Alt season has officially begun: Does your bag have the winning alt?

The word Alt season has been thrown around more often than expected. Investors in the ecosystem are eagerly waiting for another alt season, especially those who missed out on the biggest alt season in 2017-18.

Why wait for the alt season though?

An alt season is part of the market cycle when excessive surges in the price of altcoins against Bitcoin and the fiat currency are noted. This surge in price takes place after a period of stagnation or slump.

Ingredients of an Alt Season

Bitcoin’s recent rise above $10,000 and its subsequent dip below was expected. It was significant nonetheless due to two reasons – $10,000 is an important psychological level; the dominance of Bitcoin slipped from 70% to 63%. Last time Bitcoin saw the mid-60s dominance level was over 220+ days ago, in July 2019.

Dominance is a metric that is used to represent the amount of wealth held in a particular asset. Likewise, Bitcoin dominance represents the amount of total wealth in the cryptocurrency ecosystem that is held in BTC. It is also used to determine the relative health of other coins. Similarly, altcoin dominance can also be used to determine the flow of wealth into altcoins.

Speaking with AMBCrypto, Joe McCann, a popular crypto trader had a different view on alt season. According to him,

“a 20% to 100% surge from the from the lows after being down 95% from an asset’s ATH does not give me the impression a macro shift is occurring in the altcoin market.”

History of Alt Seasons

There have been a few alt seasons in the past, arguably, the 2017 alt season was the biggest one. Most altcoins easily did 10x to 50x of the initial investment. FOMO was real and most of the Initial Coin Offerings [ICOs] in 2017 caused a chain reaction of an influx of capital from around the world. This is what made the altcoins ‘moon’ and also caused a lot of naive investors to lose millions.

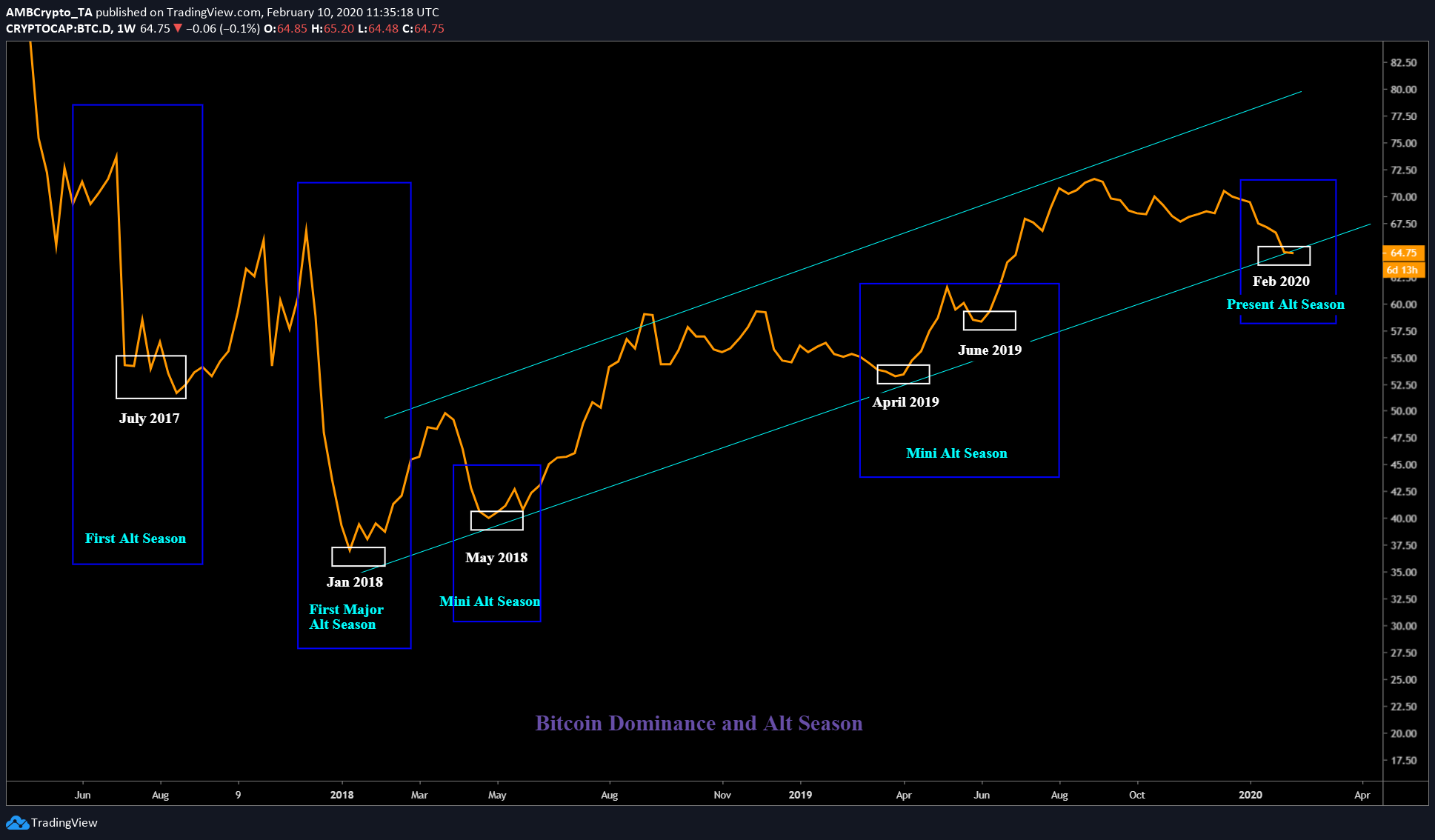

Based on the altcoin surges and the Bitocin dominance, there have been 5 alt seasons in total. The crypto-ecosystem might have already embarked on the 6th alt season.

Source: BTC.D TradingView

Typically, during an alt season, users buy alts dirt cheap, as Bitcoin dominance collapses; the alts have room to push higher. When they do, alts can be converted into BTC, thus increasing the initial capital for massive profits. As seen in the above image, every time Bitcoin dominance dips, alts surged. It has been the case since the first alt season.

First Alt Season

The table showed how massive the rally was in the first and the second alt season [December 2017 to January 2018]. However, the combined rallies didn’t stand a chance against the individual rallies. XRP surged by a whopping 52,297% in over a year.

Source: CryptoCurrencyChart

Altcoins rallied to a much greater extent than Bitcoin. All of the altcoin rallies began right after Bitcoin dominance collapsed.

Joe McCann further added that,

“Alt season was a moment in time and was fueled by the ICO boom. There will never be an alt season like the one in 2017 until there is an ICO 2.0 movement that hits the market, assuming a 2nd iteration of the ICO is ever invented.”

Successive alt seasons were witnessed every time Bitcoin dominance dropped, thus leading to an alt season. April to June 2019 saw another alt season when Bitcoin hit $13,800. It was termed as the April Fool’s rally, since BTC commenced its rally on April 01. In less than 80 days, BTC surged from a mere $4,000 to $13,800, a 242% increase.

By mid-2017 ICOs skyrocketed into a hyperbole. Each project tried to solve an issue and promised a brighter future. Naive investors hedged their money into these coins and awaited a pump, which came, making investors and creators rich. However, the first alt season didn’t end there, it continued as the euphoria from accruing investors kept pouring in. The altcoins topped from mid-December 2017 to January 2018. Thus creating the biggest alt season ever.

The same happened to every alt season after this, however, on a much smaller scale. All the alt seasons pale in comparison to the first. Each year, the nostalgia of the 2017 alt season pushes investors to unknowingly pour money into ICOs, IEOs, scam tokens. The markets are presently witnessing the early stages of the much-touted alt season; what remains to be seen is if the 2020 alt season lives up to its precursors.

The Present Alt Season

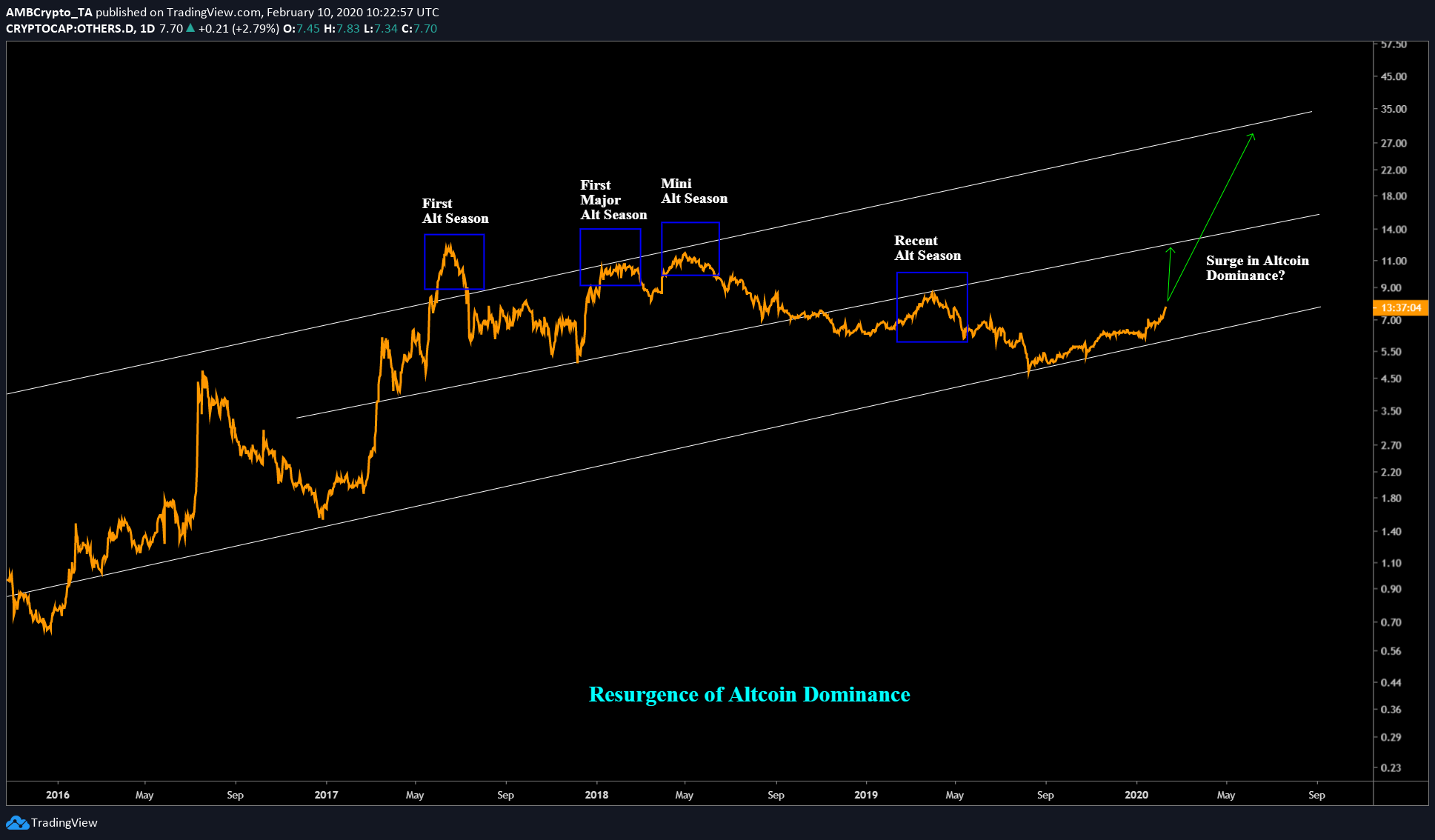

Source: AltcoinDominance TradingView

As Bitcoin slides towards the lower end of $10,000 yet again, dominance follows it. There is a simultaneous increase in altcoin dominance ergo the altcoin market cap, which is another metric to determine approaching alt season.

So, how are the altcoins performing as the alt season begins?

As it stands, the alt season isn’t in a full swing, it has just begun. The highest RoI was witnessed in Bitcoin SV [BSV] since the start of 2020 – 321%.

Source: CryptoCurrencyChart

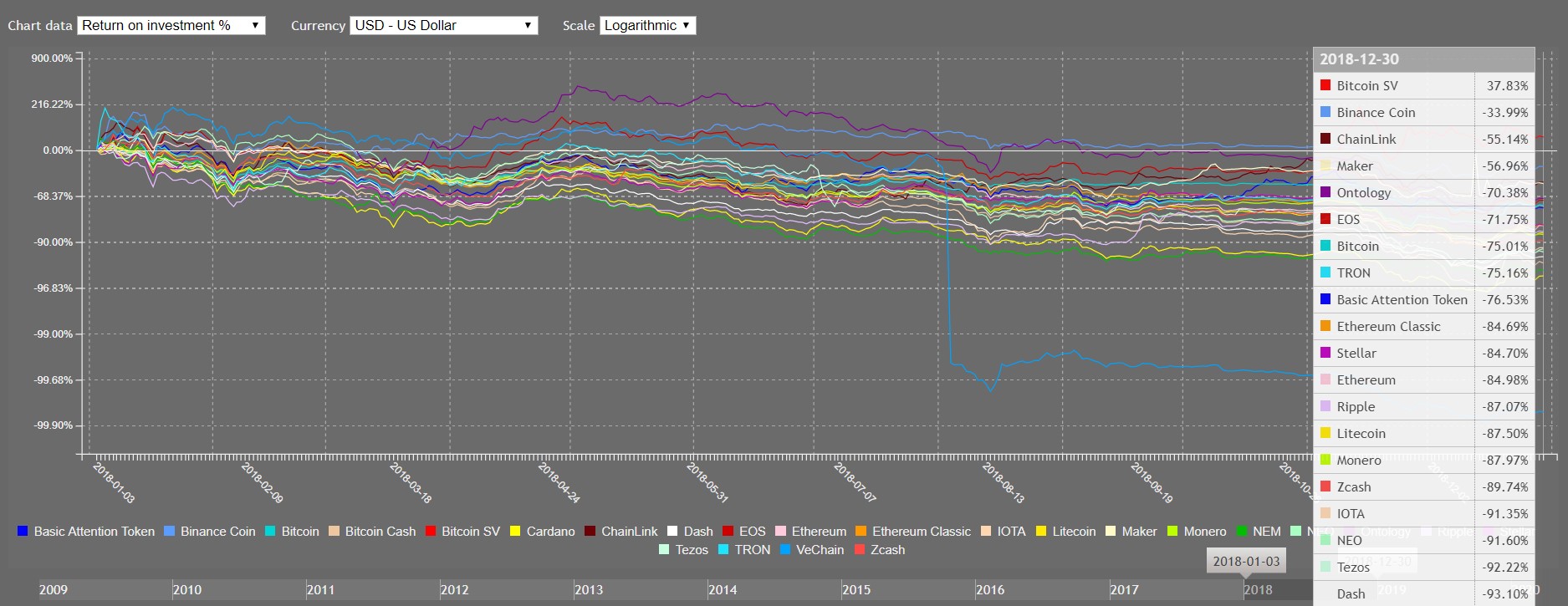

Moreover, 2018 was a very somber year for Bitcoin and altcoins alike. The coins were negatively trending; Bitcoin started trending in the $3,000-levels and all the altcoins followed the Pied Piper. A brief look at how lackluster the performance of the market was can be seen below.

Source: CryptoCurrencyChart

In contrast to the dry year of 2018, 2019 surge was definitely the start of another alt season, especially with the slumping dominance of BTC. So, in light of the data, the alt season has definitely begun; however, the continuation of the alt season hinges on Bitcoin dominance and geopolitical factors.

Chose Your Alts Wisely

The reason why alt season is the most sought-after cycle is its effects, which are pervasive. XRP surged from $0.006 on December 31, 2016, to a whopping $3.82 on January 04, 2018, a gargantuan 52,297% RoI. Similarly, NEM surged by 47,440%.

Selecting altcoins is the most crucial factor and the first step in preparing for an alt season. NEM, the second-most surged coin wasn’t even in the top 20 coins, neither was Tron and many other altcoins. So, it is important to research the coins before selecting them. A thorough fundamental analysis is the most reliable way to identify coins that have the potential for the next altcoin season. Perhaps, the current alt season could be similar to the one witnessed in 2017; maybe it won’t perform up to the 2017-mark. But it will still be a source of massive profits.

McCann had a little more to add on the alt of this season:

“As I’ve mentioned for months now in my Telegram channel, FTT will outperform everything this year. At the time of this writing, FTT is up 27% YTD and hitting new ATH’s”

“A wise king never seeks out war but must always be prepared for it”

Chasing nostalgia can drive people to the ends of the world. There are players in the crypto-ecosystem that are chasing their initial high, hoping for another alt season with their heavy bags of altcoins. A sure-shot, get-rich scheme is what most alt seasons mean to traders and investors. Now that it’s begun… the next consequential question is “How long will it last?”

The longevity of this alt season hinges on:

- Bitcoin Halving – This is a major event that is set to happen in less than 3 months, which will reduce Bitcoin block rewards creating a negative supply shock. If the demand for Bitcoin does increase with an influx of more miners, there is a chance for an increase in Bitcoin dominance. This will put a dent in the alt season if not completely stop it.

- Geopolitical Factors – The trade war between the U.S. and China, and the global pandemic scare of Coronavirus has definitely shaken the traditional world. Although Bitcoin as an asset class is still immature, there are chances of the mining industry taking a hit and causing a watershed moment affecting the crypto-ecosystem as a whole.

If the alt season does take place, are you ready with your bags?