Will Bitcoin Futures fail to replicate Q2 2020’s activity?

On 26 June, Bitcoin’s quarterly Futures contract reached its expiry after Bitcoin Futures’ Open Interest touched a 3-month high of $98 million on Deribit. The derivatives gains can be widely classified by Options demand over the past quarter, but according to Arcane Research’s latest weekly update, subdued price levels over the last few weeks have seen Futures prices falling down to spot levels, well before the expiry.

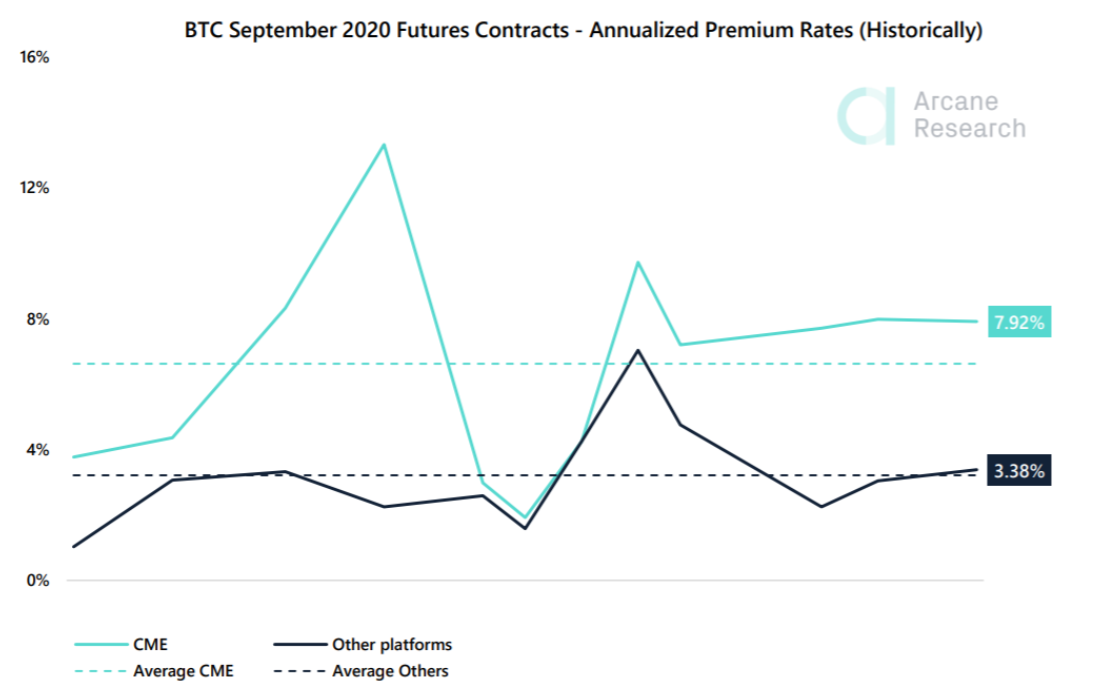

Source: Arcane Research

As observed in the attached chart, the premium rates for Bitcoin Futures Contracts were as low 0.13 percent for CME Futures, while other retail platforms were accruing premium rates of 0.10 percent on the charts.

However, the report went on to add,

“CME traders are still buying futures at a higher price than retail-focused platforms for next quarterly contracts.”

Will the Bitcoin Futures market register a similar level of activity in Q3 2020?

Q2 2020 for Bitcoin was extremely important. Bitcoin was coming off a huge decline towards the end of Q1 and in order to survive the economic downside witnessed in March, April needed to be positive for Bitcoin.

The world’s largest digital asset did not disappoint as alongside the rest of the industry, Bitcoin surged with conviction through most of April and May. However, the momentum soon slowed down towards the 3rd week of May and as per the monthly returns at the time of writing, June may be looking at negative Bitcoin ROIs.

The bullish momentum that saw a resurgence at the beginning of Q2 was carried over into the Futures market till the end of the term, but a similar level of activity might not take place in Q3 2020 for Bitcoin and its Futures contracts.

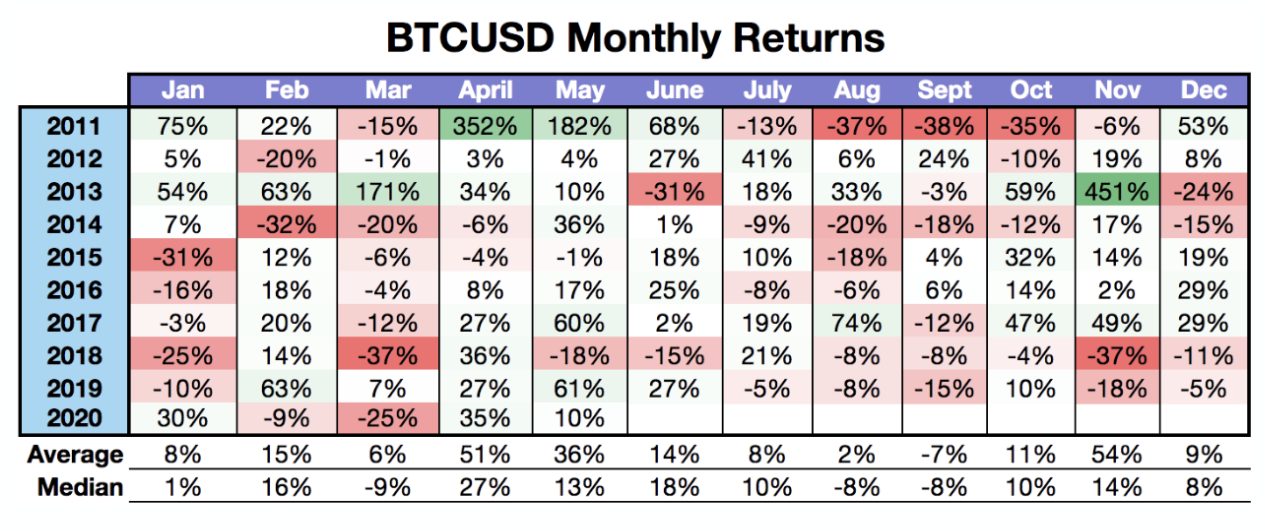

Source: Kraken Volatility Report

According to a recent Kraken volatility report, historically, July and August have usually been negative in terms of BTC/USD Monthly Returns.

With volatility levels decreasing steadily over the past couple of weeks, it is fair to argue that BTC Futures contracts in Q3 2020 might not have the same level of bullish activity that proliferated the 2nd quarter of the year.

Coupled with market recovery and Bitcoin’s imminent halving, legitimate reasons triggered Bitcoin’s rally in Q2 2020. The momentum, now, seems to be mostly exhausted, with the world’s largest digital asset entering a prolonged period of correction.

Hence, the high premium paid by CME traders for Q3 2020 BTC Futures expiring in September may decline at a faster rate than expected.