Bitcoin hoarded by exchanges amounts to over 10% of total supply

Bitcoin is known by many names. According to the white paper it’s called the “peer-to-peer electronic cash system,” to its adherents it’s hailed as the “tool for financial freedom,” to the bankers it’s “fool’s gold.” One definition that most can agree on is that Bitcoin is a “decentralized currency” The first of its kind.

But, some claim that the “decentralised” in “decentralised currency,” is fading away.

The cryptocurrency, that accounts for over 70 percent of the total market capitalization is increasingly becoming centralised. Hoarded by cryptocurrency exchanges.

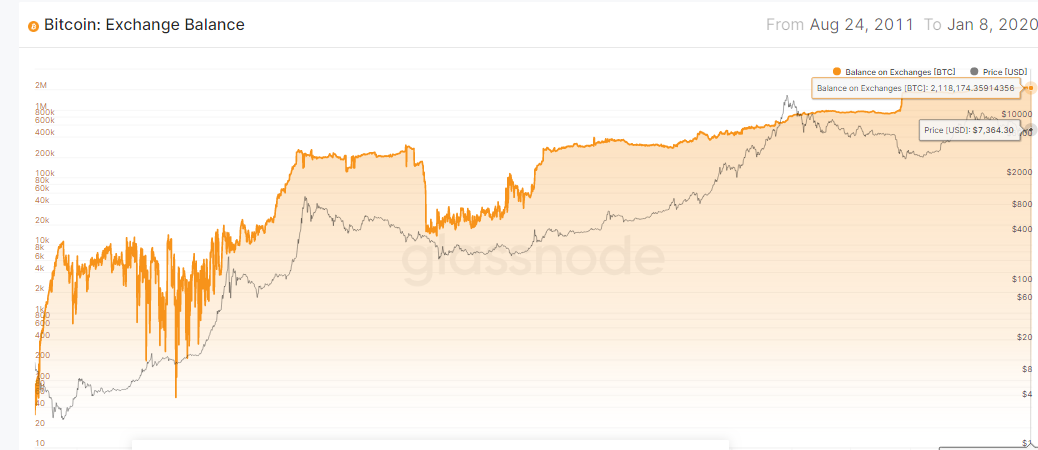

Capriole’s Charles Edwards, in a recent tweet, stated that the number of Bitcoins on exchanges was over 10 percent of total supply, citing data from Glassnode. He noted that this is a considerable increase, in light of the fact, that in November 2019 the percentage was 6.7 percent of total supply.

He referred to this as Bitcoin “centralizing exponentially,”

Only a few months ago, @TokenAnalyst had total Bitcoin on exchanges at ~6.7% total supply.

Today, @glassnode puts that figure at >10%!

?@kenoshaking for the find.We often talk about the exponential growth of BTC's price

… but Bitcoin is also centralizing exponentially! pic.twitter.com/HgdKOODnrk

— Charles Edwards (@caprioleio) January 9, 2020

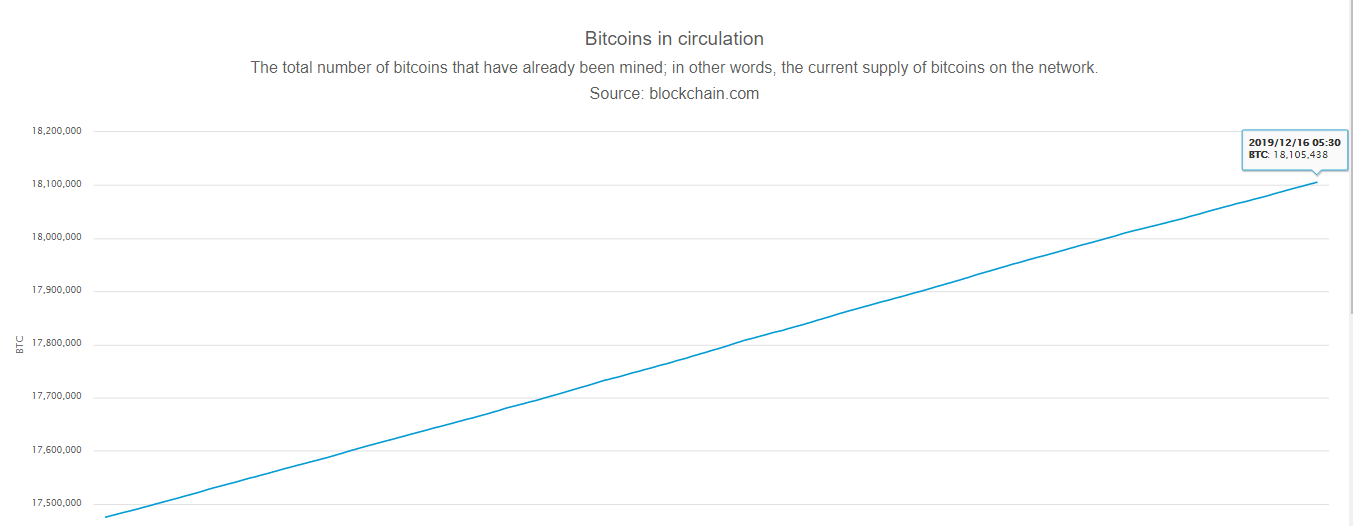

In terms of number, Glassnode estimated that the total number of Bitcoin across all exchanges stood at 2.11 million and the total number of Bitcoins in supply, according to Blockchain’s chart, stood at 18.105 million. That would put the total number of Bitcoin on exchanges at 11.67 percent.

Source: Bitcoin on Exchanges, Glassnode

Source: Bitcoin Total Supply, Blockchain.com

Exchanges are the only centralized hodlers in the ecosystem. In March 2019, Coinshares’ CEO Ryan Radloff expanded on exchanges to include ‘third-party intermediaries’ which when looked at their Bitcoin share put their percentage of total supply at 16.6 percent.

Radloff added that this Bitcoin share was “likely to be custodied by a third party,” which, in his words, was akin to “an entity that is not the ultimate beneficial owner.” While not an implication of centrality, it certainly does fly in the face of holding Bitcoin in one’s digital wallet, with a unique private key.

In a Medium post titled the “Centralization of Bitcoin,” Edwards stated that Bitcoin has been increasingly hoarded on exchanges, particularly in the last 3 years. He stated,

“In less than 3 years, Bitcoin stored on exchanges has grown over 700%. Through bull and bear markets, more and more Bitcoin is being concentrated on centralized platforms.”