For Bitcoin, Asian markets continue to be a dominant force

While cryptocurrencies were looked at with a lot of suspicion and fear during its early years, the market has significantly matured in the past few years as more investors have flocked to crypto for a variety of reasons. The increased regulatory clarity, especially in many Asian markets, has played a crucial role in increasing adoption for cryptocurrencies like Bitcoin. Today, countries like China are also leading the race when it comes to developing their very own CBDCs.

On a recent episode of the Flippening podcast, Joyce Yang, founder & CEO of Global Coin Research, highlighted the increasing role Asia is playing in the crypto-ecosystem and how a wide variety of crypto-firms have made various parts of Asia the hub for their operations. Yang pointed out,

“A physical hub can help support the burgeoning ecosystem of entrepreneurs, with funding and essentially bootstrap and accelerate the development of an ecosystem. This is similar to decades where venture capital and entrepreneurs all gathered together in the Bay area to create the Silicon Valley.”

Alongside the growth and adoption of crypto in various parts of Asia, Yang also highlighted how decentralized innovations like DeFi have gained a lot of recognition and interest from the Asian market. She said,

“So for example, MakerDAO has 30% of website traffic volume coming from China. And in fact, the team actually has said that China is the second-largest market. I mean, while Compound has over 27% website traffic coming from China and Taiwan and dYdX has 25% volume coming from China.”

One of the reasons why the Asian market has been fairly receptive to crypto and blockchain-based innovations have to do with the fact that most countries in the region have taken pro-active steps to encourage crypto via regulations. Yang highlighted Singapore’s governance model as a prime example. She said, “The Monetary Authority of Singapore is an example of the kind of folks who are very savvy and in tune with a global kind of financial innovations. And one important regulation that just came into effect is called the Payment Services Act.”

The Payment Service Act was passed earlier in the year and according to the Monetary Authority of Singapore’s press statement, it is intended to,

“enhance the regulatory framework for payment services in Singapore, strengthen consumer protection and promote confidence in the use of e-payments.”

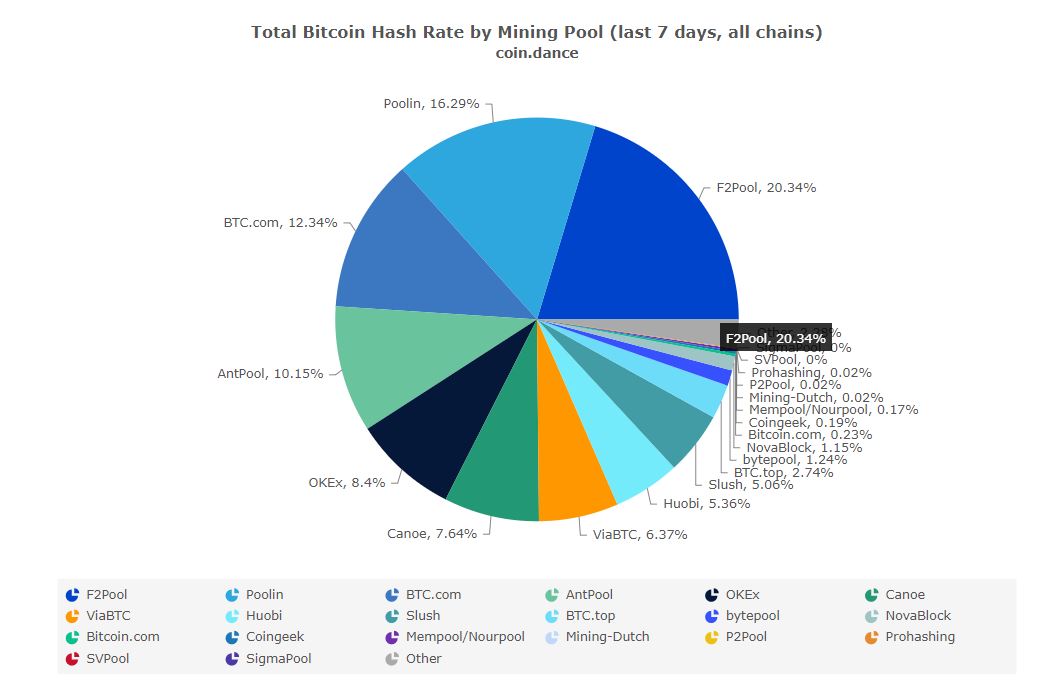

Source: Coin.dance

Asia’s presence with regard to the world’s largest cryptocurrency i.e. Bitcoin cannot be ignored. In fact, just in terms of Bitcoin’s hashrate, most of the mining pools that provide it are based out of China, especially the Sichuan province.

Highlighting how various countries and regions across the world have varying views with regard to crypto-infrastructure, Yang noted,

“There will be a divergence in the development of what cryptocurrency and blockchain mean to each country. I think with Libra getting the mandate from the US govt. to include the USD and Euro in their basket, it will become more of a geopolitical war.”