Bakkt Bitcoin Futures breaks ATH volume estimated at $16 million

Bakkt is back in the game.

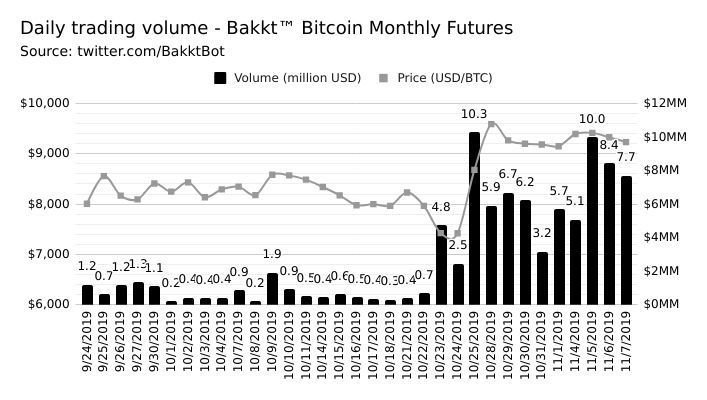

After a disappointing start, the Intercontinental Exchange’s digital asset platform is making its presence known. The Bitcoin Futures volume on Bakkt soared past its all-time-high of $10.8 million and is now poised to break the $16 million mark.

On November 8 and November 9, as Bitcoin dropped by over 5 percent on the daily, moving below the $9,000 mark, the price volatility has sparked an institutional rush, it would seem. According to the ICE’s official website at 2130 GMT, the volume was placed at 1660 contracts, and the last recorded spot price of Bitcoin was $8,990, which would place the volume at $14.75 million, well over its previous high of $10.3 million that was seen on October 25, following Xi Jinping’s Blockchain comment.

Source: Bitcoin [USD] Monthly Futures, ICE Futures US

∙ Today’s volume so far: 1741 BTC ($15,486,195)

∙ Last traded price: $8,895

∙ Trading day progress: 83%

∙ Current daily Bakktarget™: 1897 BTC ($16,873,018)— Bakkt Volume Bot (@BakktBot) November 9, 2019

The significant surge in the number of contracts traded could be down to the volatility of the underlying asset. Bitcoin, between 0300 GMT to 1400 GMT on November 8 saw a 5.11 percent decline in price, leading to a drop below the short-term support placed at $9,100. At press time, Bitcoin was trading below $9,000 for the first time since the massive 40 percent pump seen last month following China’s embrace of blockchain technology.

Source: BTC/USD on TradingView

Bakkt’s massive breakout, to some, is no surprise given the recent trend. After breaking past the $4 million mark on October 23, the volume has consistently been rising. The average volume has been well over $8 million over the past few weeks. Between November 5 to November 7, the volume was recorded at $10 million, $8.4 million and $7.7 million, respectively.

Source: Bakkt Volume Bot, Twitter

However, it should be noted that the initial weeks of Bakkt’s launch were not so fruitful. Deemed a “failure,” by many, between September 24 to October 22, the highest recorded volume for the platform was $1.9 million, a mere 11 percent of the total volume seen on November 9 alone.