Bitcoin and VIX flash red: Here’s what it means for the future of BTC

VIX aka the fear index in conjunction with BTC has become relevant due to the recent correlation of Bitcoin with the stock markets. On March 13, Bitcoin and S&P500 surged through the roof and hit a record high correlation of 0.588 the next day. During these two days, the ground beneath BTC gave up, causing the price to plunge to $4,000, noting a 51% drop.

Stock Market, Bitcoin, and the VIX

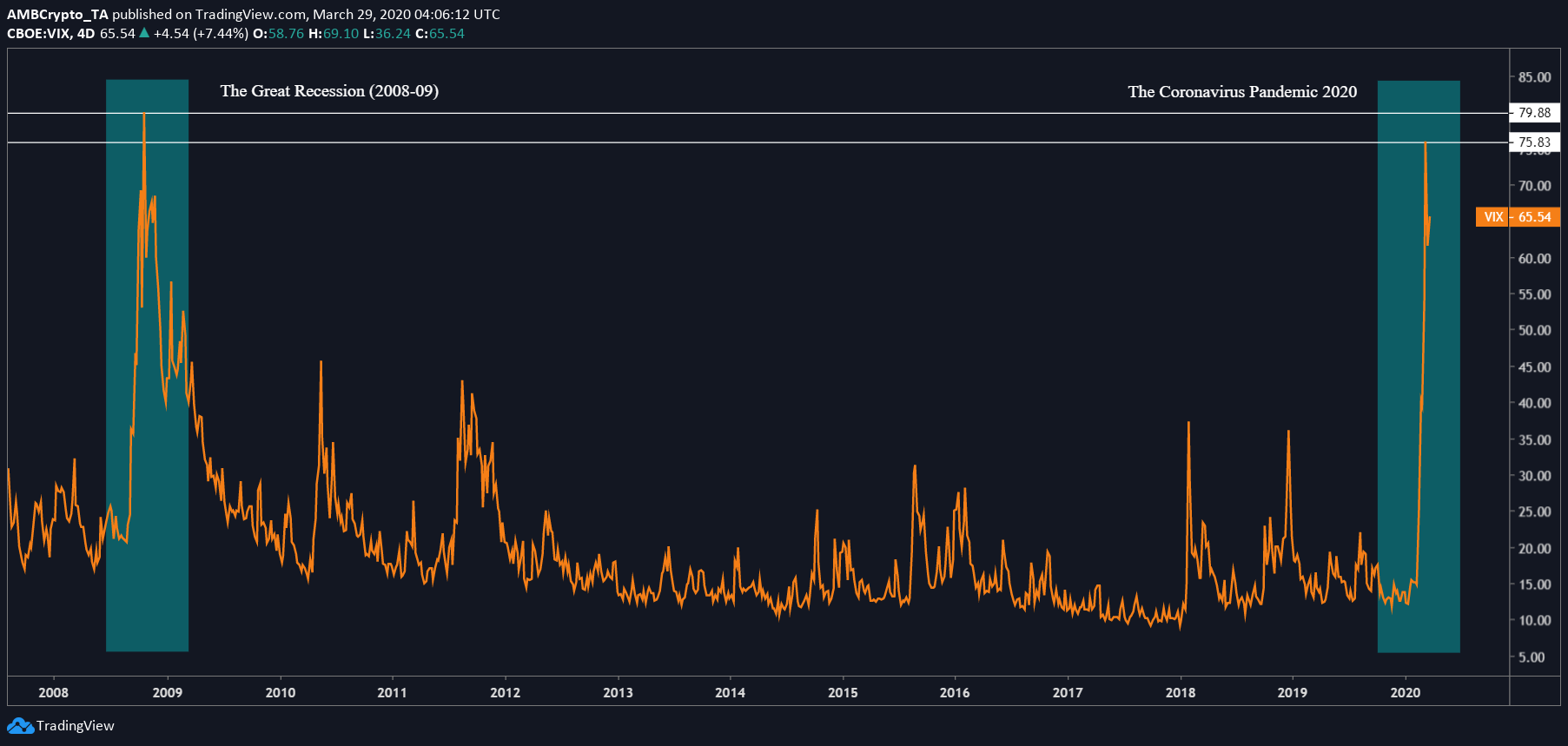

Source: VIX TradingView

Although drops like these are common in Bitcoin, the stock market hasn’t witnessed such volatility. On the same day that Bitcoin collapsed, S&P500 and the DJIA took a dive as well. March 08 onward, there was one particular indicator that had soared to levels last seen during the Great Recession of 2008-09 – VIX.

Developed by CBOE, VIX is the measure of the 30-day forward expectation of volatility derived from SPX option prices. It is used by investors to measure the level of fear, risk or stress in the market. More precisely, VIX is a signal indicating the premium on this option, hence this indicates the potential sell signal for investors who would want to capture the premium.

From the chart, the VIX, at press time, is just ~4 ticks away from hitting the 2008 levels. This is in-line with the sell-off that has been occurring since March 08.

What does this mean for Bitcoin?

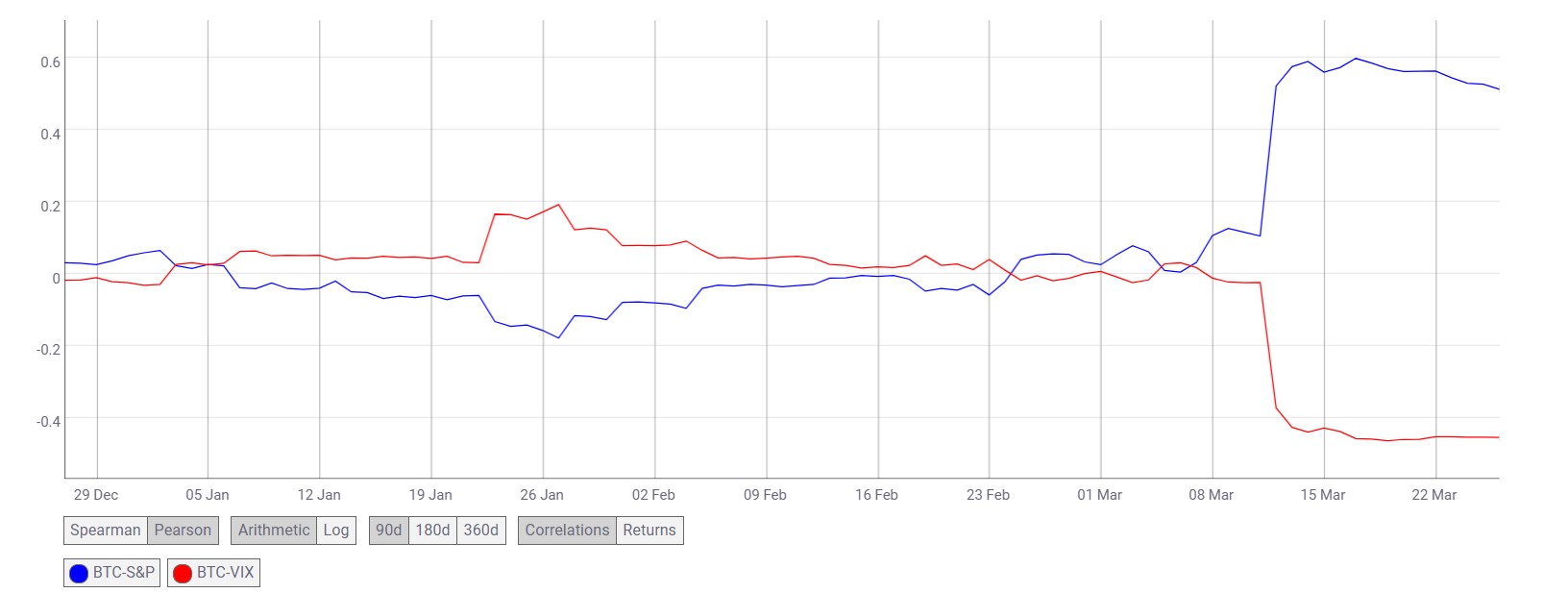

Source: Coinmetrics

S&P and Bitcoin’s correlation hit a new high, taking BTC down with it. However, VIX and S&P are negatively correlated, meaning, when VIX rises, the market aka the S&P falls. Hence, a negative correlation between BTC and VIX would indicate the troubled circumstance the crypto king is in.

As the BTC-S&P correlation reaches a new high, the BTC-VIX correlation drops. At press time, however, the BTC-VIX correlation seems to have stabilized [at -0.455]; a further drop would indicate things similar to March 13 to come.

Bitcoin’s eroding safe haven narrative?

The recent dip was a fatal blow to Bitcoin’s narrative of being a safe haven asset. A direct correlation to-date has made it even worse. This could imply a further drop in Bitcoin’s price should the stock market continue to topple. For now, BTC seems to be safe, as the markets are close for two days. However, what Bitcoin will do can only be determined after the markets open on Monday.

If it’s any consolation, Gold, also saw a decline during the recent sell-off and gold is considered as a safe have asset around the world. The same happened with gold in 2008, however, this set a stage for gold to rally to unprecedented levels. So perhaps, this dip could turn out to be good for Bitcoin as well.