‘Lower tier’ exchanges exhibit high trading volume

Lesser-known cryptocurrency exchanges have a high trading volume than the top platforms, according to the latest CryptoCompare research. CryptoCompare introduced a new grading system in which top tier exchanges were categorized as AA or B and lower-tier exchanges were graded from C to F. The research stated:

“Exchanges with grades AA 3.0% (14.87 billion USD) of total aggregate volume in September, while those rated A and B represented 14.3% (71.98 billion USD) and 4.7% (23.86 billion USD) respectively. Trading volume is still dominated by Lower-tier exchanges, with D-E rated exchanges representing 71.0% combined (347.2 billion USD). In September, volume from top-tier exchanges (AA and A) decreased 31.6% and 10.3% respectively. Meanwhile, volume from E-rated exchanges (representing 179.06 billion USD) increased by nearly 31.5% from the previous month.”

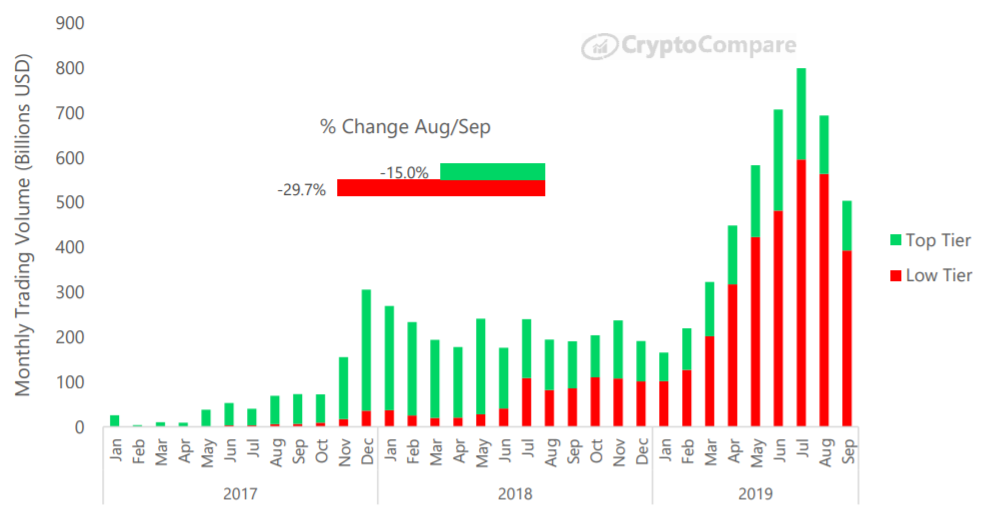

Source: CryptoCompare | Aggregate Monthly Volume by Tier

On aggregate, the volume of the top-tier exchanges, i.e., AA-B declined by 15% and volume for the lower-tier decreased by 29.7% from August to September.

Higher trade size in low-tier exchanges

According to the study, lower-tier exchanges such as Coinsbit [D-rated], LBank and P2PB2B recorded the largest trade sizes relative to other top exchanges at an average of 8.7, 2.1 and 1.2 BTC, respectively. Coinsbit witnessed an average trade size 21.7 times higher than Bitstamp which is an AA-rated exchange. The trade count was, however, lower with Coinsbit trading an average of 2,526 trades per day, while Bitstamp traded an average of 14,638 trades per day.

Manipulation?

Could these bots be manipulating trading in the low-tier cryptocurrency exchanges to inflate trading numbers? The traditional financial market and the crypto markets are plagued with trading bots. Attorney Barbara Underwood explained in a report that exchanges are highly susceptible to manipulation and mentioned that “bots are defined as the main source of manipulation”. Various reports have suggested that bots have started to flood the decentralized and centralized cryptocurrency exchanges.