Bitcoin Cash’s ascent to $348 may depend on Bitcoin’s rally

Bitcoin Cash has easily been one of the top-performing coins in 2020, with the same recording a surge of over 138 percent between 1 January and 14 February. The price scaled from $218 to $497 during the period, but a bearish turnover pulled its value to under $330. At press time, Bitcoin Cash’s market cap was around $5.93 billion, with a trading volume of just under $20 billion.

1-day chart

Source: BCH/USD at Trading View

On observing the long-term chart of Bitcoin Cash, a steady decline during the 2nd half of 2019 can be observed, with the price falling from $348 to $171 over a span of 5 months. A descending channel formed during that time period, contributing to a significant bullish breakout on 14 January, a day that recorded a whopping 30 percent in gains.

The bullish momentum continued to rally up until 14 February, reaching a yearly high of $497. This yearly-high was relatively close to BCH’s 2019 high of $515.

However, between 14 January to 14 February, a prominent rising wedge started taking shape and impacted the crypto-asset’s valuation. The price dropped from $497 to $298.60, registering a fall of 38 percent.

During the slump, BCH breached key support levels at $481, $445 and $348, with consolidation above Point-of-Control of $306. The long-term support remained at $279.

Considering the market is approaching some stability, Bitcoin Cash’s price may re-test immediate resistance at $348 over the next few weeks. According to the VPVR indicator, the trading volume between $348 and $306 has been substantial since July 2019, but a hike above $348 may trigger another significant bullish rally.

At press time, the 200-moving average continued to act as active support, validating the long-term bullish sentiment of the market.

The Relative Strenght Index or RSI suggested that the buying pressure could take control of the selling pressure as a definite reversal can be observed.

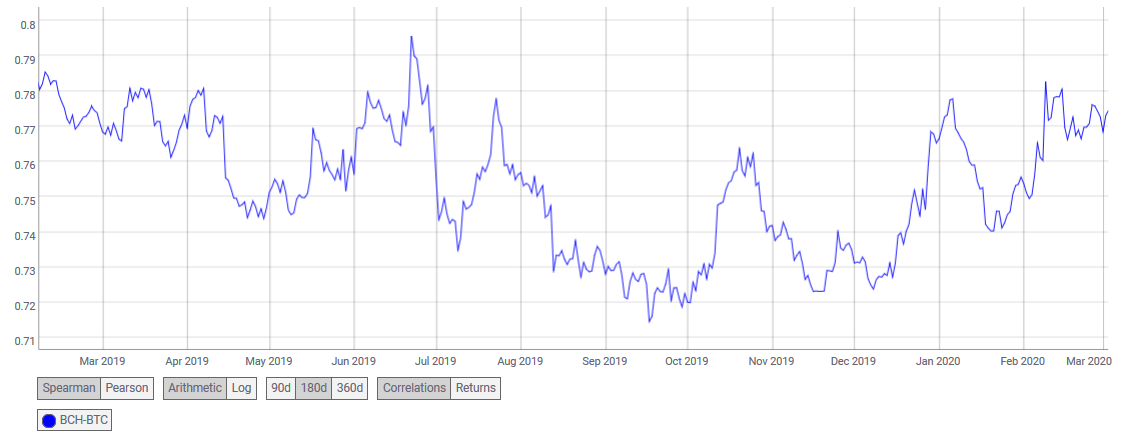

Source: Coinmetrics

However, Bitcoin Cash has been strongly dependent on Bitcoin’s price pump over the past year as in the month of February, the correlation factor has steadily increased. At press time, the correlation factor between BTC and BCH was 0.78, rising from 0.74.

With market volatility still high, Bitcoin Cash should manage consolidation above $306 this month.