Bitcoin remains a good portfolio diversification product, despite market crash

A recent investment outlook report by VanEck, an investment firm headquartered in New York, reviewed Bitcoin’s correlation with gold, the S&P500, U.S bonds, Oil, and emerging market currencies, among others, and how adding Bitcoin to investor portfolios affects returns, volatility, and drawdowns.

VanEck’s take

Bitcoin’s long-standing narrative of being an “uncorrelated asset” fell apart recently after its price collapsed by 50% on 13 March, with the larger financial market collapsing in the background as well. Since then, Bitcoin’s correlation with traditional world assets has fluctuated wildly.

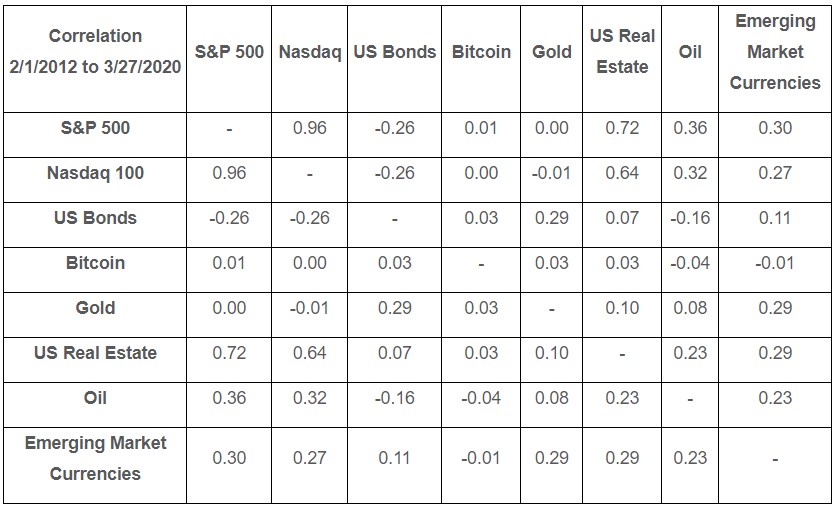

Source: VanEck

Per VanEck’s report, the volatility of Bitcoin, as compared to traditional assets, is very low. More specifically,

“… [for the] correlation data between 2012 and late March 2020, bitcoin exhibits low correlation to traditional asset classes. Bitcoin falls into the -0.1 and 0.1 correlation range with most traditional asset classes.”

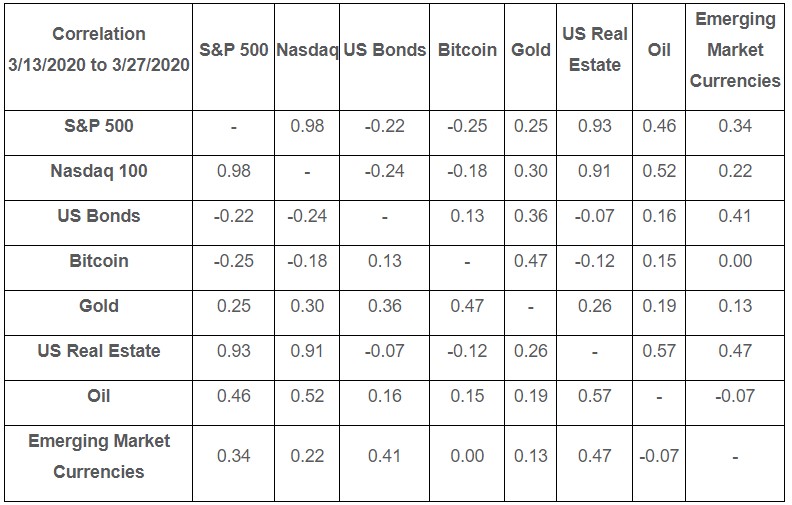

Further, when considering the correlation from 13 March to March 27, the correlation to S&P was -0.25, -0.18 with the Nasdaq 100, and -0.12 with the U.S. real estate. While Bitcoin showed no correlation with the emerging markets, the correlation was considerably high with gold [0.47] and U.S. bonds [0.13].

Source: VanEck

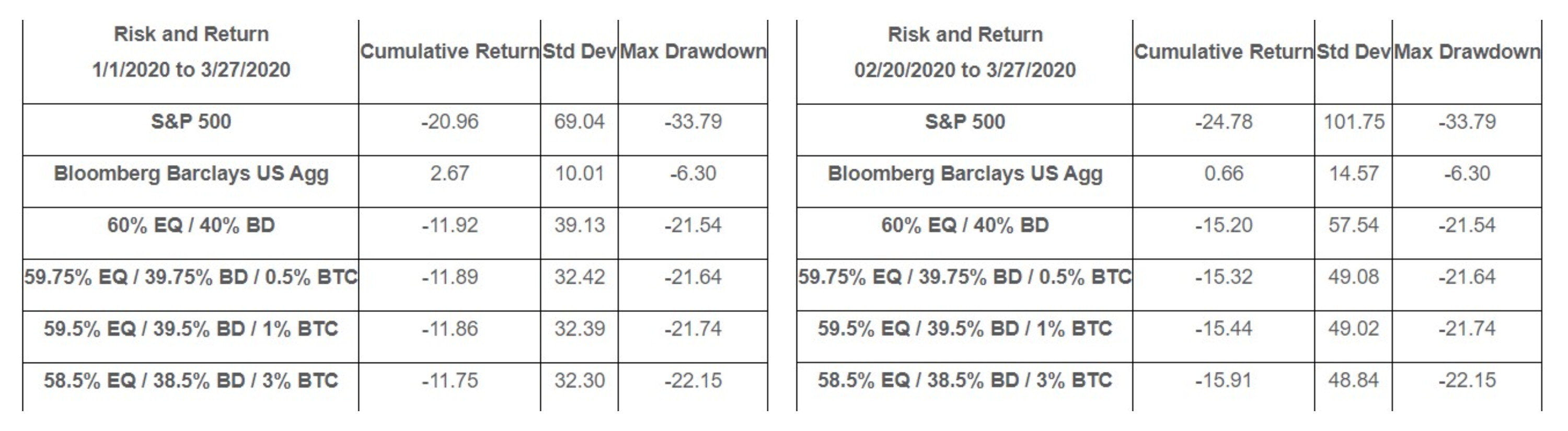

An interesting observation that can be made from the correlation metrics is the allotment of Bitcoin in a portfolio for diversification purposes. VanEck’s insight compared Bitcoin as an investment asset and explored options for adding it to portfolios in increments of 0.5%, 1%, and 3% of total investment, one where BTC was added to a portfolio containing bonds with a 60-40 blend. The first iteration measured the portfolio’s risk and returns from 01 January 2020 to 27 March 2020, while the second iteration did so from 20 February 2020 to 27 March 2020.

Source: VanEck

From the attached table, it is clear that the correlation of Bitcoin with traditional assets remains low, with the recent market events set off by the Coronavirus pandemic being the exception, rather than the norm.

VanEck concluded by stating,

“…correlations with gold increased during the [recent] sell-off, potentially hinting to bitcoin’s increasing safe-haven status. We also note that a small bitcoin addition to a 60% equity/40% bond blended portfolio may help to reduce portfolio volatility during the recent market sell-off. While there are no U.S. bitcoin exchange-traded funds (ETFs) available today, we believe such products may have significantly reduced volatility for 60% equity/40% bond blended portfolios.”

J. P. Morgan’s take

J.P. Morgan released a report reviewing the same issues back in February. And while, like VanEck, it came to a similar conclusion, it did come with a caveat. Here, it should also be noted that this report was published well before the sell-offs dated 12-13th March. The report stated,

“… even miniscule allocations remain impractical as long as lack of legal tender status limits their transactional use and in turn their liquidity.”

The report also included statements supporting Bitcoin’s low correlation, adding,

“Bitcoin’s co-movement with all markets over the past five years has been near zero, which would seem to position it better than the Yen or Gold for hedging purposes.”

However, it also went on to say that an eventual popularization of these products in the mainstream would increase correlation with traditional markets and could synchronize their moves with core markets.