What consumer-need can a CBDC address?

The digitalization fever, driven by technological advancements and decline in cash usage, has caught the central banks around the globe as they now look to cautiously approach and explore the use cases of central bank digital currencies or [CBDCs].

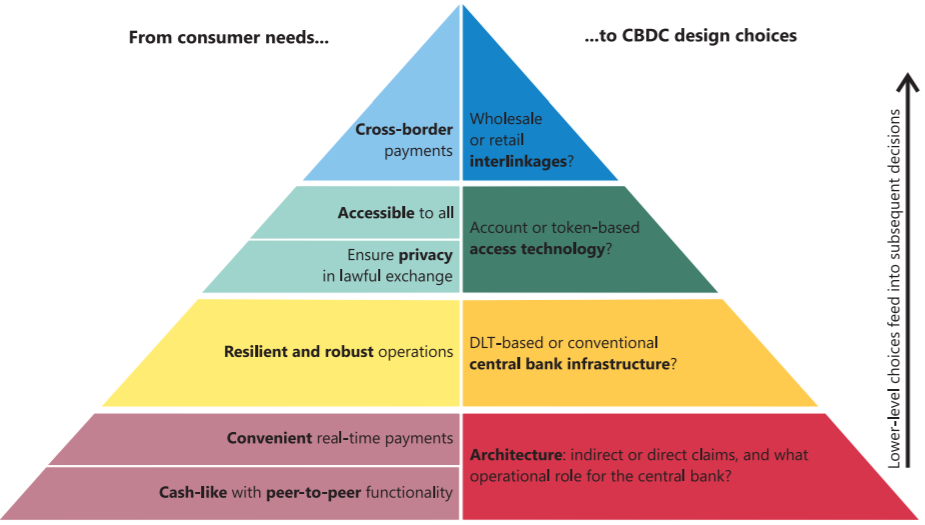

In the latest Bank for International Settlements‘ [BIS] quarterly report, the Swiss institution has structured its approach around consumer needs and the associated technical design choices. BIS graphically represented, what is called the “CBDC pyramid”, mapping consumer needs onto the associated design choices for the central bank.

BIS’s report stated,

“The focus of our approach is the ‘retail’ aspect of CBDC; we ask what consumer needs a CBDC could address. We thus sketch the development of a CBDC through an approach that proceeds from consumer needs to design choices.”

Source: BIS | The CBDC Pyramid

In terms of consumer needs, BIS’s CBDC Pyramid comprises features such as cash-like peer-to-peer usability, convenient real-time payments, payment security, privacy, wide accessibility and ease of use in cross-border payments on the left-hand side. On the right-hand side, it lays out the associated design choices.

The report read,

“The consumer’s prime need is that the CBDC embodies a cash-like claim on the central bank, ideally transferable in peer-to-peer settings.”

BIS’s report admitted that the main concern in the adoption of CBDC lies in its usability. It further stated that consumers are unlikely to adopt a CBDC if it is less convenient to use than existing electronic payments.

CBDC is a serious business now. There have been a few propositions that have been made in this to structure, outline and weigh in pros and cons. It even achieved prominence in the World Economic Forum 2020 at Davos where ConsenSys released a whitepaper that sketched a framework of a practical proposal for CBDCs on the Ethereum blockchain.