Here’s why Bitcoin might benefit from the COVID-19 pandemic

After having remained below the $10k-mark for a long time, Bitcoin’s price was able to overcome the resistance, before briefly surging past $12k recently. While Bitcoin did note a minor correction on the charts over the last few days, the coin’s price action remained promising. At the start of the year, most commentators had agreed on the significance of the year for Bitcoin.

Given the present macro-economic conditions and rising global uncertainty, Bitcoin may yet again prove to be one of the most robust crypto-assets that can be considered as a hedge, while giving gold stiff competition.

Speaking on the latest episode of the Unchained podcast, David Chaum, inventor of eCash and CEO of xx network and Adam Back, Co-founder and CEO of Blockstream, elaborated on what Bitcoin’s future is likely to be as it reacts to the present economic conditions and how it might do as governments go on a fiat printing spree to keep economies afloat. Chaum argued that given Bitcoin’s track record, it is very likely that the world’s largest cryptocurrency is likely to benefit from the chaos that has now gripped the world. He said,

“I mean it’s sad to think that something that I care about like Bitcoin is going to benefit from all these bad things that are happening to the planet but in fact, I think it should be very positive for it.”

Earlier in the year, Back had pointed out that a $300k price point for Bitcoin was possible, even without the help of large institutional investors. Back noted that given the uncertainty, more users are going to view Bitcoin as an adequate hedge. Driving home the point, he highlighted how Bitcoin has seen its price go up, as was the case with gold.

However, for Bitcoin, there are many more users who are yet to take the plunge into digital assets. This can help Bitcoin gain a substantial advantage over gold in the coming years. Back added,

“With all this pandemic, gold is typically a kind of macro hedge. So gold prices are up but you know Bitcoin prices are up too. And I have to suppose that while a lot of people have heard about Bitcoin. There are probably, you know, many people who haven’t taken the plunge and Bitcoin has differences to gold and has sort of more transactional value and utility value.”

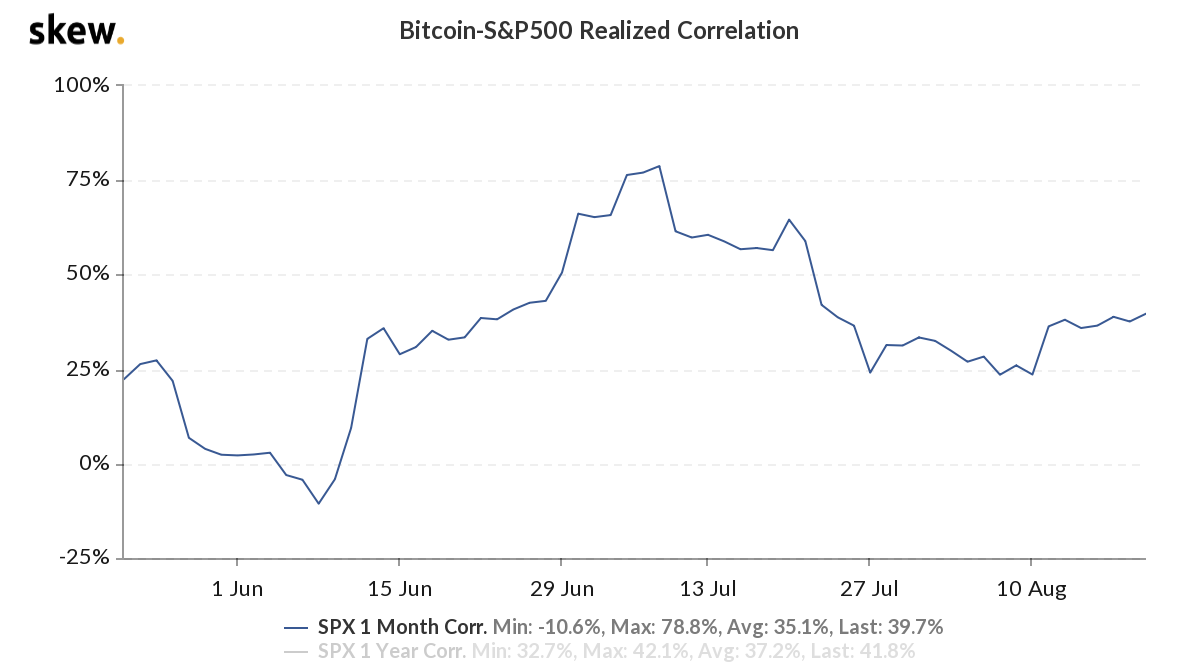

Source: skew

Taking into account Bitcoin’s correlation with traditional finance and the S&P 500, over the past few months, the same has seen a considerable drop, reiterating the narrative that digital assets like Bitcoin are likely to note movement independent of traditional assets. In fact, at the start of the month, crypto-analyst Mati Greenspan had argued that right from the early days of the pandemic, both these markets were only “loosely correlated.”

Given Bitcoin’s independent price action and the fact that its price has been able to positively react to the economic conditions, the king coin’s future does look promising.