Bitcoin investors unlikely to go ‘broke’ from current price

There are usually clear skies after a stormy night at sea and Bitcoin is more or less experiencing something similar at the moment. Following a bearish storm that resulted in a recent mediation below the $5000 range, Bitcoin has since been recording some sense of recovery, with the price of the cryptocurrency, at press time, noted to be $5.78k.

Source: BTC/USD on Trading View

Over the past three days, the world’s largest digital asset has sustained positive returns, with the token recording a growth of 19.94 percent. Consolidation above $5500 could be beneficial from a bullish point of view as the token continues to rise high on the charts.

Popular Bitcoin and cryptocurrency analyst, Willy Woo, also iterated a similar sentiment after claiming that the world’s largest cryptocurrency is already breaking away from the traditional stock market.

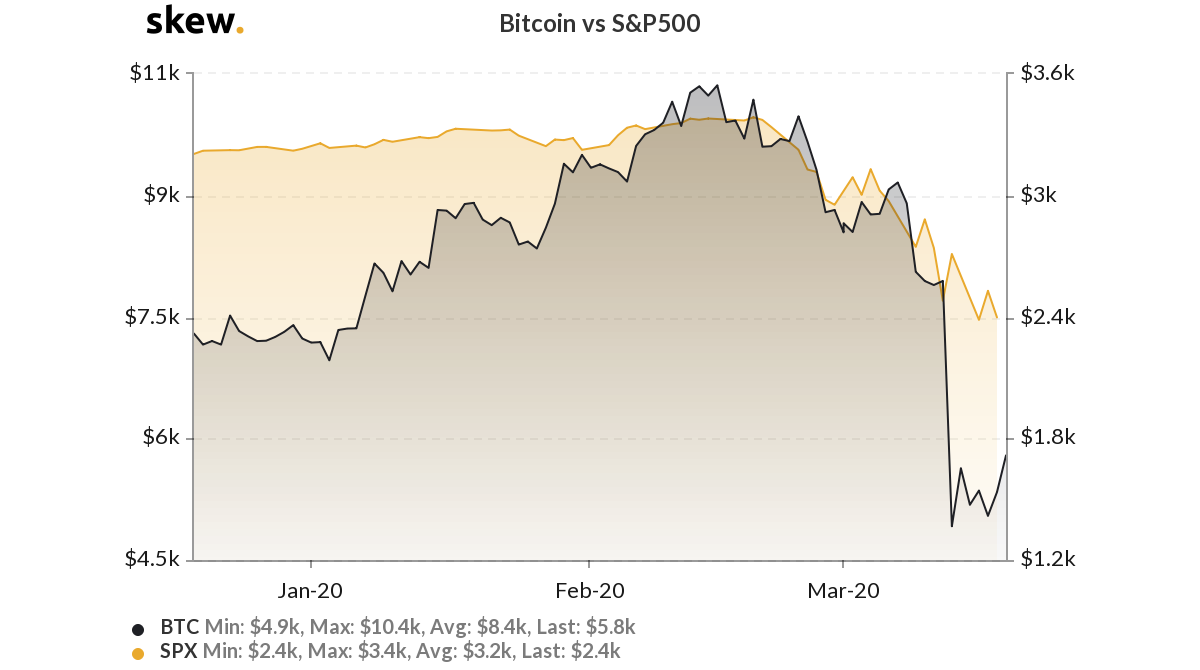

Source: Skew.com

Woo pointed out that Gold and Bitcoin, considered to be safe-haven assets in the industry, are at the time of writing indicating a de-coupling from the S&P 500. On analyzing the charts, it can be observed that the de-coupling has been constructive as Bitcoin has continued to rise since 16 March, whereas the S&P 500 has continued to dip.

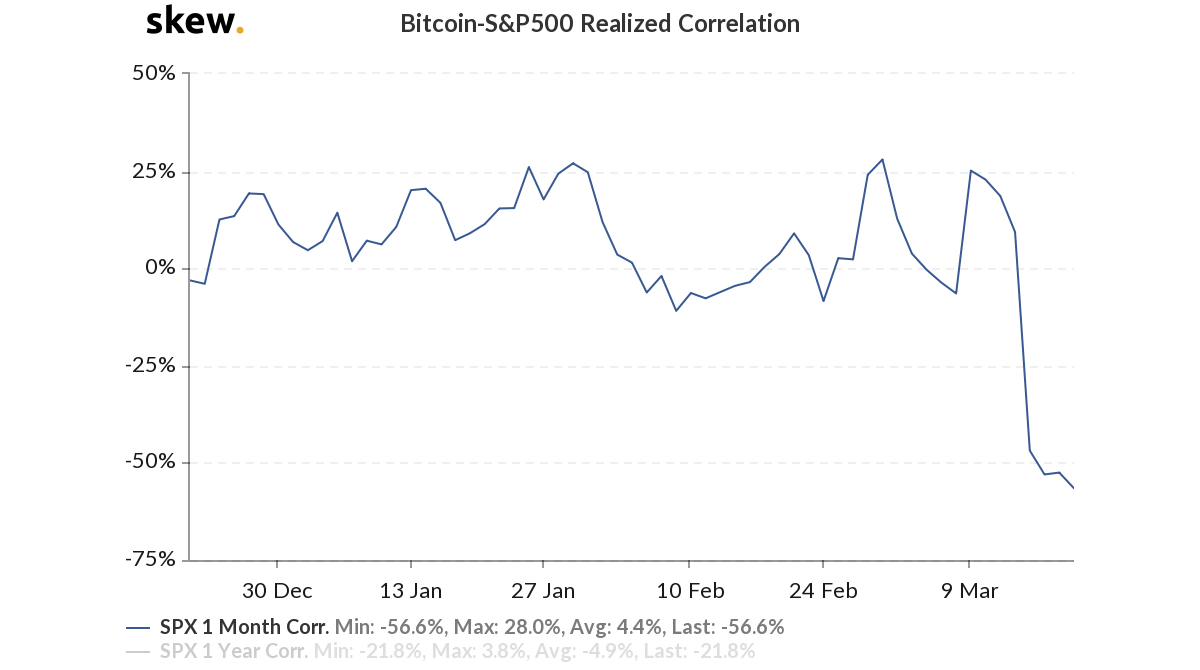

Source: Skew.com

The realized correlation between BTC and S&P 500 has also drastically dropped since hiking on 12 March. The SPX-BTC 1-monthly correlation was observed to be -56.6 percent on 18 March.

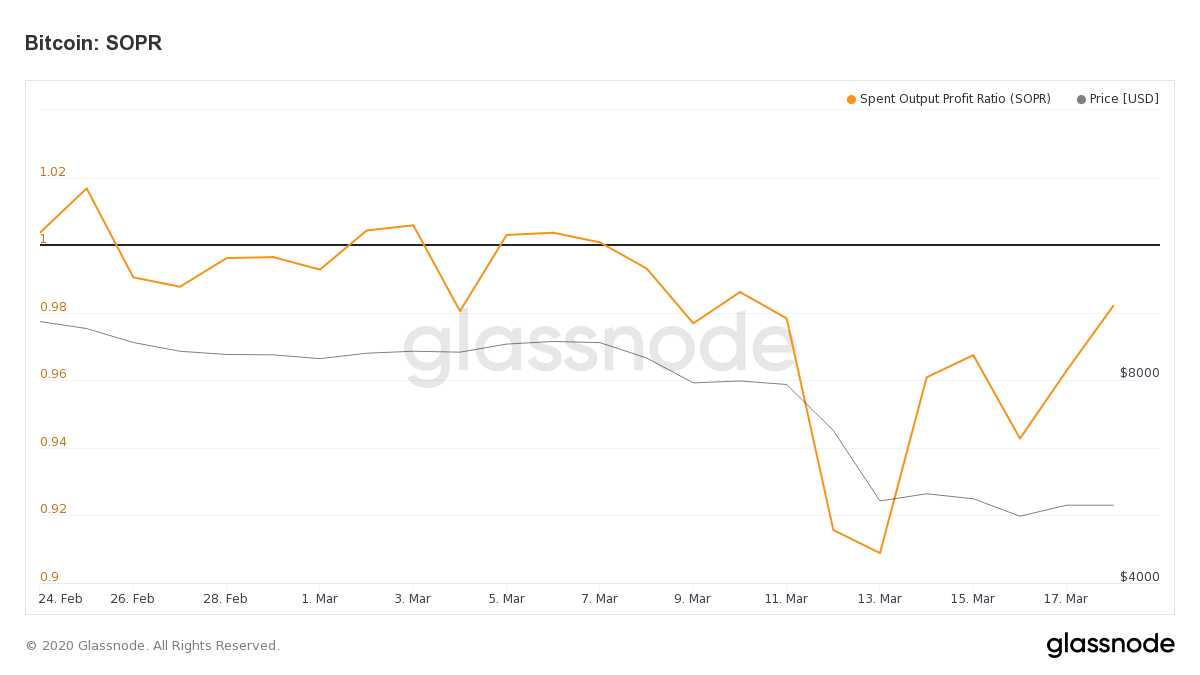

Additionally, on observing Bitcoin’s Spent Output Profit Ratio (SOPR), the on-chain net position has clearly improved over the past 3 days. The SOPR index had dropped below 1 on 12 March and recorded a value of 0.90 on the 13th. The metric has been on a recovery path ever since, with the ratio at about 0.98, at press time.

Source: Glassnode

It can thus be speculated that weak investors may have exited the market with the recent downturn while currently, long-term holders are pushing the market upwards.

Finally, Woo suggested that historically, from the current price, the possibility of losing profits after investing in the digital asset has been quite low, according to the sentiment indicated by on-chain RSI’s historical patterns.

Where do we go now?

The three-day positive returns are a great turn of events for Bitcoin, but it does not get it off the hook just yet. Bitcoin breached $5500 only in the past 24-hours, hence it is important that the token consolidates above this range for at least the next 48-hours.

Another dip under $5500 will not necessarily be a bad thing, but it leaves an asterisk on its recent bullish pullback.

However, the aforementioned indicators make a good argument for the fact that a Bitcoin bottom has been hit in the short-term. With volatility still above alarming levels, things can change fast in the space. For the time being, however, Bitcoin remains slightly on the bullish side.