Bitcoin turns the tide among macroeconomic competitors

For a large part of 2019, Bitcoin had an unlikely companion. The digital gold saw a remarkable correlation with tangible gold as the two stores of value saw like-for-like movement. While this brotherhood was brewing, another key market indicator, the S&P 500, was moving in the other direction.

At the end of 2019, the BTC-GLD correlation was as high as 0.2 on the Person scale, continuing its momentum upwards since May 2019. Ironically, this was when Grayscale launched the #DropGold campaign and gold bottomed-out, following which, it started rising.

From the start to August 2019, the 180-day correlation between BTC and SPX was heading south.

With the script for 2019, putting Gold as a supporting cast member and SPX as the villain in Bitcoin’s heroic story, market movements in 2020 show that there has been a stark role-reversal.

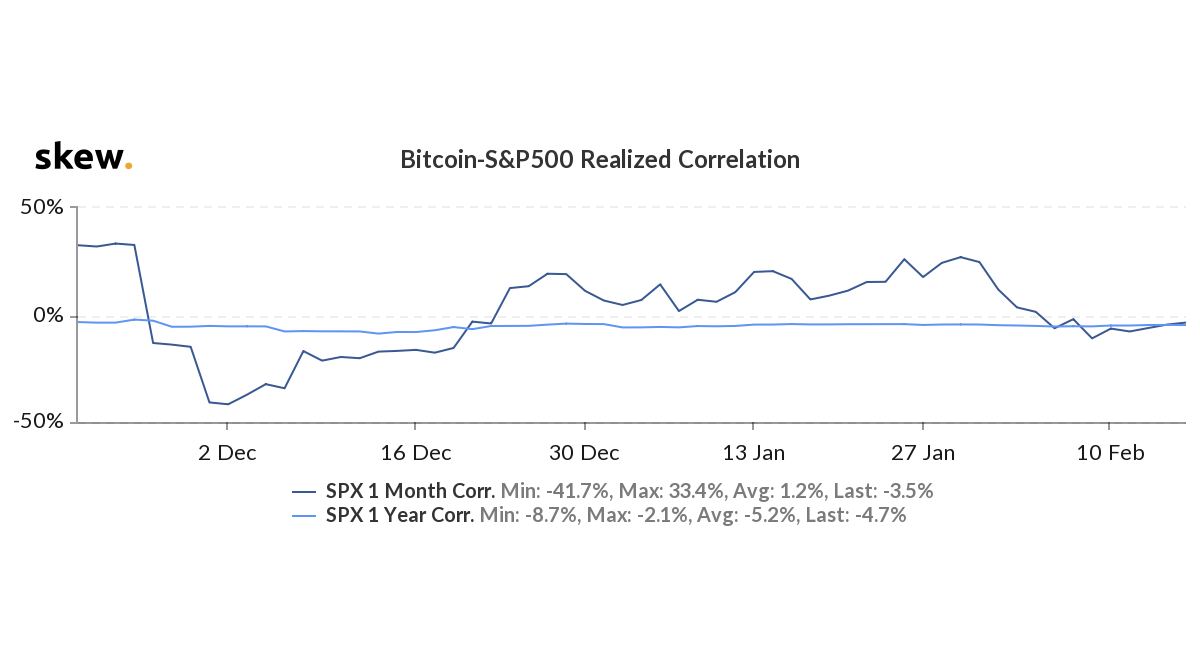

Source: BTC – S&P500 Realized Correlation, skew

According to data from skew markets, the Bitcoin-S&P500 realized correlation has been on the rise since the first week of March, surging from -10.9 percent to -3.5 percent over the past two weeks. The 1-month correlation between the two assets is now over the 1-year measurement for the same.

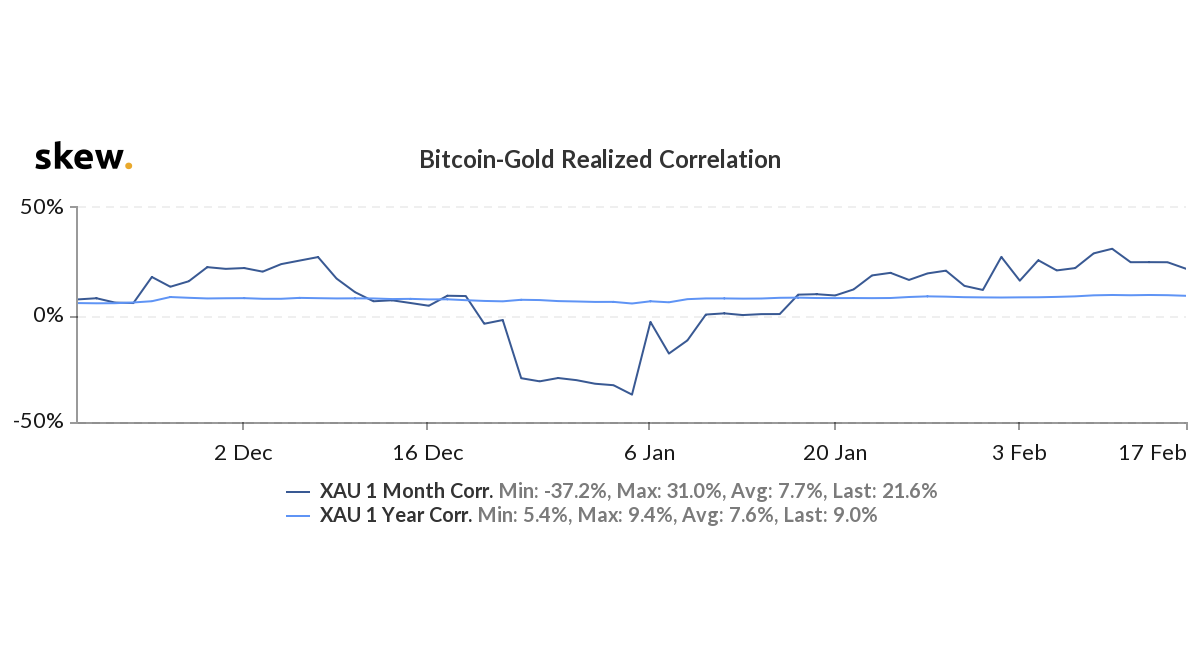

Source: BTC – Gold Realized Correlation, skew

Interestingly, as this crypto-equity movement is taking place, the commodity-friendship is moving in the other direction. The Bitcoin – Gold realized correlation has been dropping over the past two weeks, down from 31 percent to 21.6 percent.

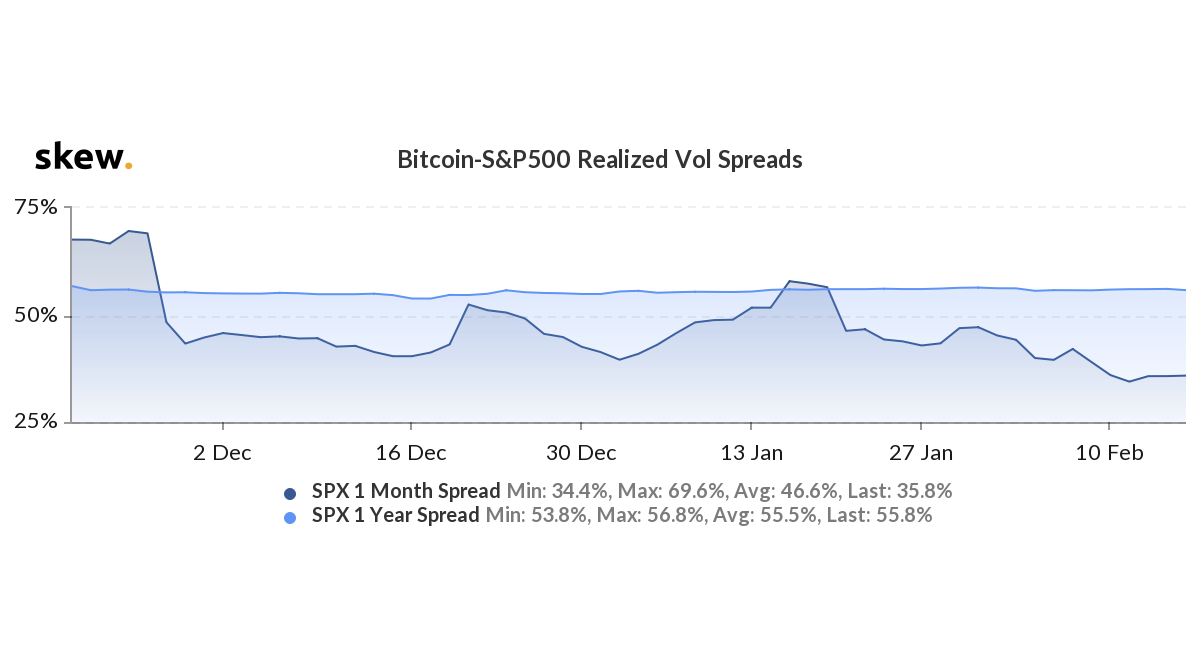

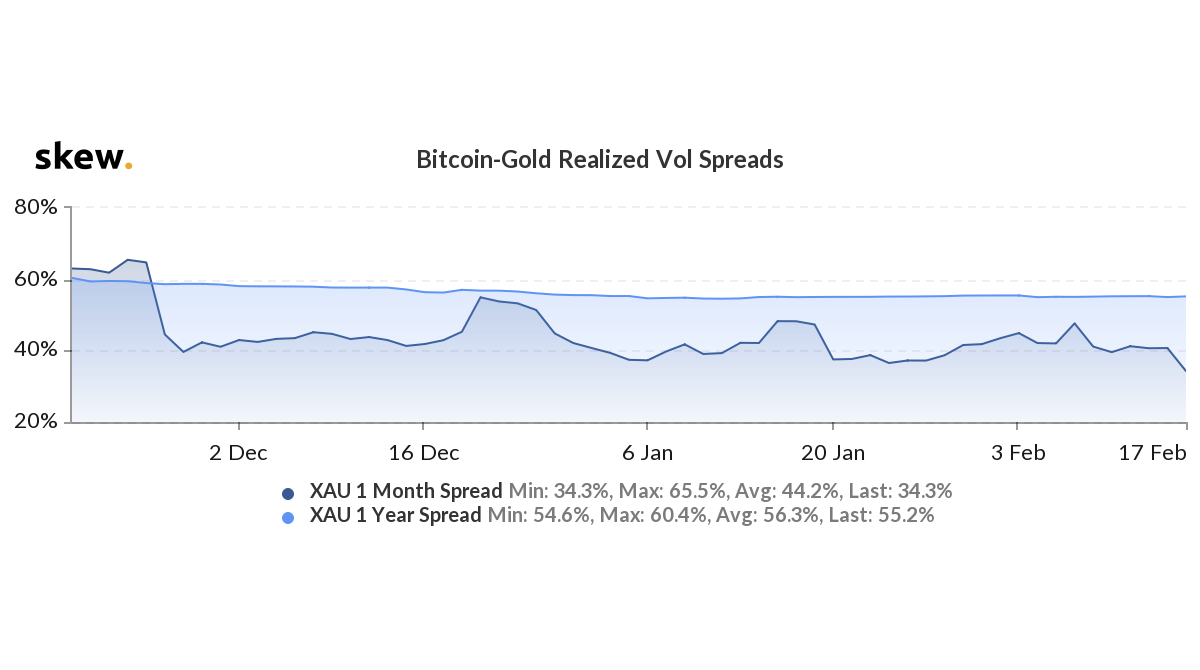

To further compound the role-reversal between the assets’ relationships, the realized volatility spread of Bitcoin – S&P500 after falling since mid-January has seen a short, but visible change in direction. On the other hand, the realized volatility between Bitcoin and Gold has dropped by 28 percent.

Source: BTC – S&P500 Realized Volatility, skew

Source: BTC – Gold Realized Volatility, skew

Back in January, the S&P500, like most global indices, took a beating following macroeconomic outbreaks. With tensions between the U.S and Iran looming large with the attack on an Iranian military commander, equity markets went down as oil, gold, and Bitcoin went up, almost in unison.

However, as the month came to a close, with the Convid-19 cases piling up, gold stayed steady at around $1,580 an ounce, while both Bitcoin and the S&P500 gained. Bitcoin broke into the $9,000 range and continued closing in on $10,000, while the SPX recovered over 100 points over the same period.

It would seem that the roles of gold and the S&P500 in the Bitcoin market could be inter-changing in 2020.