What is the bottom for Bitcoin’s crash? When should you buy BTC now?

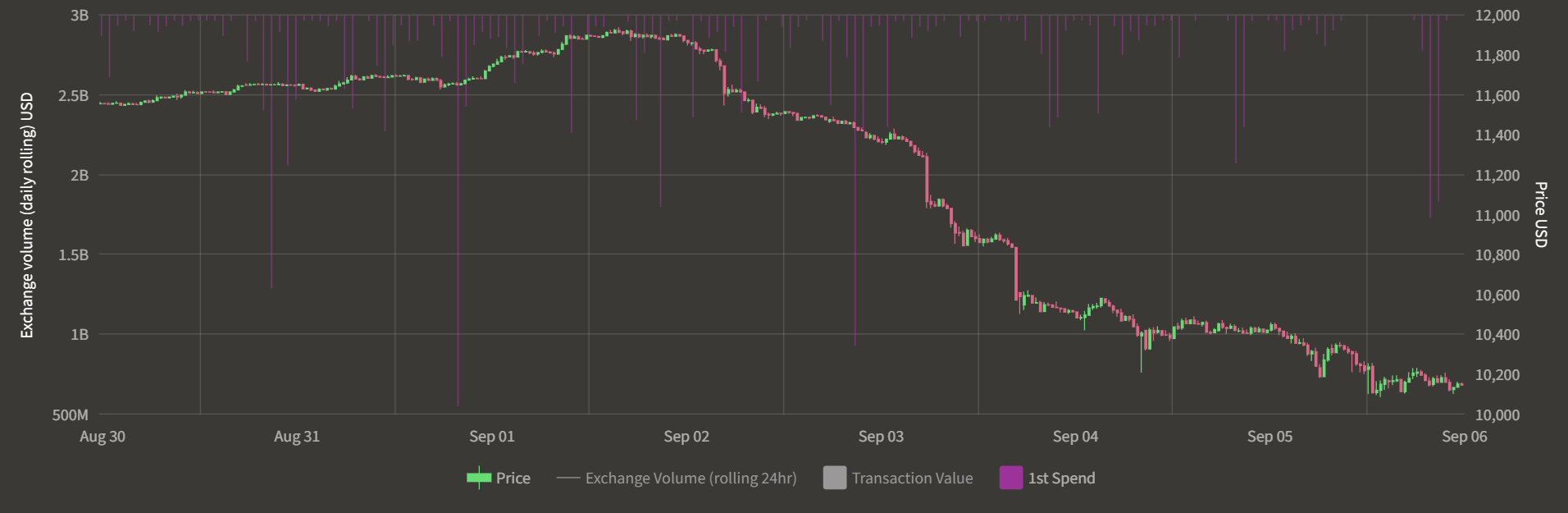

Bitcoin has crashed from $12,000 to below $10,000 all in under a week. Six months after suffering a brutal crash, bitcoin is crashing yet again and unlike the last time, the reason is slightly different. The blame is in part on miners who seem to be selling off their holdings rapidly.

How do miners fit here?

While miners are an absolute necessity to the ecosystem they have and will always be a constant source of selling pressure. Miners mine bitcoin and this operation of theirs is expensive. To support the operation, miners sell their mined bitcoin to a widely adopted currency, which could be USDT or USD.

Source: Bytetree

As of 1 September and 3, there have been huge outflows from miner wallets. About $5.3 million and $4.8 million worth of bitcoins have moved from miners and to exchanges. The effect of this can be seen on the price of bitcoin, which has dropped from $11,500 to under $10,000.

There are, however, macroeconomic problems that are also responsible for this crash. One of which is that the world’s reserve currency has seen drastic changes in the last six months. The Fed has printed trillions and basically shooed away the recession but this rampant printing and rate cuts will cause inflation and ripples of this will be felt by many markets.

How much will bitcoin drop?

Now that the “why” of the bitcoin crash is explained, the next topic is about bitcoin’s price and the extent of this crash. Here are some common questions that need to be looked into”

- Where is the bottom of this bitcoin crash?

- If and when one should buy bitcoin during this crash?

As explained a month ago, there is a CME Gap that ranges from $9,645 to $9,925. Disregarding the reason as to why the gaps are closed it looks like this gap will also be closed soon.

Hence, the obvious answer to the first question is that bitcoin’s bottom will be at $9,645.

But, are there chances that the price will dip even lower? Yes, considering how important the $10,000 level is, if the price closes below it, this will cause a FOMO and hence a sell-off to $9,000 – even stronger support.

On-chain analyst, Cole Garner’s tweet showed that whales are bidding at $8,800 level, which is reasonable and hence wicks down to $8,800 levels can be expected. Hence, an approximate bottom of bitcoin can be at $8,800.

This would mean a 25% drop from $11,200, however, just to be on the safer side, a 30% drop would mean that bitcoin has bottomed; hence, the absolute bottom of bitcoin could be at $8,300. It can be assumed that any dips beyond the $8,000 level will be bought out quickly.