CME Bitcoin Futures volume sink as stock market resurges

The coupling and decoupling of Bitcoin to the S&P500 took another turn late last week with the recent stimulus injection. With all the talk of the United States Federal Reserve pumping billions into the stock market, the hope for a spillover into Bitcoin’s institutional market was palpable.

On the institutional front, those familiar with cryptocurrency have a favorite, the Chicago Mercantile Exchange [CME]. However, despite the latest move by the Fed to pump roughly $2 trillion into the US economy, in addition to the ongoing quantitative easing and slashing of interest rates, the increased liquidity failed to move into Bitcoin Futures.

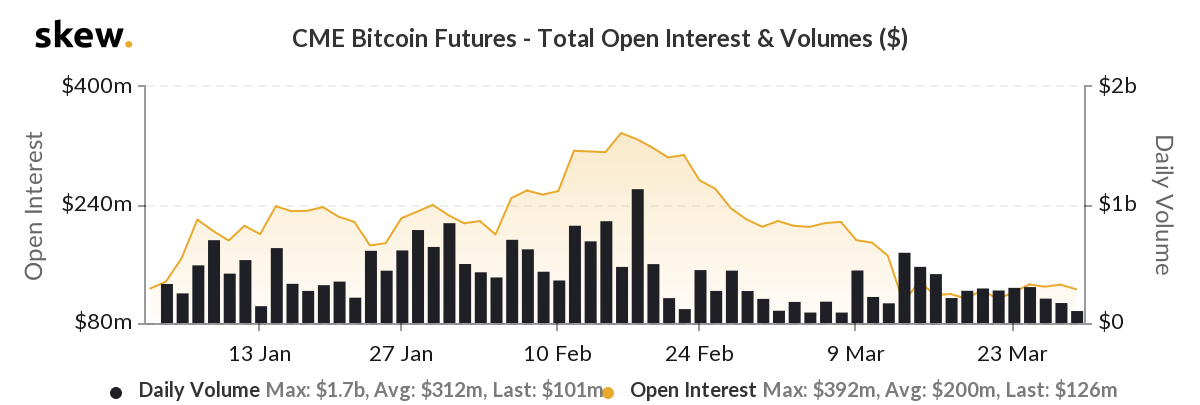

According to data from skew markets, the close of one of the most stimulus-heavy weeks in US financial history saw a significant drop in Bitcoin Futures volume on CME. Just over $100 million was traded on March 27, the lowest volume over the past three weeks, akin to early-March volumes when the price was trudging around $8,000.

CME Bitcoin Futures Volume and Open Interest | Source: skew

In terms of the number of contracts traded, that figure stood at 3,029, each contract representing 5 Bitcoins.

The drop in volume was coupled with a simultaneous drop in Open Interest, as traders began closing out positions. At press time, the open and active positions on the exchange were valued at $126 million, up by over $20 million since early-March, but down by over $200 million since mid-February when the open interest was over $325 million.

At a time when the US equity markets have recovered over 12 percent of value lost due to the ongoing pandemic, artificially albeit, the movement into Bitcoin, or lack thereof is surprising. In February, Bitcoin, despite being uncorrelated, was seeing like-for-like movement with the S&P500, and when it endured its 5.57 percent single-day drop, the cryptocurrency lost almost half its value in less than 15 hours.

This plummet for Bitcoin, occurring on March 12, coupled with a drop in gold, was indicative of investors selling off highly liquid assets in order to hoard cash, which, by all regards is still king. The simultaneous drop of the commodity and the cryptocurrency, at a time when the stock markets were at record-lows, suggested a liquidity crunch, which is evading the market currently.

Given that a massive addition of liquidity has just struck the market, and stocks are regaining, it looks like Bitcoin is not enjoying any dollar-inflow.