CME Bitcoin Futures find respite as U.S markets tumble

Bitcoin might not be playing to the safe-haven narrative, but its contracts are certainty a “haven” of sorts.

Global markets already suffering from the COVID-19 meltdown have now been hit hard by the oil supply shock. On 9 March, Russia and OPEC leader Saudi Arabia clashed over the balancing of oil prices amid the declining demand owing to the virus outbreak. Oil prices fell to its lowest point since the 1991 Gulf War, with U.S crude oil dropping by 34 percent in a day.

Equity markets, the S&P500 in particular, also saw a pullback. After a 7.4 percent surge last week, Monday saw a massive drop by 4.5 percent, dropping to as low as 2736 points. As confidence in the markets was dropping, so was confidence in the government. The United States’ 10-year money market note yield dropped below 0.5 percent for the first time ever.

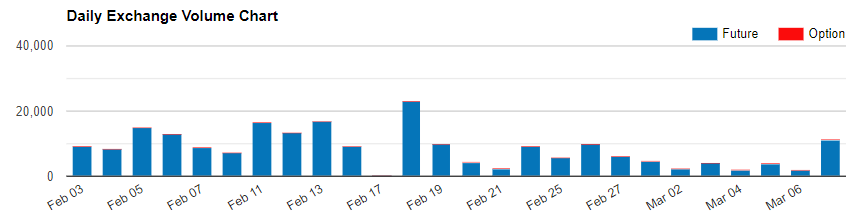

CME Bitcoin Futures contract volume | Source: CME

Needless to say, corporate and public sentiment was in the mud. Surprisingly, Bitcoin, the “uncorrelated” asset in the global market, also dumped. Since 7 March, the top cryptocurrency has lost 14.3 percent of its value, undoing much of its 2020 gains, and was trading at a press time price of $7,930.

However, the severity and speed of the Bitcoin drop rekindled the Futures market, signalling a shift in the institutional mindset. Following weeks of low trading, the Chicago Mercantile Exchange [CME] saw a burst in volume, trading 11,291 BTC Futures contracts on 9 March, amid the price fall.

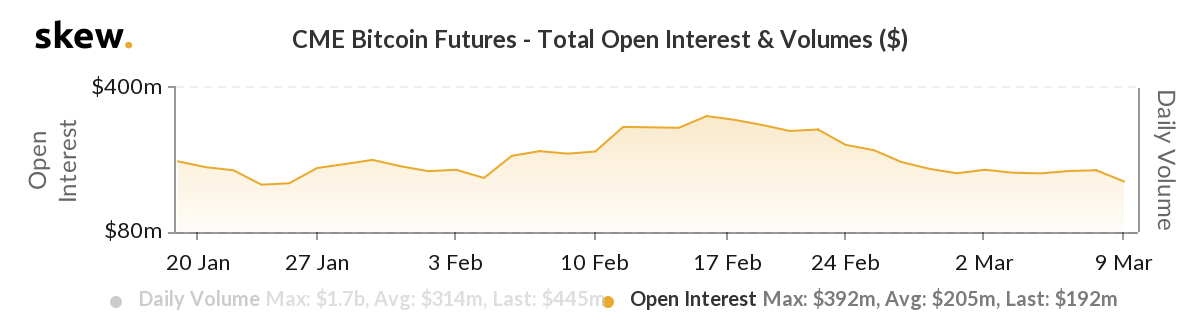

Since 18 February, when over 23,000 contracts were traded, the average volume per day was 5,137 contracts. March 9’s uptick was a 119 percent increase from the aforementioned average. Even as the volume spiked, the Open Interest slumped. As the volume saw a 3-week high, the OI saw a 1-month low. A significant amount of positions were closed off as the active positions dropped to $192 million, 76 percent lower than its 2020 high of $338 million on 18 February.

CME Bitcoin Futures open interest | Source: skew

While the equity, cryptocurrency, and oil markets were witnessing collective sell-offs, the Futures market saw bearish trading and positions being closed off.

This comes at an important juncture for the market. Last week, the Federal Reserve had announced a cut of 100-basis points to the domestic interest rate in light of the COVID-19-induced “emergency” economic slowdown.