Binance, Coinbase and Ethereum’s incubation programs are shaping the future of decentralized space

The importance of incubation programs in the blockchain space is quite significant since the space in itself is only 10-years old and most of the startups venturing into this space lack any idea of shaping their business to the need of the masses. Thus, established players and stakeholders have come up with different incubation programs which are curtailed to help these startups become disruptive forces.

Blockchain incubation programs are quite different from traditional ones, with the focus of the traditional sector mostly concentrated on raising investments from venture capitalists or angel investors or IPOs. On the contrary, blockchain incubation is more about nurturing and building a successful business venture from scratch.

These incubation programs help these startups to test their core ideas and objectives and slowly mold them into a use case or service which can prove to be a game-changer in the real-world.

While the approach and methodology of different incubation programs could be different, the goal is the same i.e to help startups with great ideas to become a successful business venture. We will look at some of the most notable incubation programs of the decentralized space which have proven their mettle and provided the perfect platform for budding startups.

Best blockchain incubation programs in the decentralized space

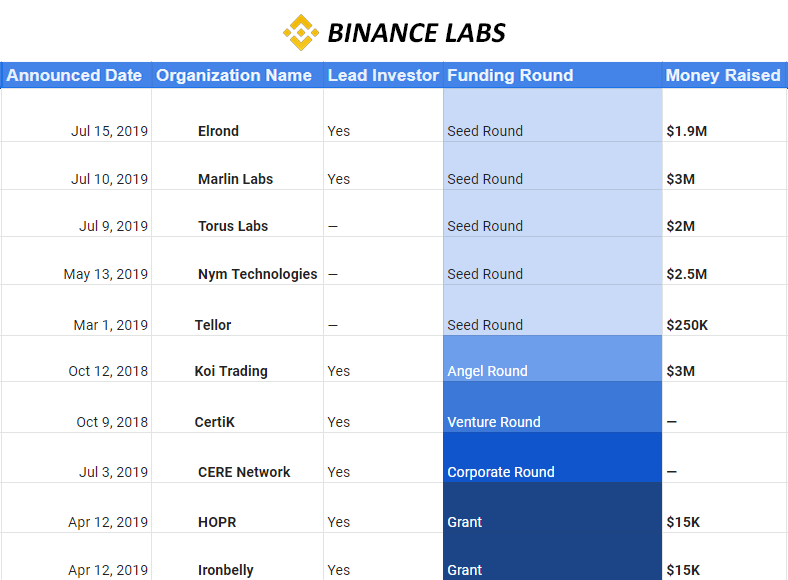

Binance Labs, the venture arm of the Malta-based exchange, recently announced season 3 of its incubation program. Binance has set aside a total capital of $1 billion for nurturing and molding upcoming blockchain startups which have the potential, but not necessarily the resources to become a disruptive force. Started back in 2018, the incubation program has been quite a success as most startups under its wing have gone on to make a name for themselves.

Under its incubation program, Binance Labs provides an initial seed funding of $500,000 to each selected startup, with more investments pumped in through a series of funding depending on the progress and need of the startups. These startups are provided with all the necessary tools and resources including a seed funding, followed by mentor guidance from seasoned players, management skills, introducing them to the right network of industry leaders and of course, holistic support. Binance Labs gets a 10% stake in the business, with the official website claiming that Binance labs provide 10% equity and 10% of Token Sale Pool as well.

Ella Zhang, Head of Binance Labs, spoke to AMBcrypto about the importance of incubation programs in the decentralized space and stated,

“Binance Labs is committed to supporting entrepreneurs who will drive adoption and innovation in blockchain. India is full of exceptionally talented developers, as we have witnessed from working closely with our portfolio founders at Matic Network and Marlin Network. We are excited to see more token projects coming out of the country and fund them to find product market fit in the nascent industry.”

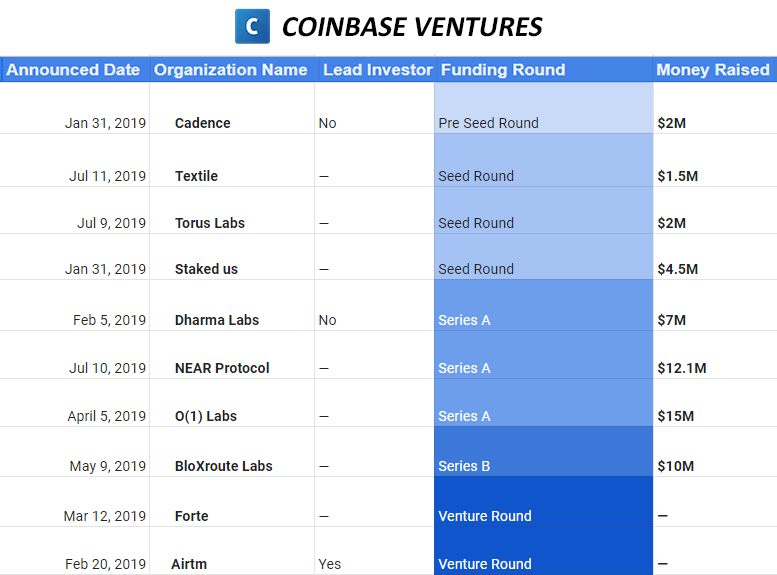

Some of the most notable names to have come out of the incubation program to raise a lot of capital have been listed below,

Coinbase Ventures was started back in 2018 as a sidearm of the main exchange service with a goal of creating an open financial system. The firm promises to make early investments in startups which have the potential of fulfilling that goal. This incubation program is different from many others as it does not promise any strategic partnerships in the future and only provides the necessary capital flow to help them flourish. Interestingly, the firm has also decided to invest in those firms which are in a way, direct competition to their own business.

As of now, the Venture arm of Coinbase has invested in 42 startups and some of their most prolific investments and funding rounds have been listed below,

source: Crunchbase

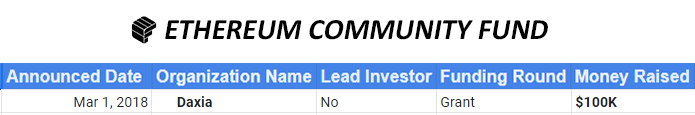

Ethereum Community Fund is another incubation program run by the Ethereum network in order to find the best startups with great ideas about scaling the decentralized space. The aim behind the program is to find the best coming-of-age ventures which can help the Ethereum ecosystem, as well as contribute to larger adoption of decentralized tech.

It is a non-profit organization which provides seed funding and guidance, along with critical infrastructure, research, developer experience and tooling, open-source development advocacy, educational initiatives, and responsible community growth. The firm has only one significant investment until now in Daxia.

source: Crunchbase

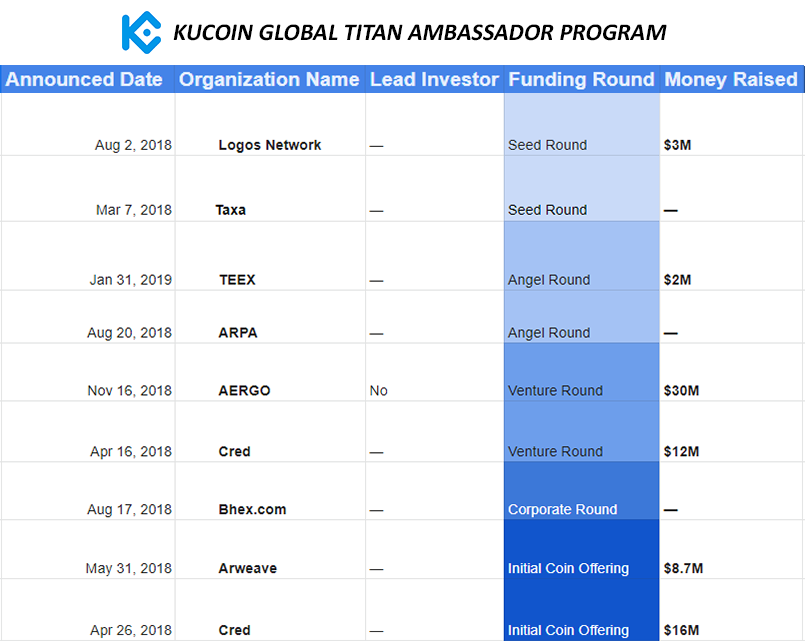

KuCoin Global Titan Ambassador Program was launched back in August 2018 and recently, it announced its association with GBIC and Block 72 for driving investments for new and upcoming startups in the blockchain space. Global Blockchain Innovative Capital (GBIC) is an established fundraising firm started back in 2017 and Block 72 is its subsidiary for various upcoming blockchain projects. GBIC has invested in several firms including Aelf, Zilliqa, Cred, Thunder, Cortex, TEEX, DATA, and AERGO.

GBIC has been able to incubate several startups, all of which have gone on to raise notable funding after the incubation program. A few of them have been listed below,

source: Crunchbase

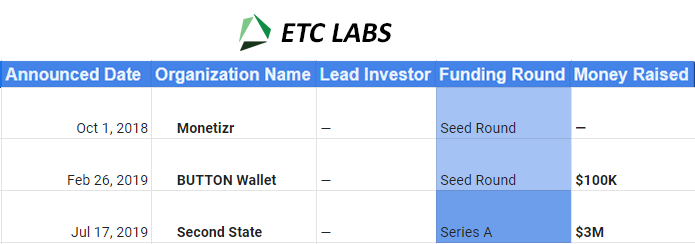

ETC Labs is another incubation program which has completed its first phase called Cohort 1, wherein a total of 11 startups were selected. ETC labs put in total funding of $500,000, with each of the 11 startups receiving a certain amount depending on their progress and requirements. The Cohort II acceleration program starting on 19 August would see a total of 8 selected startups learn the niches to become a successful venture.

Elizabeth Kukka, Head of ETC labs, spoke to AMBCrypto about the intent behind a program like ETC labs. She said,

“ETC Labs was created to help increase the number of projects built on Ethereum Classic, while also providing mentorship, capital, and tech support (we have 14 full time blockchain Devs on staff). It’s been a great way to help grow our blockchain eco-system broadly and Ethereum Classic specifically.”

The platform provided free office space, advisory, support and access to a community of peers to grow the ETC ecosystem. Out of the selected 11 startups, many have gone on to write success stories of their own. Some of the most successful ventures to come out of the Cohort I program are,

- Cryzen, a crypto-trading algorithm platform, launched its product mid-program and has since signed on a dozen paying customers, as well as a larger enterprise customer.

- Ethernode, a decentralized server solution, concluded the program with a prototype and beta product. Just last month, it officially launched with confirmed pre-sale customers in the queue.

- Monetizr, an API for game developers to monetize their gaming solutions, doubled its customer base since leaving the program and has just signed a partnership agreement with AngryBirds.

- ButtonWallet, a wallet solution that’s pre-installed on Telegram, completed a fiat on-ramp just before concluding the program and now has over 100,000 users.

source: Crunchbase

Final Thoughts

Incubation and acceleration programs have been on the rise lately, with most prominent players of the cryptospace launching their own. These programs have proven to be a win-win situation for both the startups, as well as the hosts. Hosts are responsible for providing all the necessary resources, expertise and connections, while in return they get small equity in the startup.

These blockchain incubation programs have become a launchpad for startups and might have the recipe for a successful product, but not necessarily the resources. Given the fact that the crypto and blockchain sector is relatively new, the importance of such programs rises by many folds as present stakeholders are not just helping a startup go mainstream, but also shaping the future of the decentralized space.