What are the world’s best Bitcoin investors saying behind closed doors?

Bitcoin’s rapid institutionalization has raised many eyebrows, around the world. In addition to this, it has also raised the interest and investment of institutional investors, family offices, and HODL waves from retail. In the latest episode of the Pomp Podcast, Raoul Pal takes us to conversations that happened behind closed doors between Macro guys from the 90s. The barrier to entry in Bitcoin was relatively low back before the historic bull run of 2017 and that changed the landscape of cryptocurrencies and the world economy as we know it.

The prime mover of Bitcoin’s price chart, its volatility has led to this rapid spike in Bitcoin market capitalization. Raoul being a Technical Analyst, owing to the fact that more than volatility, chart patterns like the triangular wedge pattern on the Bitcoin chart led him to invest over 50% of his liquid cash in Bitcoin. The propensity for higher ROI took him all the way and this was before the price rally started. Unlike maximalists or Bitcoin proponents, traders and investors who identify themselves as macro guys took big risks on Bitcoin with their liquid cash.

Behind the doors, almost everybody has a personal allocation in Bitcoin. Dan Moorehead, Novogratz, and everyone else included. An entire generation of macro investors that grew up together went from one trade to the next, increasing exposure to Bitcoin, irrespective of the position it was in, during its market cycles. These investors bought Bitcoin at $8000 and they bought it at its previous ATH. The big macro players identified Bitcoin as a tremendous influence on a huge amount of capital.

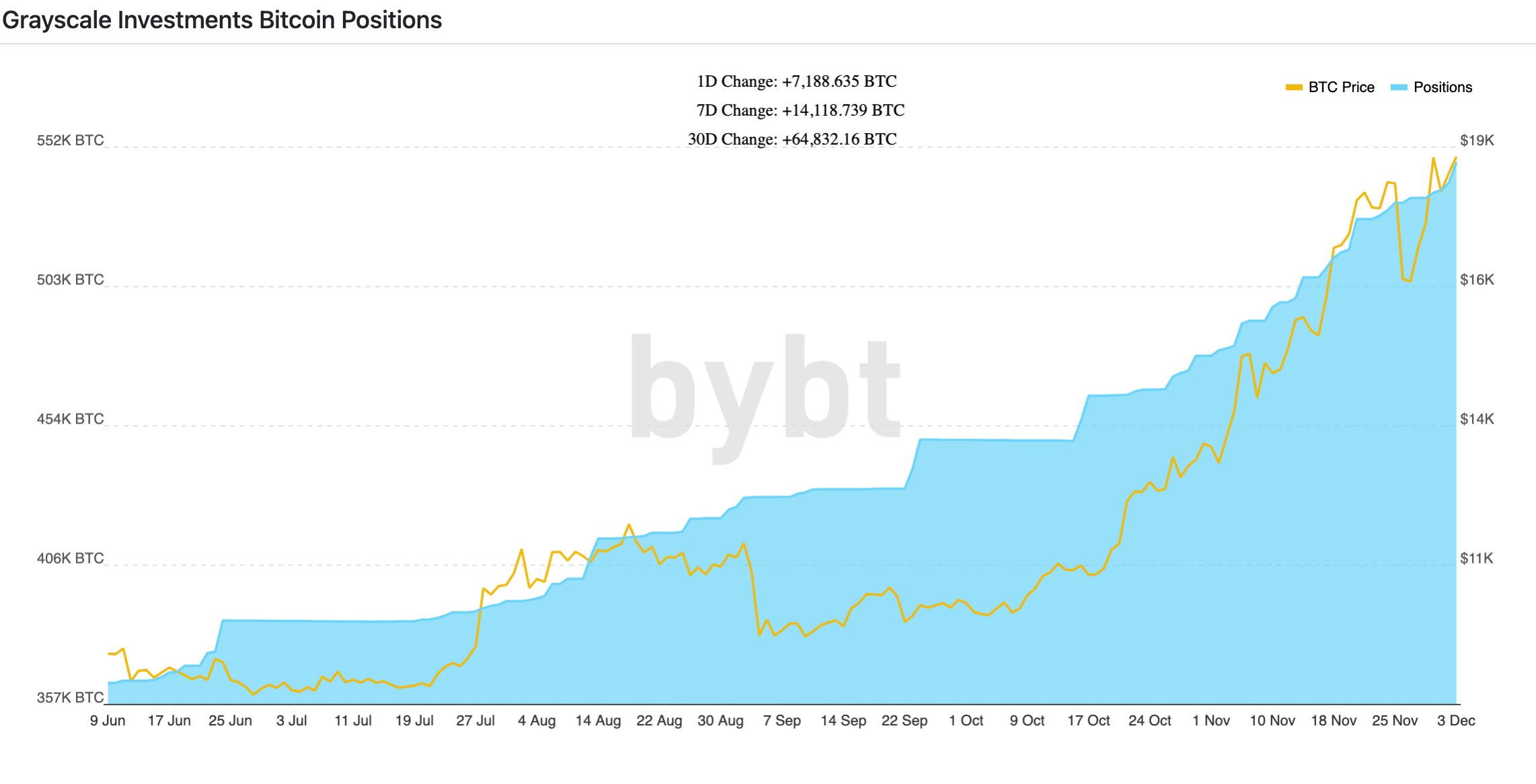

At a time when most Hedge Fund managers suffered from the vice of low volatility that did more harm than good to their portfolio performance, turned to Bitcoin for its high volatility and higher ROI. “A parallel universe” of Bitcoin existed for those in Macro and the great speculators. This explains the rapid institutionalization and the growing market cap, network momentum, and volatility in Bitcoin. The Grayscale Bitcoin Trust with it’s Bitcoin Trust Fund that mirrors Bitcoin’s performance is one such institutional player, leading the way with systematic Bitcoin purchases every week.

Grayscale’s Bitcoin Positions || Source: Twitter

The accumulation above $18k has continued and this metric has driven the demand for Bitcoin consistently since the price crossed $10000 in July 2020. The pre-Bullrun and the ongoing price rally has led to more conversations and subsequent dialogue on further integration of Bitcoin in the world economy. Closed-door conversations are clear to retail traders since there is little sign of FUD this time around. The market cycle may possibly skip a phase if Bitcoin closes above $20000 in 2020.