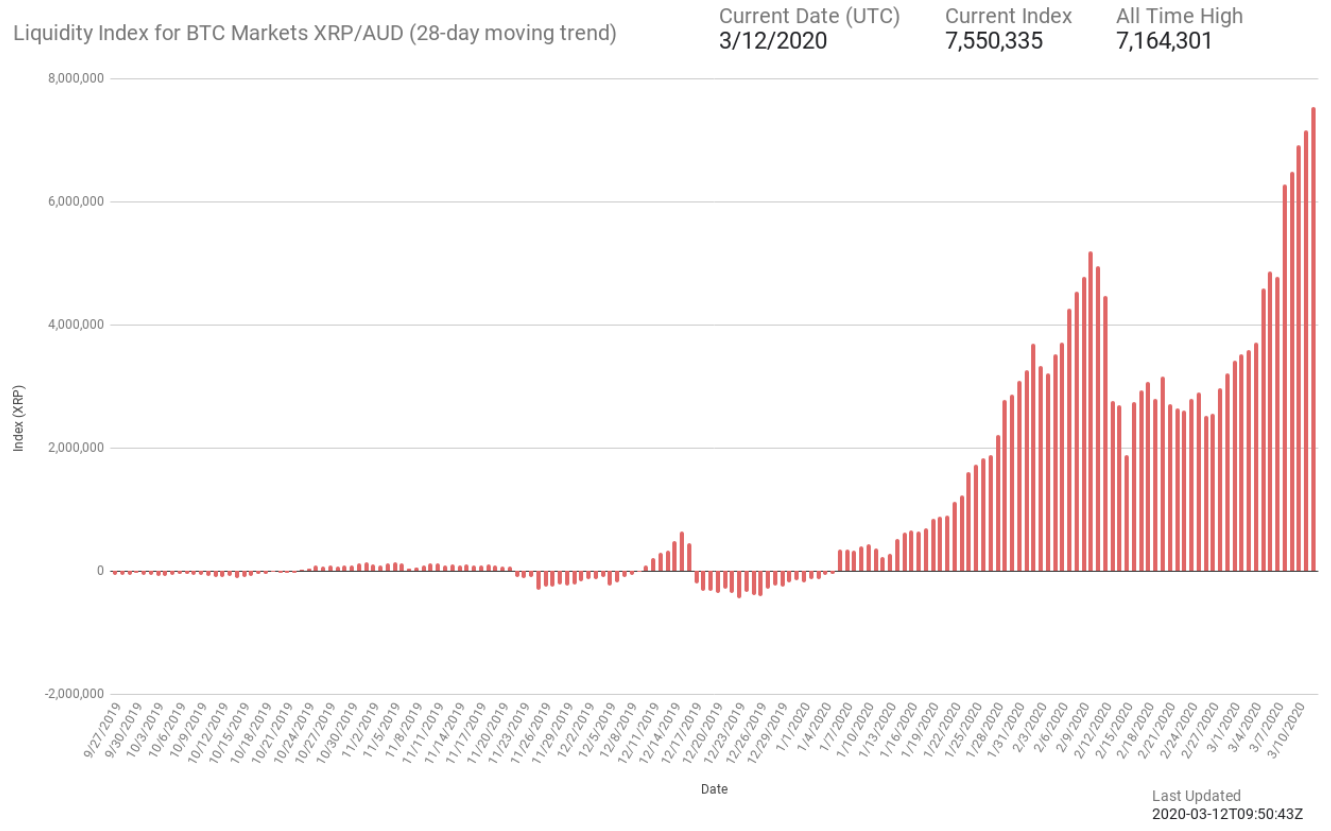

XRP/AUD liquidity index on BTC market surges to new ATH

Ripple’s on-demand liquidity [ODL] has been on the rise for a long time now. Its payment corridors have breached previous all-time highs. In a recent development, XRP liquidity on Australia’s BTC markets has hit an ATH. Liquidity Index Bot, the Twitter bot which tracks the liquidity index of XRP on various corridors, revealed today that the liquidity index for BTC Markets for the pair XRP/AUD climbed to a new high of 7.550 million on 10 March.

What is interesting to note here is that at press time, the progress for the day had only been 42%.

Source: Twitter | Liquidity Bot Index

Its previous high stood at 7.165 million. The XRP liquidity on Australia’s BTC market started gaining traction only in the first week of January 2020. The corridor reached its first major milestone on 9 February, with the figures surpassing $4 million for the first time. The liquidity fell shortly after, however, and hit a slump after falling below $2 million. Since then, the figures have maintained an upward trend.

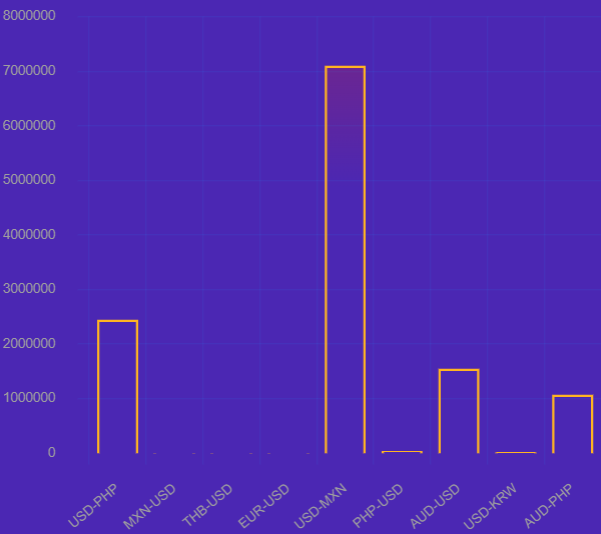

Besides, data on Utility Scan revealed that the ODL volume for AUD-USD over the past 24-hours shot up to a whopping $1.56 million, at press time.

Interestingly, it is not just the Australian corridor that has seen a drastic increase with respect to the XRP liquidity index. This was evident as the Utility Scan chart was dominated by the most popular corridor, USD-MXN, which registered a volume of $7.073 million over the same time frame. This was followed by USD-PHP with a 24-hour volume of $2.44 million, at press time.

Source: Utility Scan | USD Last 24-Hour Volume Per Corridor

Additionally, Liquidity Index Bot had revealed that XRP/PHP registered an all-time high of 6.026 million on 5 March on the Philipines corridor which works via Coins.ph. This figure was on the rise as well as the Philippines’ corridor continued to record strong growth.

Ripple’s ODL has forged many partnerships and unlocked new gateways across the world. While the Australian front noted significant activity, the country’s banks, however, are not keen on adopting the blockchain firm’s product.

The Chief Enabling Officer, Nicolas Steiger of FlashFX, which is a licensed entity in Australia using RippleNet, had previously stated that the chances of ODL adoption by Australian banks were slim due to lack of need and/or understanding, as well as a lack of regulatory clarity.