Here’s why Bitcoin accumulation isn’t stalling despite $19K price

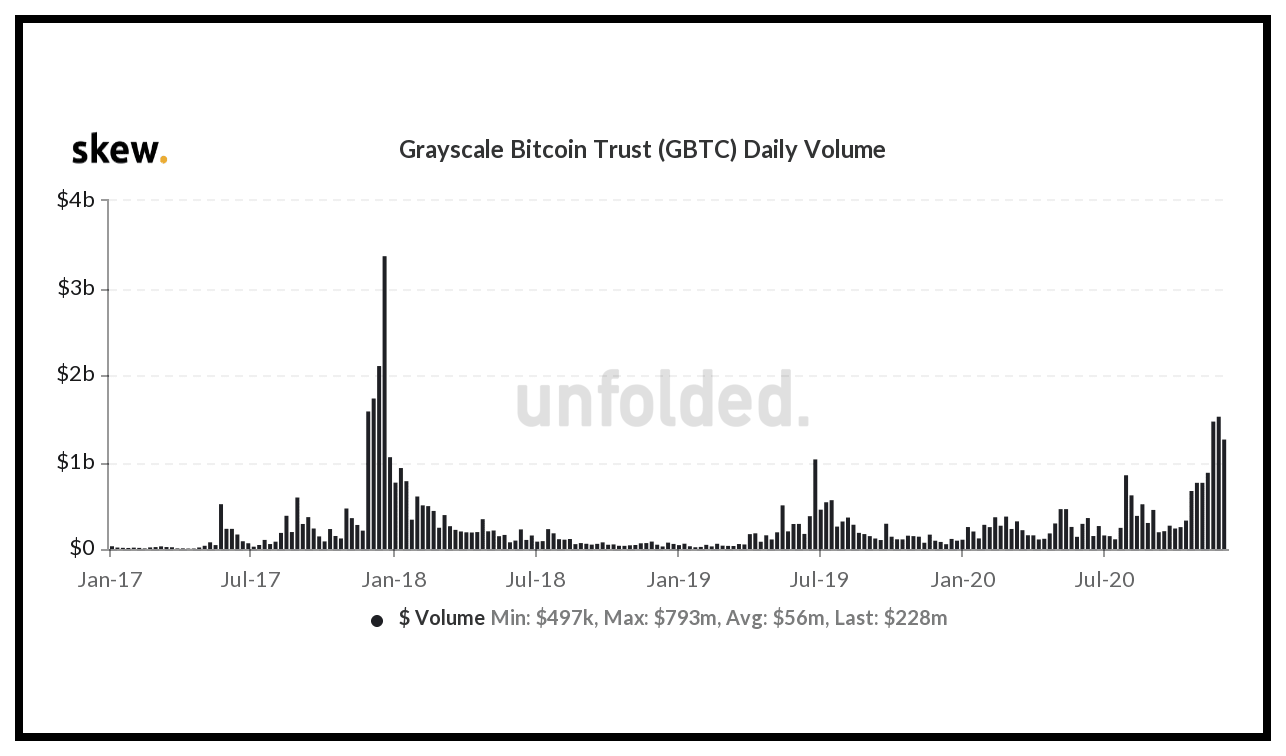

Grayscale Bitcoin Trust may be the closest to a Bitcoin ETF in 2020. The daily GBTC trade volume has increased steadily since June 2020 and this is critical to Bitcoin’s price and liquidity. Grayscale Bitcoin Fund requires a minimum investment of $50000, and the trade volume in GBTC is a clear indicator of the demand from users who would otherwise own two Bitcoins or more.

GBTC Daily Trade Volume || Source: Twitter

This steady increase in daily volume to $1.5 Billion, despite GBTC’s premium, suggests a direct increase in demand for the currency, as it mirrors Bitcoin’s price trend. In the absence of a Bitcoin ETF, this is the go to Bitcoin investment for family offices, and traders with over $50000 at their disposal. What’s interesting is that, apart from whales and institutions, retail traders with 0.1-10 BTC balance in their wallets have continued accumulating Bitcoin, even at the current price level. There have been several price corrections, to $18000 level after hitting new ATH, but network momentum has sustained and accumulation is on.

Hourly map of unspent Bitcoins || Source: Whalemaps

While Grayscale bought 7000 Bitcoins in the past 24 hours, an interesting point to note here is that when Bitcoin’s price hit a new ATH the liquidity increased and on-chain analysts suggested that demand needs to be generated to absorb the liquidity before the price goes higher. With consistent buying and accumulation above $18000, network momentum may build up for price to cross $20000. While the fair price is $8500, and Bitcoin is trading above $19000, the daily GBTC volume is higher than in the first quarter of 2020, and there is accumulation by both institutional and retail traders. There is a likelihood of further demand generation if buying continues.

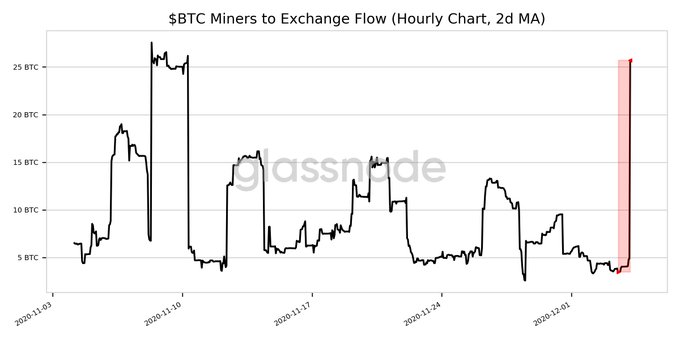

Miners flow to exchanges || Source: Glassnode

An interesting point to note here is that when Bitcoin’s price hit a new ATH the liquidity increased and on-chain analysts suggested that demand needs to be generated to absorb the liquidity before the price goes higher. A key metric that is evidence for this increasing liquidity is Miner’s flow to exchanges. Bitcoin $BTC Miners to Exchange Flow has increased significantly in the last 24 hours. The current flow to exchanges is 25.707 BTC per hour (up 636.2% from 3.492 BTC) and the above chart shows the increase.