of the contracts combined, including the Trump 2020 contract. Pete Buttigieg remained flat with no change, while two-term vice president, Joe Biden also saw an increase of 4.35 percent.

While volatility is rampant on the Dem-derivatives, market participants are still bullish on a continuing Trump presidency. Latest information suggests Trump is riding high at a price of $0.63 percent, but who knows… a tweet could soon change that. How things go from here to November will be very interesting.

Regardless of the outcome and the market, the fact that a derivative product priced in dollars and traded for cryptocurrencies is predicting a Democratic Socialist to win the nomination reeks of unending irony. What’s even more ironic is that FTX is restricted in the US, so US citizens cannot trade a contract predicting their next president.

Even still, predicting who will be the next US president is easier than predicting the price of Bitcoin.