XRP’s price hanging on a loose thread as third death cross nears

XRP’s consolidation above $0.21 was hammered by numerous market corrections. The most devastating blow to its value was caused by Bitcoin’s massive market crash that drove the coin down to its 2017-lows. XRP lost 60% of its value since its 2020-high of $0.335. It has registered one of the steepest declines this year. At press time, it was priced at $0.134.

XRP’s 4-Hour Chart:

Source: XRP/USD on TradingView

The candlestick arrangement for the 4-hour XRP Chart indicated formation of a symmetrical triangle in which the breakout could be on either side. However, the moving averages exhibited an interesting trend.

The 50 daily moving average [Purple] and the 200 daily moving average [Orange] underwent a golden cross on 25th February this year. However, it appears as though the bullish trend might be negated by a potential death cross in the near future.

While bears have already taken a stronghold for XRP, the death cross could further extend losses for the coin and cause a drop to $0.116, a level last seen in May 2017.

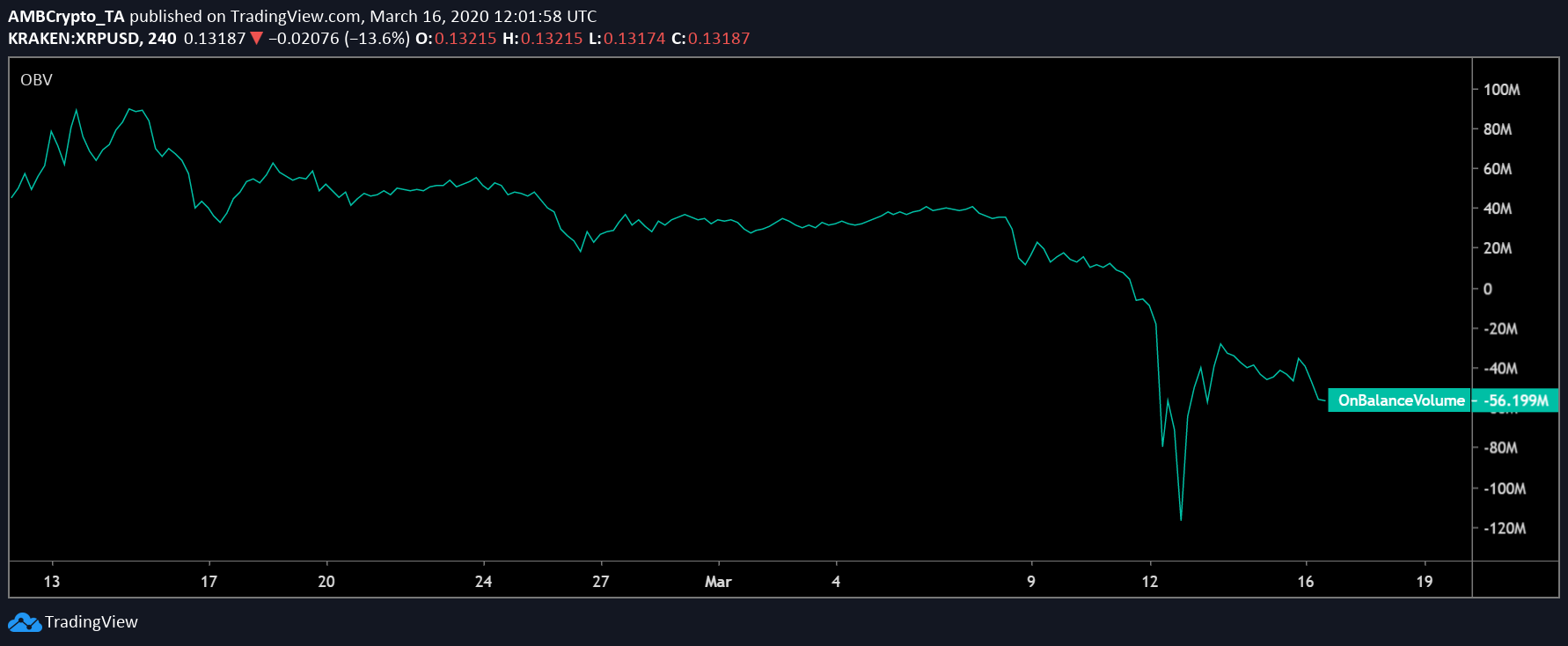

The crypto market has witnessed a severe sell-off this month. On Balance Value [OBV] indicator has been moving in agreement with XRP’s price action for a long time now. Despite the fact that OBV went up shortly after the fall, the indicator, at press time, suggested high sell-volumes as it appeared to be headed downwards. This indicated a decline in price in the near future as cumulative volumes continue to decrease.

Source: OBV Indicator

VPVR Indicator exhibited an increasing trading activity in the $0.151 region. In an unlikely scenario of a trend reversal, XRP could climb to the aforementioned level, however, this would mean a surge of nearly 14% from the price at press time, which seems highly doubtful considering the strong bearish projections.

Conclusion:

If the death cross materializes, this would propel the coin to fall significantly and hover close to its May 2017 lows. The target point, in this case, would be $0.116 which has been supporting the coin as it appeared to be in troubled waters. This downward momentum could also lead the coin to lose the position of being the third-largest crypto by market cap.