How blockchain technology can democratize the purchase of art

This article was written in co-authorship with Aly Madhavji. Aly Madhavji is the Managing Partner at Blockchain Founders Fund. Aly is a Senior Blockchain Fellow at INSEAD and was recognized as a “Blockchain 100” Global Leader by Lattice80.

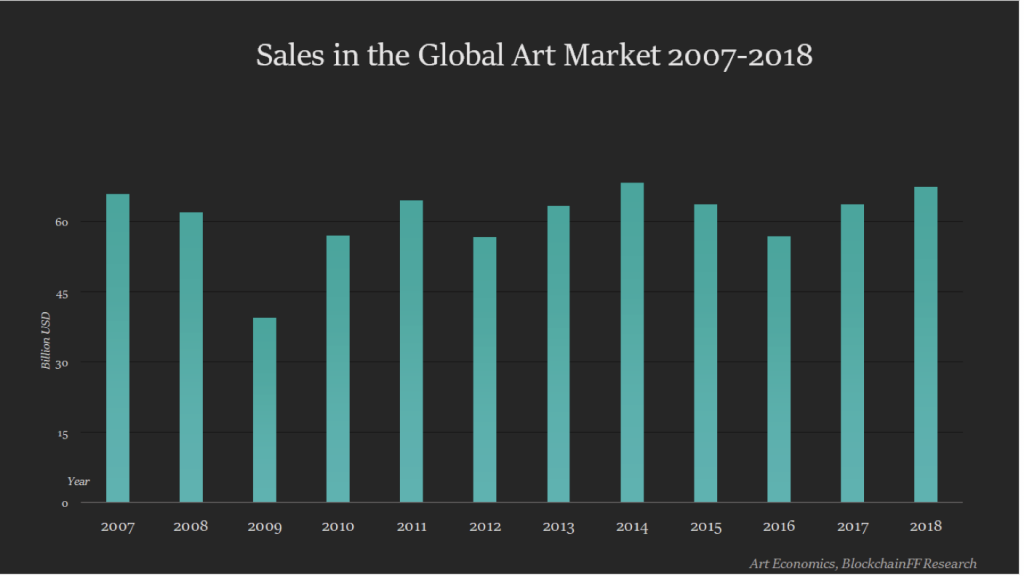

We live in an era in which technology is evolving at a pace we can barely keep up with. Advances in robotics and artificial intelligence are already changing our media, our workplaces, our politics, and our society. The art world seems to be one of the last bastions of tradition. Very few museums or galleries tend to exhibit digital art or art that involves cutting edge technology. When people think of art, they think of framed objects they can be hung on their walls. Moreover, in its current iteration, the art world feels positively old-world. It’s a rarefied, elitist niche with unbreachable gatekeeping, in which less than 1% of artists capture value from a global market that is worth $67.4 billion, as can be seen in the graph below. Galleries working on the primary market report that 63% of their sales were by their top three artists, with a single artist accounting for up to 42% of that value.

Enter Blockchain

We have been consuming music, movies, books, and images digitally for years. Thanks to the Internet, we can access the entire repository of human art with one click. But this digital ubiquity also means that we can make screenshots and use digital images or content without attribution, permission, or payment to the creators. Art is at our fingertips, but its value is not captured fairly or accurately.

Now, thanks to blockchain technology, digital content can become a unique asset. Put in simple terms: you can now own your digital content. Think of Bitcoin. It’s a digital currency that can be transacted without double-spending, just like fiat money. Similarly, digital art can now be tokenized either as a non-fungible original, or as fungible editions. It can be bought, sold, and collected without the risk of double-spending. Ownership can be verified in a transparent manner and digital art represented by its token can even accrue value.

Yes, you can still take a screenshot of an image on your computer, but that is akin to making a photocopy of an artwork or snapping a photo of a Van Gogh in a museum. The value is in the original artwork, or in this case, the token.

Collectors are already buying and selling digital art with cryptocurrency or fiat money in marketplaces like Superrare, Rare Art Labs, and Open Sea. Artists are already benefiting from direct payments into their digital wallets and the guaranteed attribution and authentication of their work. The smart contracts attached to the tokens can ensure that artists get royalties even on the secondary market, which simply does not happen in the mainstream art market. The use of blockchain can introduce a different economic model for artists; be it a peer-to-peer system, guaranteed royalties on secondary sales, or a participatory economy.

Blockchain can democratize the purchase of art and brings the experience of owning and collecting art to a much broader market, giving exposure to a more diverse set of artists all over the world. Moreover, non-fungible tokens encoded in a smart contract of the blockchain can be layered, allowing for the creation of collaborative works in which different elements of an artwork such as images, music, or animation can be tokenized and all the different creators can get a royalty when that work is sold or licensed. The transactions are registered indelibly on the blockchain so everybody knows when the artwork is transacted, and who owns it (even though the identity of the owner is a unique string of characters). Once blockchain achieves mass adoption, people will get used to owning the art or digital content they like, creating value for the artists, and for themselves, as collectors.

Currently, however, because of blockchain’s problems with lack of scalability, lack of coherent regulations, and of mass adoption, this market is yet to grow out of its shell — a small niche of artists and creative technologists. Blockchain dapps (decentralized applications) are not yet user-friendly and the display and user experience for collectors of tokenized digital art needs much more improvement. Still, creative technologists are bullish on the promise of this emerging market.

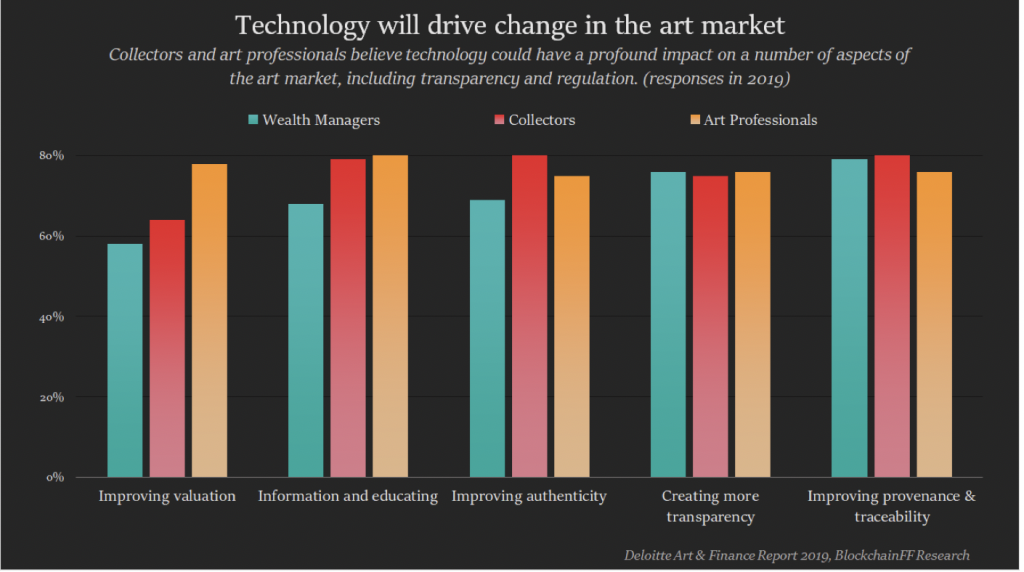

Blockchain also helps with issues of authentication and provenance for existing art, which according to the 2019 Deloitte Art And Finance Report, are the main areas of concern for asset managers, collectors, and art professionals.